Senior leaders of five recent Baldrige Award recipients representing diverse sectors of the U.S. economy—The Charter School of San Diego (CSSD), Elevations Credit Union, Guidehouse (formerly PricewaterhouseCoopers Public Sector), Memorial Hermann Sugar Land Hospital, and Stellar Solutions–presented insights on how they guide their high-performing organizations to innovate at the Baldrige Performance Excellence Program’s 34th Quest for Excellence® conference in April 2023. Following are highlights of the presentation by Gerry Agnes of Elevations Credit Union.

Senior leaders of five recent Baldrige Award recipients representing diverse sectors of the U.S. economy—The Charter School of San Diego (CSSD), Elevations Credit Union, Guidehouse (formerly PricewaterhouseCoopers Public Sector), Memorial Hermann Sugar Land Hospital, and Stellar Solutions–presented insights on how they guide their high-performing organizations to innovate at the Baldrige Performance Excellence Program’s 34th Quest for Excellence® conference in April 2023. Following are highlights of the presentation by Gerry Agnes of Elevations Credit Union.

What Does Innovation Look Like for a Relatively Small Organization?

Gerry Agnes, president and CEO of two-time Baldrige Award winner Elevations Credit Union, began his presentation on innovation at the Baldrige Program’s Quest for Excellence® conference by demonstrating his great appreciation for the people who work at the Colorado nonprofit, as well as for the people served by them.

Of Elevations’ 600-plus employees, he said, “I learn from them every day, and they inspire greatness inside our organization.” Of the credit union’s 176,000 members today, he said, “We listen to what they have to say. We have a variety of listening mechanisms, and we learn from them.”

In outlining Elevations’ journey to excellence, Agnes noted, “We’ve come a long way since our very humble beginnings.” The organization was established in 1952 to serve faculty and staff members of the University of Colorado. Known then as the University of Colorado Federal Credit Union, it had 12 members and assets of less than $100, he said. Today, it has assets of more than $3.3 billion, though Agnes pointed out that it is still a “community-based financial services organization” and its community, the Front Range region of Colorado, is “still a small market.”

Agnes joined Elevations in 2008—a month before several big, national mortgage banks failed, he noted. As Agnes and his team considered how to succeed, “We asked ourselves at Elevations, ‘What would innovation look like for us, and could it be more incremental [than the pace of innovation at very large companies] but still have a big-bang disruptive force inside our [much smaller] market?’”

Embracing Improvement and Innovation

According to Agnes, a simple concept and a question helped Elevations move forward with changes that eventually disrupted its market: “Let’s help people fulfill their dream of home ownership” and “How can our organization be better today than we were yesterday and become better tomorrow than we were today?”

In Elevations’ industry of residential mortgages, price isn’t a significant variable, he explained, and Elevations already had key products in place and a good brand to promote. So Elevations looked at how it was positioned in the marketplace, and the organization’s focus for change “came down to process management.”

Probing the question, “Who is the customer of the mortgage?” Elevations recognized that “the true customer is the realtor and the title insurance company,” he said, since “we get the member through the process.”

The focus on fulfilling the needs of those key customers (realtors and title companies) drove Elevations to change its residential lending process based on the question, “How quickly can we close [on each mortgage loan] without exceptions?” he said. “The ability to do that faster, better than anybody in the marketplace, is really, really important because that’s when the brand recognition comes into play.”

Key Results and Guidelines

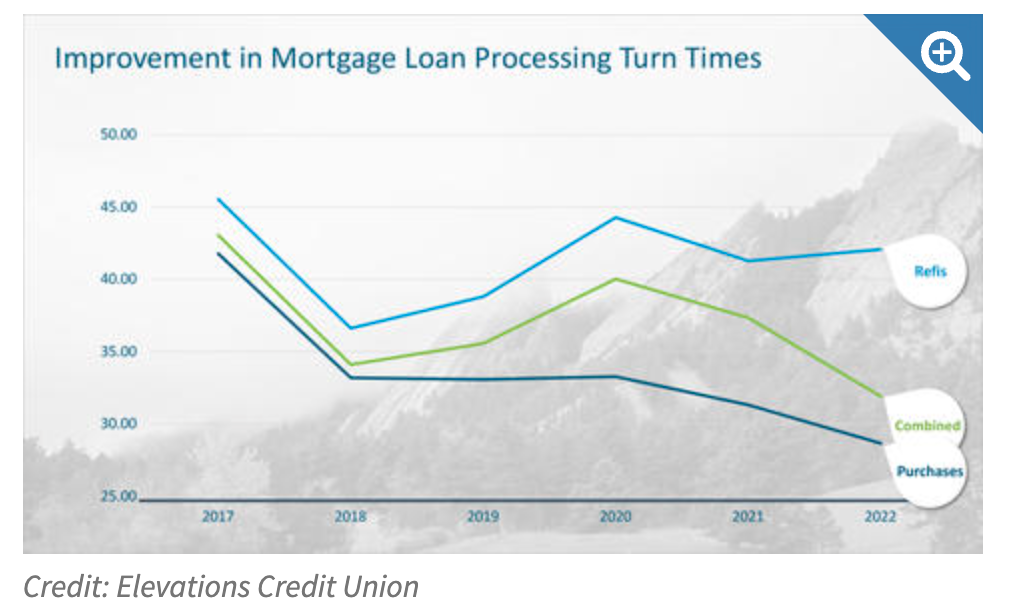

Starting in 2011, Elevations was able to improve its loan processing turn times significantly enough that by 2013, it began outperforming two large, nationwide competitors in its community market for home loans. As shown in the graphics above and below, Elevations sustained and increased those gains for several subsequent years.

In sum, Agnes stressed the benefits for Elevations of “incremental change,” starting with asking the question, “What if we’re able to come out and become disruptors at a very, very large scale?”

“We were able to do that,” he added, “and that’s just one example of how we applied the Baldrige framework inside Elevations.”

Agnes then stressed the value of openly and thoroughly discussing with employees the questions that make up the Criteria for Performance Excellence® (part of the Baldrige framework booklet).

He concluded with three points of guidance for other organizations seeking to innovate and succeed:

- “Embrace the Baldrige framework because it really is innovation.”

- “Never underestimate the capabilities of a stellar team.”

- “Ensure that the Baldrige framework is contained in your strategic plan.”

Five-Part Leadership Blog Series

Previous Blog

Leading for Innovation, Part 1: Insights from CSSD’s Mary Bixby

Baldrige Excellence Framework®

The Baldrige Excellence Framework® has empowered organizations to accomplish their missions, improve results, and become more competitive. It includes the Criteria for Performance Excellence®, core values and concepts, and guidelines for evaluating your processes and results.