If you want your business to survive, you need to innovate. If you want your business to have a chance of thriving, you need transformation. Certainly, either innovation or transformation are no guarantees of success – but the lack of both almost certainly leads to doom. Need proof? Can you name one company or one industry (other than government) today that, when faced with a change in the marketplace, failed to innovate – and instead stayed with its traditions, and survived – not to mention, thrived? If you think of one, let me know. How about a company that faced a transformation in the marketplace – how did it fare over time?

If you want your business to survive, you need to innovate. If you want your business to have a chance of thriving, you need transformation. Certainly, either innovation or transformation are no guarantees of success – but the lack of both almost certainly leads to doom. Need proof? Can you name one company or one industry (other than government) today that, when faced with a change in the marketplace, failed to innovate – and instead stayed with its traditions, and survived – not to mention, thrived? If you think of one, let me know. How about a company that faced a transformation in the marketplace – how did it fare over time?

But, what is innovation? And what is transformation?

Do people even differentiate between innovation and transformation? Do a series of innovations, introduced in rapid succession, result in transformation? It is easy to confuse the two or to blur the borders. For your consideration:

Transformation is the process of starting or ending a paradigm and involves a terminus. Think about the invention of the lightbulb (which marked the end for gas lamps), or the shipping container (which marked the beginning of globalization). Within a company, it means the complete redefinition of its core value proposition – for instance, IBM was a company whose founding and existence depended upon selling computers and related peripherals until it had a near-death experience in the early 1990’s and transformed into a business consulting firm (with an emphasis on information systems). And…

Innovation is the process of evolutionary step-changes in a product or service offering. Think about incremental releases (versions) of software – each designed to build from the previous, but adding various improvements in design and ability. In an enterprise (consisting of a company, and its value chain), innovation might take place in the form of a reorganization.

So, although innovation is necessary for survival, transformation is the big-bet. The go-big or go-home moment which has the greatest risk, but also the greatest potential for reward.

Transformation:

The obvious example of a company that is both transformative and innovative is Apple. But Apple is far less transformative than it is innovative. This is not a criticism as much as it is an observation. And it only makes sense because transformation is a lot more difficult.

From my perspective, Apple has introduced only four transformations to the marketplace and all of the other offerings Apple has introduced have been innovations to these transformations – or they were flops by Apple standards (ie. Lisaand Power Mac g4 Cube).

- Apple-][; Launched in 1977, the Apple-][ heralded the introduction of the personal computer which brought real computing power to the hands of individuals.- Marked the demise of the mini-computer (such as the offerings of IBM and their 3x Series and the similar offerings of DEC and their VAX) and also diminished the need for mainframes such as the IBM 37x.

- Macintosh; The Apple Macintosh was launched in 1984 (some of you might remember the Orwelliancommercial at its introduction). This was the personal computer which introduced an operating system that supported a multi-panel user interface – allowing users to run multiple sessions simultaneously.- Ended the era of operating systems that did not run multiple sessions – including Apple’s own Apple-][. To compete (even to stay relevant), Microsoft introduced its response in the form of the Windows Operating System.

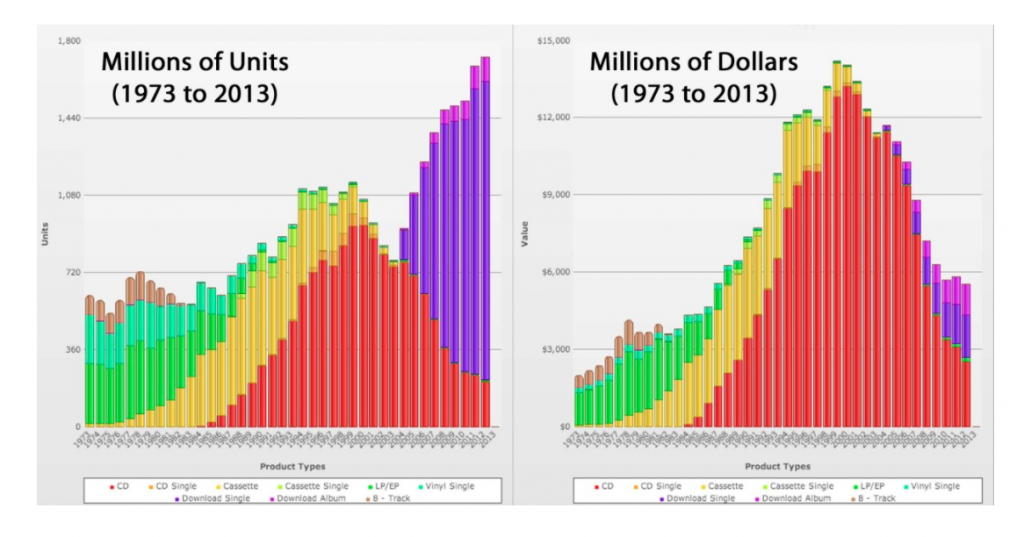

- iTunes; Apple purchased SoundJam-MP in 2000 whose product was an MP3 Although the acquisition and technology involved were not transformational in themselves, they served as the core technology for the creation of iTunes, which was introduced in 2001 and allowed users of Apple equipment the opportunity to purchase digital versions of music online. This transformed the way the music industry sold its offerings – a transformation with which the industry still struggles today. In 2003, Apple renamed iTunes to the iTunes Music Store as it opened the offering to customers who did not run Apple products. And later, it was renamed again to the iTunes Store as it began selling all manner of intellectual property delivered in digital form – not just music, but movies, books, podcasts, software, “apps”, and so forth.- Marked the demise of delivering music on physical media and the way the music industry itself operated. There is a great article which shows the evolution of the music industry written by Andrea Swensson in February 2014 and published on The Currententitled, “40 Years of Album Sales” which does a deep dive into the numbers and trends. Although media had come and gone over the years (anyone remember 8-Track Tapes?), the iTune Store was the only disrupter that transformed the distribution channel (taking it away from the music industry).

- iPod Touch; In 2007, Apple introduced the iPod-Touch. Although iPods had been available since 2001, the iPod Touch was the first to have WiFi built into the unit and also a touch-screen user interface. It was not too difficult to imagine a future version with a built-in mobile phone (which I consider an innovation rather than a transformation).- Marked the beginning of the era where computing power became untethered. No longer did a computing device have to be physically attached to anything; it could use WiFi (and later, mobile telephone service) to access data and websites. Data could be stored elsewhere (eventually, in the “Cloud”) to be accessed anytime and anywhere a device could connect to the internet. And “Apps” could be downloaded and serve as the front-end for processing (and creating) data.

Transformation Frameworks

So, in the forty (40) years that Apple has been in existence, it has introduced four (4) offerings which could be considered transformational. And I believe we would all be hard-pressed to think of a company that has introduced so many transformative offerings that have directly effected as many people over a similar period of time (or even over its entire existence).

In 2005, W. Chan Kim and Renée Mauborgne wrote the best-selling book, Blue Ocean Strategy. Its premise is that it is better to create a new market and the resultant customer demand – where there is little or no competition and the margins can be very healthy (blue ocean) – than it is to try to compete in a market that is commoditized and the primary differentiator is price, resulting in a feeding frenzy of vendors vying for customers at the sacrifice of margin (red ocean).

But I am left wondering; are companies transformative or are individuals transformative? Do they actually use the frameworks suggested in the book, or are the frameworks in the book a reflection (post transformation analysis) of what the result of the transformation looked like? Even Apple has had its share of flops, but is that just a natural expectation of transformative risk-taking? If you think of Apple as a venture capital firm, it is expected to generate more flops than hits – so is that it? Just a “numbers game” that comes with taking risks? Try it, cut your losses early and take your lumps, then move on?

How much data is collected and analyzed before introducing the transformative offering? What is the origin of that data since there should be no data for a market that doesn’t yet exist? If so, what kind of company will Apple become over the next generation now that Steve Jobs (February 24, 1955 to October 5, 2011), arguably the heart and soul of Apple’s creativity, has passed to the ages?

Was it Thomas Edison or was it the company he founded (General Electric) that was transformative? Today, I would argue that General Electric is an acquirer of transformative technologies and a master integrator of those acquisitions into its business. Do you think that the General Electric of the 21stcentury would indulge over 1,000 failures in developing an offering as Thomas Edison endured when inventing the light-bulb?

Is Elon Musk transformative or is it the companies he founded and still leads (Tesla, SpaceX, and Solar City) that are transformative? How about Paul Galvin and Motorola?, or Malcom McLean and the shipping container?, or Bill Gates with Microsoft?, or Larry Page and Sergey Brin with Google? Can you think of a company that is transformative without having a single creative genius at its core?

Are there other circumstances that influence the success or failure of a transformation?

If MySpace had been developed at a different time, when social media was a bit

more mature, would Facebook even exist today? After all, they both drove similar value to their users. Maybe MySpace would be today’s Facebook if Rupert Merdoch’s News Corporationdidn’t purchase MySpace and try to charge users of

the platform a fee for access resulting in an exodus and, instead, sought revenue

from advertising – generate revenue from those who wanted to gain from access to the ecosystem rather than from the users of the ecosystem. But that didn’t happen and MySpace is almost completely extinguished from the social-media landscape.

Then there is geography. LinkedIn and XING started about the same time doing the same thing (a social media platform for professionals). But where LinkedIn was founded in Silicon Valleyand had access to a lot of capital from serial-investors in technology companies, XING was founded in Hamburg, Germanyand never enjoyed the benefit of access to capital or marketplace that LinkedIn enjoyed. Perhaps if XING had relocated to Silicon Valley early, it would be the center-of-gravity instead of LinkedIn.

How about a company that is less innovative, but is superior at strategy execution? Take Ford Motor Company; the founder, Henry Ford, didn’t invent the automobile, but he was the first to mass-produce them by manufacturing them using a production-line – a transformation in strategy execution.

Do you think that any of the individuals or their companies listed above applied some framework for the creation of their offering? Or do you believe it was more likely they had an educated hunch that their soon to be created offering would be well received by customers who didn’t yet know the offering will exist (not to mention want to purchase it)?

It has been nearly ten (10) years since Apple has introduced its last transformational disruptor, the iPod Touch. Apple’s history would indicate that it is due for another – but what might that transformational disruptor be? Or, did Apple’s transformation train die with Steve Jobs. Time will tell.

Innovation

To compare Transformation with Innovation and staying with the analysis of Apple, each of Apple’s transformations have been followed by a plethora of innovations. Considering each of Apple’s product lines; How many versions of the Macintosh have there been? And what about the iPod-Touch which begat the iPhone and the iPad (and however many revisions each therein)? Each step improvement has been part of an evolutionary journey and each involved innovations.

Even the many peripheral devices and applications that depend upon the core transformational technologies above should be considered innovations rather than transformations. Take the Apple Watch, for instance; it requires an iPhone in order to function – even while the chances of it rendering obsolete traditional watches are slim to none. If you consider Moore’s Law, which proposes that computing power will double every two years or so? Can you see a world where people would be compelled to replace a $500+ watch every couple of years? And for what?

Or how about the rate of which innovations are introduced? Especially in electronic gadgetry, Moore’s Law renders nearly obsolete products that are more than two years old. The rate of innovation can matter as much as the innovation itself to keep offerings competitive. Consider Apple and its competition for device sales, Samsung; Apple certainly capitalized on being first to market with the smartphone, but now Apple and Samsung are locked in heated battle to keep-up and one-up one another. Each new offering, introduced every couple of years or so, is; faster, thinner, bigger screen without increasing the size of the device, higher resolution, more apps, and so on. At the end of the day, which is really better than the other except for the customer being a fan of Apple or Google.

Innovation Frameworks

Whereas transformation is usually the result of an individual leading an effort, innovation is likely the result of a more collaborative approach. This is reasonable since the base-line data exists for the original transformation; What do customers dislike (thickness, battery life, screen size) and how can we improve? What do customers like (selection of apps, integration with other devices) and how can we give them more of what they want more easily? What do customers need (peripherals and additional functionality) and what do we need to do to develop these expanded capabilities?

Each of these can leverage data from customer feedback (as opposed to transformation where the offering and resultant customer feedback is not available). And there can exist within a company collaborations between engineering design and development, marketing, and sales to develop offerings that are a result of the customer feedback.

If you consider Porter’s Five Forces (as one of many formal approaches) what are; the opportunities or threats from substitutes offerings or new entrants? What is the bargaining power of suppliers and customers? And what industry rivalry might exist? Each of these exerts forces which influence the outcome of innovation – the form it takes.

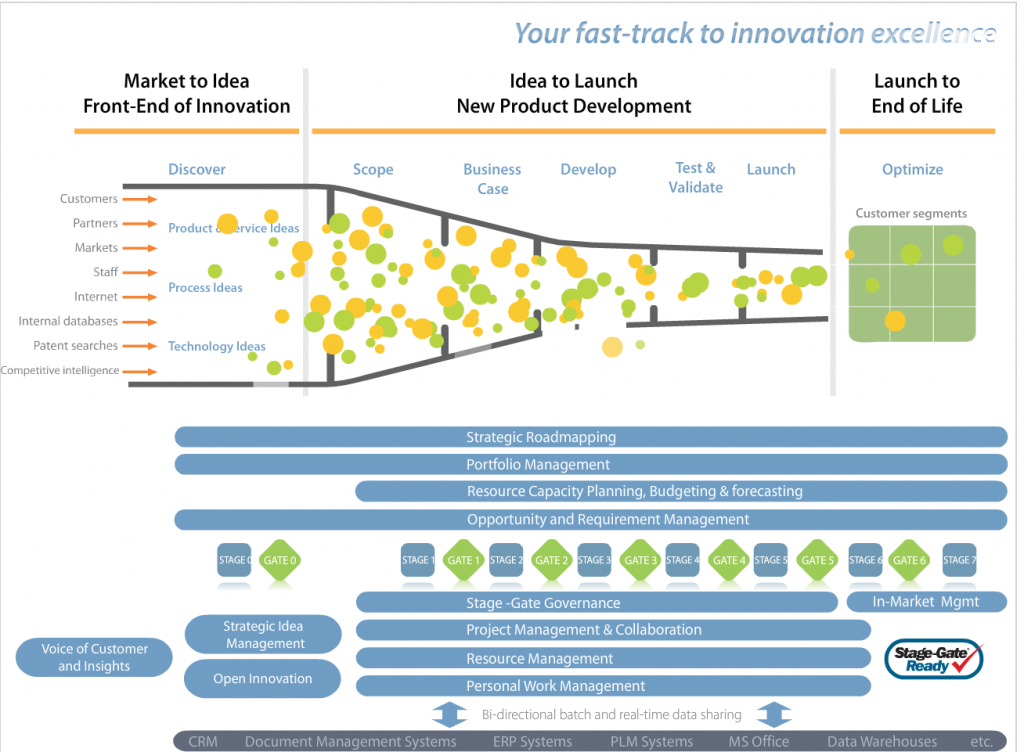

Innovation Framework Technologies has presents a roadmap for Innovation Management and New Product Development and Launch that is concise with a good graphic that distills an framework for innovation in a clear and understandable manner.

But you can see by this framework that there are many data-points that feed the framework. And many (perhaps most) of which are not available when you are developing an offering that is transformational in nature – a blue ocean offering.

This is what worries me about Apple

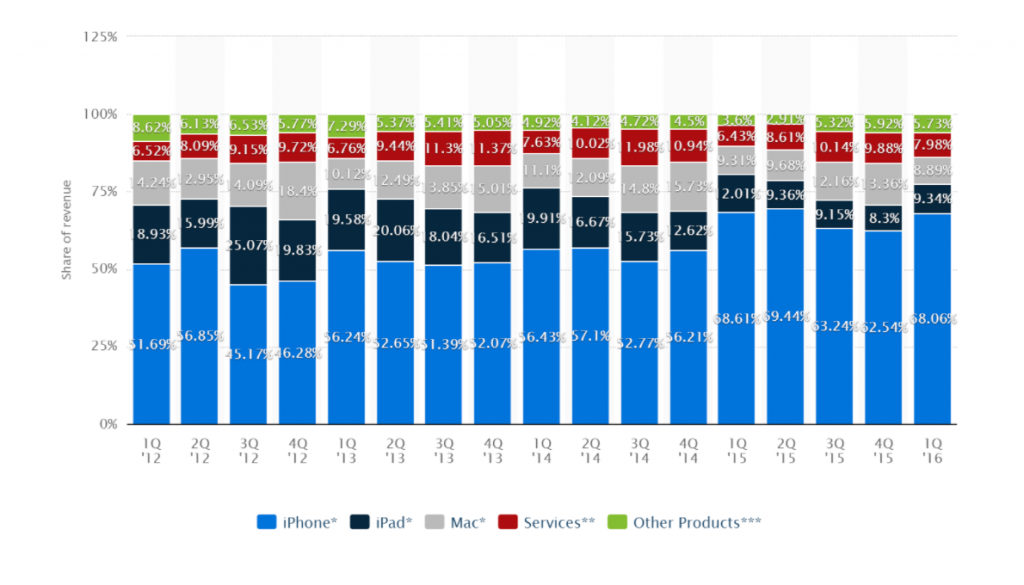

The first question to ask is, “What is the source of Apple’s revenue – what is its composition?”

If we consider the analysis from Statistica of Apple’s revenue by category, we can see that there is an increasing dependency on revenue from the sale of iPhones over other offerings from Apple. In fact, the revenue from the sale of iPhones for 2015 and going into 2016 averages a full two-thirds (66%) of Apple’s total revenue – as compared to 53% from 2012 thru 2014.

The risk here is of Apple becoming a one-trick pony. I am not saying it will, but there is a risk.

Take GoPro, for instance – a company that arguably makes the best cameras and peripherals for the sports enthusiast (the more extreme, the better). According to a report on Bloombergentitled GoPro Shares Nosedive as Demand Slumps for Action Cameras (January 13, 2016); after its IPO in the beginning of 2014, GoPro saw revenues of $250million in Q2 and Q3 of 2014 and they jumped to $650million in Q4 of 2014 for the holiday season. However, afterwards revenue shrank back to less than $450million in each of the quarters of 2015.

Certainly, the introduction of GoPro’s latest offerings in 2015 were not compelling enough for people to want to buy. But the bigger challenge was that most of the people who craved the devices (low-hanging fruit) had already bought and only new customers (with less desire to own) or returning customers that just have to have the latest, were buying.

Obviously, the marketplace and demand for smartphones is much greater than that for action-cameras, but it should give cause for pause when you consider that Apple is the most valuable publicly traded company in the world, and two-thirds of its revenue depends upon a single product.

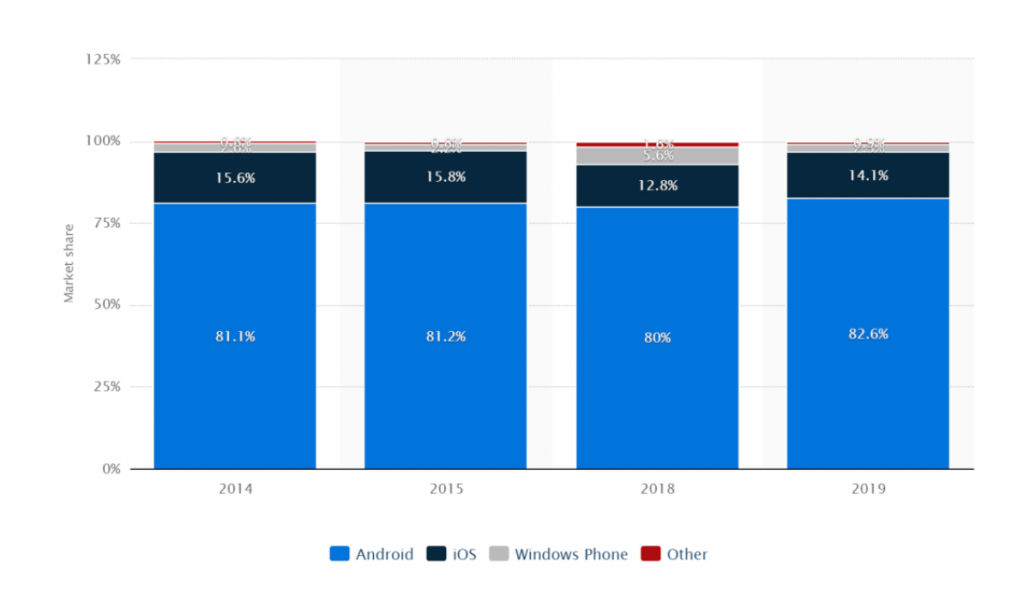

But who is Apple’s competition? In my opinion, if you said Samsung, you would be wrong. Apple’s competition is Google and, specifically, the Android Operating System. In the information age, the advantage goes to the company that has the larger market share for managing the connectivity of devices – a lesson a person could have predicted that Apple would have learned when it competed against Microsoft for ownership of desktop operating systems, but evidently not.

Statistica reports the worldwide smartphone shipments by operating system for Apple’s iOS at approximately 16% for 2014 and 2015, and forecasting a drop through 2019 – compared with Android hovering around 82% of the marketplace. This means that the center-of-gravity for smartphone operating systems into the foreseeable future will be Android – and Google. But whereas Apple depends on the sale of iOS for 66% of its revenue, the revenue to Google for the licensing Android is less than 10%. Instead of the sale of devices and operating systems, Google’s strategy is to earn revenue from those who engage the ecosystem – this being a long-term annuity as compared to the one-off revenue earned by selling devices. And, unfortunately, the Apple Store is no longer the only place where a consumer can get digital media – unless it’s an app that runs on an iPhone.

So this is the challenge for Apple to retain its reputation and valuation – it needs to introduce another successfultransformative offering.

If it can create the transformative offering from within, it will retain its much-deserved title and reputation as one of the most transformational and innovative companies in the world.

If it has to acquire the transformative offering, it will be seen as having lost its entrepreneurial spirit and become a mature company – taking a hit on its reputation and not seen as worthy of the premium price-equity ratio it presently enjoys. To be successful here, Apple will have to become more like GE; an expert at acquisition (valuation and marketplace) and integration. Looking at Apple’s acquisition history, and in particular its deal under Tim Cook purchasing Beats Electronics(a maker of headsets) for $3billion is not a confidence-builder.

If it fails to create or acquire the transformative offering, it will stagnate unless it accelerates the rate and impact of innovations in the offerings it already has on the market. Otherwise, Apple will be seen as just another company that sells cool gadgets – perhaps even become a take-over target for someone else.

Transformation, Innovation, or Stagnation – it kinda makes you wonder what Tim Cook and his team has planned. I hope it’s another blockbuster and proves to the world that Apple was not just Steve Jobs.

Bio:

Joseph Paris is an entrepreneur with extensive international experience. He is the Chairman of the XONITEK Group of Companies, an international management consultancy firm he founded in 1985; and the Founder of the Operational Excellence Society, a “Think Tank” dedicated to serving those interested in the disciplines of Operational Excellence. In addition, Paris serves on the Advisory Board of the System Science and Industrial Engineering Department at Binghamton University and on the Process Industries Division at the IIE. He is also on the Editorial Board of the Lean Management Journal and a sought-after speaker, guest lecturer and writer.

Mr. Paris is also the author of State of Readiness.