Time matters most when decisions are irreversible

Time matters most when decisions are irreversible

Transparent vulnerabilities are so obvious that they are easily overlooked; they are the ones we:

- see when they are pointed out;

- recognize when we are made aware of them;

- fail to acknowledge, leading to potentially significant consequences when the vulnerability is realized.

Risk and time are opposite sides of the same coin; for if there were no tomorrow, there would be no risk. Growing government intervention in the private sector therefore becomes a transparent vulnerability that we have not accounted for in our identification of vulnerabilities. Time transforms risk. The nature of risk is shaped by our time horizon. In order to achieve corporate goals and objectives time horizons are established few take into account government actions.

Where next for Private Sector Continuity?

When government becomes the largest consumer of resources, either as a result of its need to sustain its ability to conduct war while maintaining domestic tranquility; or as a result of resource scarcity and a need to maintain domestic control, the sustainability of consumption over time cannot be supported indefinitely. Declining domestic resource pools (raw materials) engenders greater government involvement to secure resources to maintain domestic tranquility. Private sector enterprises become more dependent on government to protect their interests in the effort to secure more resources (raw materials, etc.) resulting in growth of government and the exerting of more government controls (regulations, etc.). The effect of a highly complex tax system, growing government involvement in business operations (private sector) and society coupled with a decline in the quality of human capital (knowledge), lack of infrastructure sustainability, high cost of resources that are not located or controlled domestically creates a wealth differentiation (gap) that results in the collapse of society as consumption cannot be sustained.

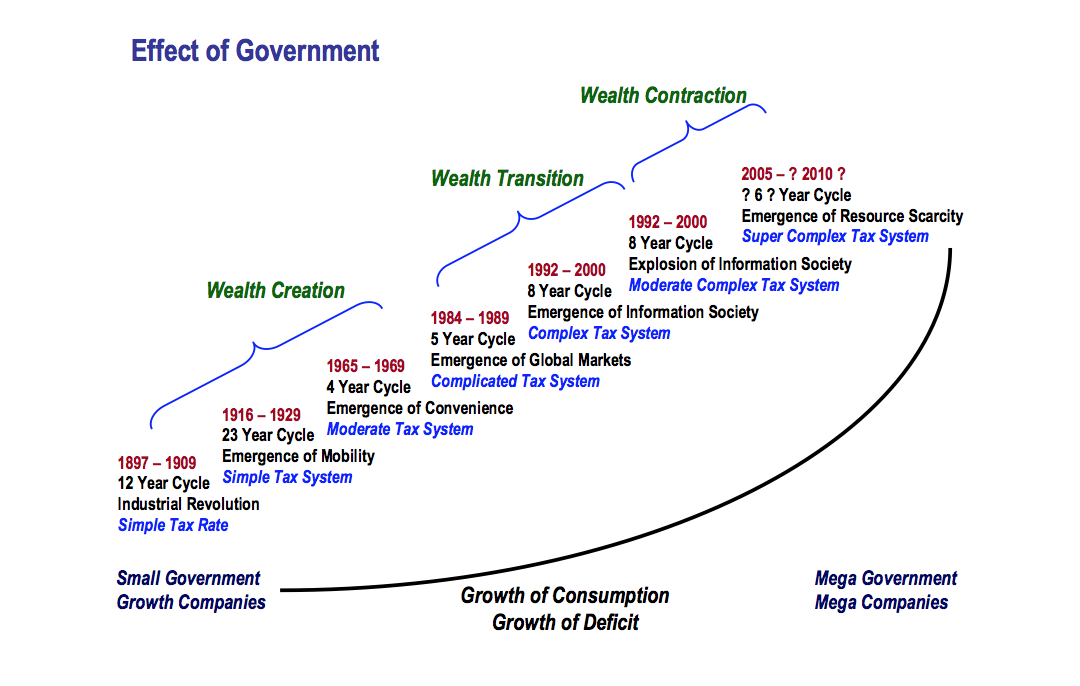

The typical Business Impact Assessment (BIA) is generally limited to an assessment of internal logistics; identifying systems, processes, hardware, software and relocation options. The underlying vulnerability is that the BIA fails to address the obvious – “what is the impact of government and how will my business survive?” As depicted in the figure below we can see that the impact of government has created a transparent vulnerability that will affect our ability to act decisively.

An action can be a right action or it can be a wrong action. A decision not to act can result in the right action with positive consequences or it can be the wrong action with negative consequences; or visa versa. One of the questions for Business Continuity planners should be asking is, “If the trend of government involvement in private sector operations continues, what impacts will there be on business continuity planning as we currently practice it?”

As depicted in Figure 1, “Effect of Government Consumption” (this is very generalized) we can see the consumptive nature of government as expressed in the growing complexity of the tax system with each societal transition that the U.S. has experienced. We started with a simple tax system and small government; specifically designed by the signers of the Declaration of Independence to control spending and taxation by government. However, as time has gone on and we have transformed from an agriculturally based society into a globally complex society, we have seen more and more government intervention in the form of taxation, entitlements and consumption. As we enter the “Resource Scarcity” era, we see a super complex tax system and an increasingly consumptive government, devouring resources; as the private sector is relegated to either becoming part of the system or attempting to compete against the system. The private sector does not have the resources to compete with government.

As Richard Epstein, Professor of Law at the University of Chicago, states, “Government works best when it wears one hat, not two. It cannot function well as a regulator when it is also a participant in the market. Human nature being what it is; key government officials will always find a way to subsidize their own activities or penalize those of a rival. In the not so long run, these distortions will push private competitors to the fringe, thereby leaving us in that worst of worlds dominated by government run firms that suck life out the economy.”

Human society consists of four core elements:

- Resources – naturally occurring factors in the environment that can be exploited in some manner but have not yet been extracted and incorporated into the flow of energy and material (i.e., iron ore not yet mined, oil not yet extracted). Resources are numerous, complex and changing. Human beings can also be viewed as a resource that can be exploited.

- Capital consists of all factors from whatever source, that are incorporated into the flow of energy and material but are capable of further use (i.e., physical capital – food, fields, tools; social capital – hierarchies, economic systems; human capital – laborers, scientists; information capital – technical knowledge). Capital is diverse, complex and changing.

- Waste consists of all factors that have been incorporated into the flow of energy and material, and exploited to the point that they are incapable of further use (i.e., laborers that are at the end of their useful lives, information garbled or lost).

- Production is the process by which existing capital and resources are combined to create new capital and waste.

Maintenance of a steady state requires new capita from production to equal waste from production and capital. Effect of decreasing marginal return; over time discovery and development of resource replacements are both subject to decreasing marginal returns. Resources used faster than their replenishment rate become depleted. A depleted resource must be replaced by existing capital to maintain production, and the demand for capital increases exponentially as depletion continues.

Resource depletion is one of the two factors that tend to overcome the momentum of an anabolic cycle. The second factor is the relationship between capital and waste. All capital is constantly subject to conversion to waste.

Societies differ in their response to changes in resource availability and maintenance costs. The spectrum of response ranges from adjustment to a steady state, through a history of repeated maintenance crises and partial break downs followed by recoveries, to severe depletion crises and total collapse.

Resources may not be sufficient to maintain indefinite expansion. Each resource has a resource replenishment rate – the rate at which new stocks of the resource become available. Solutions to problems that result in more severe problems than those that they attempt to solve are becoming commonplace as government consumes more and more resources. As an example, our society is:

- An economy dependent on cheap, abundant fuel – oil, natural gas, coal

- Our production fails to meet maintenance requirements for existing capital.

- We have heavy dependence on foreign investment to finance the purchase of imported oil.

- We operate in a state of denial due to our failure to address the problem.

- Our long term investment strategy is to invest for the short term.

- We are finding that technology fails to provide a solution.

- As a country we face bankruptcy – economic collapse, price bubbles as evidenced by the recent financial crisis, crash of real estate prices, stocks, etc.

- The U.S. is a petroleum based economy; any large scale changes may actually require too much energy to accomplish.

While a challenging picture for any company; it becomes almost impossible to surmount when the government steps in and takes more than the lion’s share of the resource pool.

Competition and Competitive Strategy – Business Continuity where are you?

When government competes with the private sector for resources, the likelihood is that the private sector will in some way lose. When society becomes dependent on government to fix what’s broken we ease our way into an “Entitlement Mentality,” that soon morphs into an “entitlement culture.” Society at large (and the private sector) begins to see their salvation (primary recovery dependent on government) coming from government aid, in the form of grants, bailouts, loans, etc. all backed by government assurances that all will be made right.

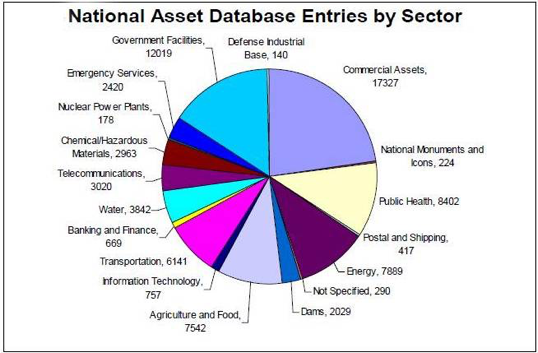

My colleague John Stagl posits the following question for Business Continuity planners – “Which industry sectors had the best business recovery plans in the recent financial crisis?” Give this some thought. It is a question that begs an answer. Was it the energy sector? Was it the retail sector? How about telecommunications; or food and agriculture? Was it any of the Critical Infrastructure sectors listed below?

Infrastructure sectors

- Banking and finance

- Transportation

- Power

- Information and communications

- Federal and municipal services

- Emergency services

- Fire departments

- Law enforcement agencies

- Public works

- Agriculture and food

- National monuments and icons

With much of the critical infrastructure privately owned, one would think that one of these sectors was “first in class.” The long awaited answer – AIG, GM, Citibank, Freddie Mac, Fannie Mae, Lehman Brothers, Bank of America; the list goes on. “What?” you say; “How can this be? All these companies had to be bailed out by the U.S. government!” Yes, they did; and as a result they continue in business today. All had the ultimate Business Continuity Plan – the Federal Government and the U.S. Treasury printing presses! What the private sector is experiencing is a tour de force of government spending. What the private sector should be analyzing is the reality:

- Inflation: There is $50 trillion dollars in unfunded liabilities on the U.S.’s balance sheet. If the U.S. played by corporate America’s accounting rules, we’d be bankrupt. The laws of gravity still apply. We will experience significant inflation in the near future as a result of unprecedented running of the government printing presses.

- Job Growth: Since the start of the recession in December 2007, the U.S. has lost almost 8 million jobs. Millions more have stopped looking for work. The analysts keep saying this downward trend will stop. But it hasn’t.

- Innovation: The credit contraction makes it harder for entrepreneurs and small businesses to invest in growth. This segment of the economy is where a rebound will start. Don’t watch the Dow, watch small business credit (contracting) and patents filed (contracting).

- Education: The important word in “Gross Domestic Product” is product. We must have highly skilled knowledge workers to compete against other economic innovators. Approximately 33% of U.S. high school students aren’t graduating. We live in a world that is increasingly technology dependent; yet we have a population that is more interested in fantasy sports, games and abdication of responsibility. The U.S. cannot sustain its current status in the world without a well educated workforce.

It’s very likely that over the next decade we are going to see the dollar fall to less than half of its current value (half is an optimistic assumption) as compared to global currencies. The combination of high and rapidly growing U.S. debt loads (nothing is being done to reverse this trend), the erosion of U.S. safe haven status due to crony capitalism and an accelerating movement among exporting nations to replace the dollar as the reserve currency (with a basket of currencies/gold) have turned this trend into an onrushing freight train. This depreciation and the loss of reserve currency status will have the following effects:

- It will make U.S. government debt very expensive. Funding for foreign wars, big domestic programs, and economic stimulus efforts will dry up (we are already seeing the fear of this driving decisions on Afghanistan and health care ‘reform’).

- Costs for the middle class will skyrocket. The ongoing depopulation/depletion of the middle class participating in the global economy will accelerate.

- Locally produced goods/services will become very competitive with globally/nationally sourced goods. Why? Energy costs will zoom.

The U.S. is suffering from a rapid and severe decline in respect, financial and military strength. The rest of the world is beginning to suffer from uncontrolled U.S. consumption of critical resources. The reality is that a near term significant consequence will be an increase in international chaos as various entities leverage the shortfall to take advantage of U.S. inability to stop or contain low cost-high impact disruptive activities. Examples include piracy (not just in Somalia), disruption of oil supplies (Iraq, Nigeria) and faltering infrastructure in many of the oil producing states comprising OPEC. The result of this will be global shortages of food, water and energy, increased protectionism, military conflagration, increased income disparity, and any other number of woes.

Imperial overreach by the U.S. as presented in Paul Kennedy’s “The Rise and Fall of the Great Powers” Chalmers Johnson’s “Nemesis: The Last Days of the American Republic,” lead to Imperial decline and geopolitical chaos.

And it’s not just the U.S.; Russia’s economy shrunk 9.4 percent in the third quarter of 2009, Bloomberg reported, citing an e-mailed statement from Russia’s Economy Ministry. China, India and Brazil also are experiencing declines. For China and India, each tied to the U.S. economically, the effect of a downturn ripples deep through their emergent economies.

Nigeria has lost some $47,000,000,000 in revenue from oil firm Shell since 2006 due to cuts in output caused by rebel attacks. Unrest in the Niger delta region has cost Nigeria $1,000,000,000 a month in lost revenues, according to the central bank, and has helped to push up global energy prices.

Dimitry Orlov, author of “Reinventing Collapse” discusses what he terms the “Five Stages of Collapse;” a pattern of collapse seen in Russia and Eastern Europe during the 1990’s:

- Financial Collapse already in motion.

- Commercial Collapse well on its way.

- Political Collapse a loss of faith in ideology has rapidly gained momentum in the U.S. since the 1970’s.

- Social Collapse predicated on too few resources being chased by too many consumers; the biggest being the U.S. government. This potentially reflects an end state for most of the world. Everyone against everyone with points awarded by the global marketplace.

- Cultural Collapse Convergence, where prices escalate in relation to availability of resources and value of the currency. Many predict a full meltdown with global markets breaking. There may be a time of chaos, but not utter chaos as markets have a tendency to find equilibrium, albeit not at a price point that many can afford.

The collapse in the USSR/Eastern Europe ended due to connectivity to a large external environment, collectively the West, which provided stability and a route back from chaos. The U.S. does not have an external environment to gain support from with the coming collapse. It will be global.

The premise for a collapse of the U.S. with respect to unbridled government spending and the infusion of billions into the bailout of “too big to fail” companies reflects the relationships among resources, capital, waste and production; forming the basis for an ecological model of collapse in which production fails to meet maintenance requirements for existing capital.

Joseph Tainter in his book, “The Collapse of Complex Societies,” states – “complex societies break down when increasing complexity results in negative marginal returns.” The unsustainably high level of complexity that the U.S. government currently has evolved into reflects the “perfect storm” for igniting a collapse. The fact that the rest of the world is so tied to U.S. consumption will impel the collapse at a greater speed due to the level of connectedness. Tainter further states, “Human societies and political organizations, like all living systems, are maintained by a continuous flow of energy. More complex societies are more costly to maintain that simpler ones, requiring greater support levels per capita.” As government consumption challenges the private sector and its influence (read takeover) over the private sector becomes dominant the private sector, as we know it, will cease to function as it does today.

Joseph Tainter in his book, “The Collapse of Complex Societies,” states – “complex societies break down when increasing complexity results in negative marginal returns.” The unsustainably high level of complexity that the U.S. government currently has evolved into reflects the “perfect storm” for igniting a collapse. The fact that the rest of the world is so tied to U.S. consumption will impel the collapse at a greater speed due to the level of connectedness. Tainter further states, “Human societies and political organizations, like all living systems, are maintained by a continuous flow of energy. More complex societies are more costly to maintain that simpler ones, requiring greater support levels per capita.” As government consumption challenges the private sector and its influence (read takeover) over the private sector becomes dominant the private sector, as we know it, will cease to function as it does today.

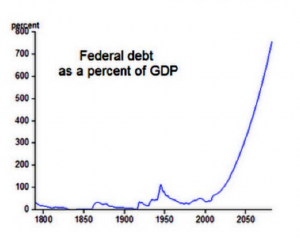

The U.S. is a “nation bereft of fiscal discipline,” having borrowed 340% of the U.S. GDP, exceeding the Great Depression high of 265%. The U.S. is dependent on financing its debt through foreign funding – primarily China. As depicted in the graphic; U.S. Federal debt is projected to reach 800% of Gross Domestic Product (GDP) by 2050.

The U.S. is a “nation bereft of fiscal discipline,” having borrowed 340% of the U.S. GDP, exceeding the Great Depression high of 265%. The U.S. is dependent on financing its debt through foreign funding – primarily China. As depicted in the graphic; U.S. Federal debt is projected to reach 800% of Gross Domestic Product (GDP) by 2050.

The U.S. is reaching a peak in the extended process of progressive disintegration that began in the late 1960’s – mid-1970’s with the peaking of oil production in the U.S. Rather than seeing a rapid shift from stability to instability the U.S. is on an accelerated path to an unsustainable state of consumption.

U.S. influence is declining; the result of a faltering currency; vastly over-stretched military commitments, a growing perception of the U.S. as a source of instability rather than stability and uncontrollable government debt (deficit spending). See the graphic for debt and projected debt growth.

A series of crises, already in motion (financial, energy, geopolitical), will lead the U.S. to a loss of complexity. Initially, the establishment of temporary stability at less complex levels of activity will appear to resolve the issues (i.e., falling oil prices, financial bailouts, etc.). However, the U.S. will experience that stability will prove to be unsustainable; followed by a further crisis and loss of complexity. The theory of catabolic collapse, explains the break down of complex societies as the result of a self-reinforcing cycle of decline driven by interactions among resources, capital, production and waste.

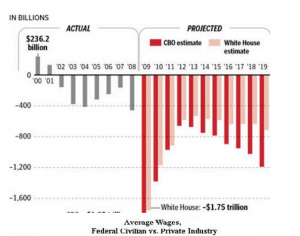

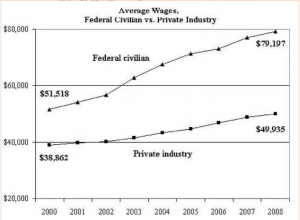

Add to the above, the fact that government pay for civilian workers outpaces that of the private sector (see figure), and you have to wonder about the ability of the private sector to compete with government for talent. And, as government spends more, there is a need for more resources (talent) to manage all that spending. One has to posit the question, “Why would a young, talented, or for that matter, untalented person want to enter the private sector when they can be employed in the public sector with better pay and better benefits?” A 20 year career in the public sector provides a nice retirement pension and benefits; and, it leaves the door open to entering the private sector and being employed by a company that is either contracting with, or seeks to contract with the public sector. This presents an ominous cloud of uncertainty for private sector entities when seeking to retain a competitive edge in the marketplace.

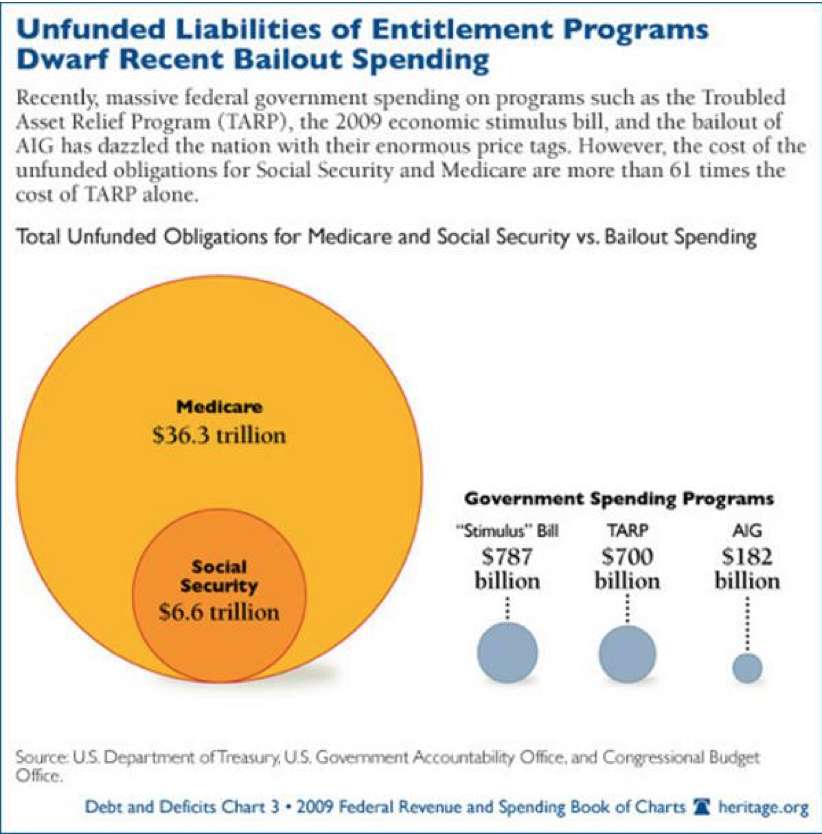

In addition to better pay, let’s look at unfunded or under funded government programs that are poised to become accelerators of the next media flash. The economic stimulus bill, bailouts of “too big to fail” companies (Troubled Asset Relief Program [TARP]) pale next to the total unfunded obligations for Medicare and Social Security; which, when combined total $42.9 trillion – that is a lot of zeros after the 9. Even the stimulus, TARP and AIG bailout only total a fraction of this amount ($1.669 trillion). The question of where the money is going to come from is mute – it will come from the government printing presses. Expect to see an inflation of the money supply like we have never experienced before in history. This could result in the U.S. dollar becoming worthless or near worthless. We might begin competing with some third world countries, such as Zimbabwe. Just look at the example of what could occur: Shortly after Zimbabwe logged a 132 billion percent inflation rate, the country issued a new currency – the 100 trillion Zimbabwe dollar. The issuance of the new currency notes (Z$100 trillion, 10, 20, 50 trillion currency), was the government’s attempt to address hyperinflation. As happens, the new currency was not able to keep up with soaring prices for goods and the lack of goods to purchase.

In addition to better pay, let’s look at unfunded or under funded government programs that are poised to become accelerators of the next media flash. The economic stimulus bill, bailouts of “too big to fail” companies (Troubled Asset Relief Program [TARP]) pale next to the total unfunded obligations for Medicare and Social Security; which, when combined total $42.9 trillion – that is a lot of zeros after the 9. Even the stimulus, TARP and AIG bailout only total a fraction of this amount ($1.669 trillion). The question of where the money is going to come from is mute – it will come from the government printing presses. Expect to see an inflation of the money supply like we have never experienced before in history. This could result in the U.S. dollar becoming worthless or near worthless. We might begin competing with some third world countries, such as Zimbabwe. Just look at the example of what could occur: Shortly after Zimbabwe logged a 132 billion percent inflation rate, the country issued a new currency – the 100 trillion Zimbabwe dollar. The issuance of the new currency notes (Z$100 trillion, 10, 20, 50 trillion currency), was the government’s attempt to address hyperinflation. As happens, the new currency was not able to keep up with soaring prices for goods and the lack of goods to purchase.

Many countries sell their goods with U.S. dollar price tags. It is not just goods; even services are pegged to the U.S. dollar in other countries. What effect could the U.S. debt mountain have on the world economy? Think of talent exodus for starters!

Dynamics of events and decision making

Speed, intangibles and connectivity, according to the authors of “Blur” published in March 1998, were going to be the driving force in the economy beyond 2000. Speed, is the first critical characteristic. Our highly mobile society operates at greater speed, allowing us to conduct business worldwide. Speed also impacts an organization’s ability to develop, implement and manage strategic initiatives. So if we are basing our business continuity plan on an incomplete or limited analysis of the business can we expect it to be valid?

Connectivity is the second critical characteristic. Supply chains, outsourcing, etc. are interdependent systems (utilities for example). We in the United States import more of our daily necessities that we produce domestically.

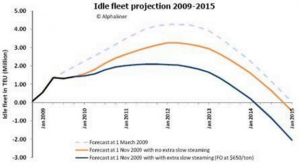

The third critical characteristic is Intangibles. Today’s business environment is the product of thousands of years of forces acting on it; the result is today’s worldwide or global economy. Intangibles are difficult to identify for many due to a narrow field of focus. For example, currently there is a glut of capacity in the shipping industry as depicted in the graphic, “Idle fleet projection 2009 – 2015.

In economics, arbitrage is the practice of taking advantage of a state of imbalance between two or more markets: a combination of matching deals is struck that capitalize upon the imbalance, the profit being the difference between the market prices. Why not take advantage of imbalance – a crisis – as an essential element of your business continuity strategy? Companies regularly invest their capital in the markets. Shouldn’t part of the Business Impact Assessment, the plan and the implementation of the plan during a crisis involve strategically directed investing (hedging, derivatives, arbitrage, etc.) as a part of the business continuity toolbox? Strategic investing, Options, Arbitrage, Short-Selling, Derivatives, etc. have long been part of the CFO’s risk management conceptual framework.

In economics, arbitrage is the practice of taking advantage of a state of imbalance between two or more markets: a combination of matching deals is struck that capitalize upon the imbalance, the profit being the difference between the market prices. Why not take advantage of imbalance – a crisis – as an essential element of your business continuity strategy? Companies regularly invest their capital in the markets. Shouldn’t part of the Business Impact Assessment, the plan and the implementation of the plan during a crisis involve strategically directed investing (hedging, derivatives, arbitrage, etc.) as a part of the business continuity toolbox? Strategic investing, Options, Arbitrage, Short-Selling, Derivatives, etc. have long been part of the CFO’s risk management conceptual framework.

John M. Greer, author of “How Civilizations Fall: A theory of catabolic collapse,” touches on some of the over-arching global trends such as the consequences of an ageing population, the end of cheap, abundant commodities; and the geopolitical tensions this mismatch of demand and supply creates. Given rising demand from China, India and other nations; and falling availability, commodities will become a central point of focus for the U.S. government consumption machine.

Can private sector entities cut back on a reliance on the U.S. government for solutions for jobs in favor of self-reliance and a broader spectrum of income, community and sources of prosperity? Or is the private sector too far gone to effectively change the tide of the government tsunami of printing and spending? It seems that a drop in U.S. real wealth (rising debt levels falling asset values) will inexorably diminish U.S. influence, power and prestige. While we can debate the consequences and speed of this decline, that there will be consequences is beyond debate.

Conclusion

Elizabeth Kübler-Ross defined the five stages of coming to terms with grief and tragedy as denial, anger, bargaining, depression, and acceptance, and applied it quite successfully to various forms of catastrophic personal loss, such as death of a loved one, sudden end to one’s career, and so forth. Dimitry Orlov’s five stages of collapse may be well worth taking another look at:

Stages of Collapse

Stage 1: Financial collapse. Faith in “business as usual” is lost. The future is no longer assumed to resemble the past in any way that allows risk to be assessed and financial assets to be guaranteed. Financial institutions become insolvent; savings are wiped out, and access to capital is lost.

Stage 2: Commercial collapse. Faith that “the market shall provide” is lost. Money is devalued and/or becomes scarce, commodities are hoarded, import and retail chains break down, and widespread shortages of survival necessities become the norm.

Stage 3: Political collapse. Faith that “the government will take care of you” is lost. As official attempts to mitigate widespread loss of access to commercial sources of survival necessities fail to make a difference, the political establishment loses legitimacy and relevance.

Stage 4: Social collapse. Faith that “your people will take care of you” is lost. As local social institutions, be they charities, community leaders, or other groups that rush in to fill the power vacuum, run out of resources or fail through internal conflict.

Stage 5: Cultural collapse. Faith in the goodness of humanity is lost. People lose their capacity for “kindness, generosity, consideration, affection, honesty, hospitality, compassion, charity” (Turnbull, The Mountain People). Families disband and compete as individuals for scarce resources. The new motto becomes “May you die today so that I die tomorrow” (Solzhenitsyn, The Gulag Archipelago). There may even be some cannibalism.

Geary Sikich – Entrepreneur, consultant, author and business lecturer

Contact Information: E-mail: G.Sikich@att.net or gsikich@logicalmanagement.com. Telephone: 1- 219-922-7718.

Geary Sikich is a seasoned risk management professional who advises private and public sector executives to develop risk buffering strategies to protect their asset base. With a M.Ed. in Counseling and Guidance, Geary’s focus is human capital: what people think, who they are, what they need and how they communicate. With over 25 years in management consulting as a trusted advisor, crisis manager, senior executive and educator, Geary brings unprecedented value to clients worldwide.

Geary is well-versed in contingency planning, risk management, human resource development, “war gaming,” as well as competitive intelligence, issues analysis, global strategy and identification of transparent vulnerabilities. Geary began his career as an officer in the U.S. Army after completing his BS in Criminology. As a thought leader, Geary leverages his skills in client attraction and the tools of LinkedIn, social media and publishing to help executives in decision analysis, strategy development and risk buffering. A well-known author, his books and articles are readily available on Amazon, Barnes & Noble and the Internet.