Ever since the H1N1 outbreak in 2007 that was declared a pandemic by a reactive World Health Organization (WHO); WHO and Centers for Disease Control (CDC) have been reluctant to move too quickly in declaring an outbreak, whether influenza, Ebola, Norovirus, Adenovirus, Mengla virus or any of the myriad of potential pandemic causing viruses a pandemic.

Perhaps once burned, twice shy? The concern, however, should be on assessing our preparedness to deal with a large-scale outbreak. Since the threat of H5N1 (Bird flu) in the mid-2000’s pandemic planning has gone into hibernation for most organizations.

Far Greater Immediate and Long-Term Impacts?

The economic impact of a global pandemic could be drastic, the chief economist for the International Monetary Fund warned when ‘Bird Flu’ looked to be the greatest threat. Shortages of commodities that are imported and exported; mainly food products, could occur due to restrictions, quarantines, sick agricultural inspectors, etc. Today in the USA there is a shortage of IV saline solution due to the hurricane that hit Puerto Rico. As it turns out, almost 50% of IV saline is produced in Puerto Rico. It gets even more threatening; consider that almost 80% of all pharmaceuticals are produced overseas (China and India are the main producers).

Potential Economic Impacts

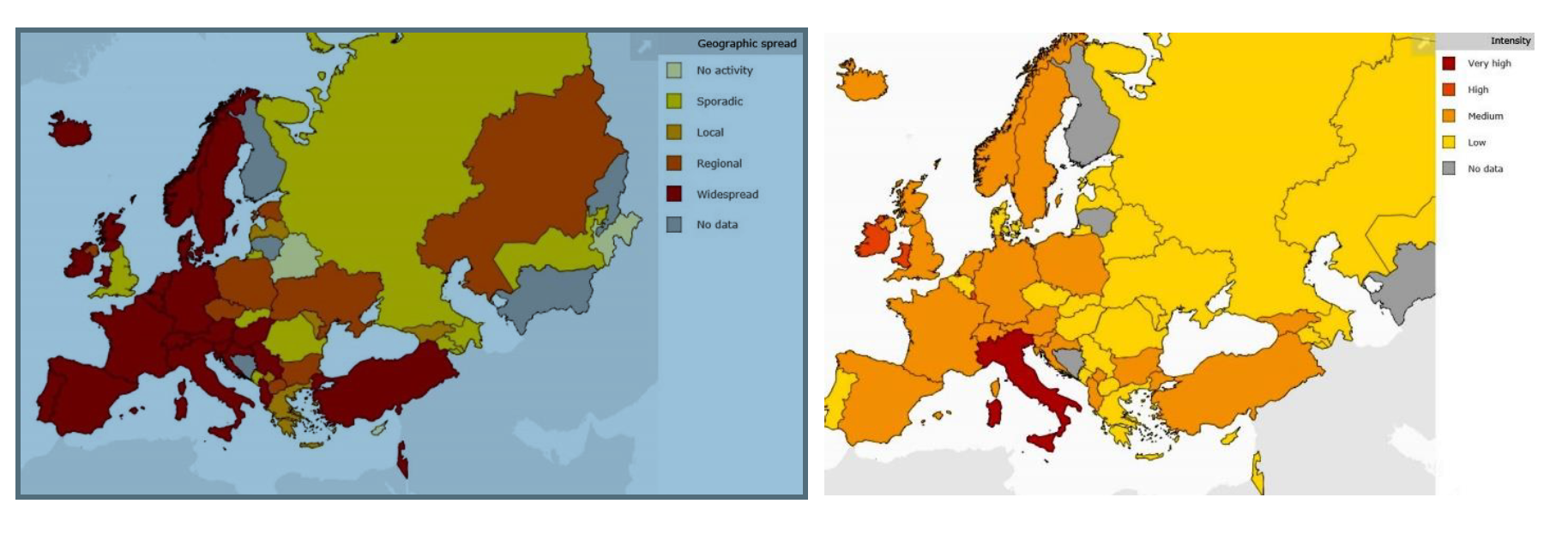

Seasonal flu affects between 5% and 20% of the US population. Approximately 200,000 people are hospitalized as a result. There are approximately 36,000 deaths from seasonal flu in the US, mainly the aged and very young. Worldwide, season flu is estimated to result in about 3 to 5 million cases of severe illness and about 290,000 to 650,000 deaths. In Croatia 45,852 flu cases were reported during the seasonal flu in 2016/2017. The two maps below provide some interesting information on the current flu situation. The first is a depiction of geographic spread and the second depicts intensity. While the flu is widespread; it is of very high intensity in Italy, Sicily and Sardinia.

The Spanish Flu, of 1917 – 1919/20 produced a highly infectious virus that it is estimated caused the deaths of 50 to 100 million people worldwide. The mortality rate was just 2.5%. The 1957 and 1968 flu outbreaks had a mortality of just 0.5%. Yet, the results were seen in economic disruption. The cascade effects will be seen in commodity prices, stocks of food companies, energy prices, pharmaceutical company expenditures to find a vaccine and any measure of things.

A pandemic will have a domino effect worldwide. It will create a unique set of conditions that impact society, governments, businesses and medical support systems. Current thinking about pandemic generally starts with the recognition of the illness and a projection on its societal impacts. We know that:

❑ People are affected

❑ Society is unprepared

❑ Governments are unprepared

❑ Private Sector Enterprises are unprepared

❑ Medical Institutions will be impacted

❑ Economic Sectors Worldwide will be impacted

❑ Medical Support Systems are impacted

❑ Social Behavior will reflect be Susceptible to Significant Degradation

The following are the initial, albeit, speculative impacts that we can attribute to a pandemic:

Business (all forms of Private Enterprise) Impact

❑ Reduction in workforce this leads to a reduction in output capacity

❑ Reduction in consumption (people staying at home) leads to a decrease in demand

❑ Reduction in revenue leading to less profit, leading to less taxes being paid

❑ Lack of consumption demand leading to employees being laid off; leading to loss of benefits (healthcare insurance, etc.)

❑ Reduction in disposable income leads to further consumption declines and consumption focused on necessities (healthcare insurance may become a luxury)

❑ Redistribution of family asset spending – necessities only

➢ Food

➢ Medical (if you can pay health insurance, you still have deductibles; will the influenza be covered under your existing plan?)

➢ Housing

➢ Private transportation – if possible

❑ More layoffs due to a worldwide sloughing off demand and some countries closing borders as they attempt to isolate themselves

❑ Business bankruptcies medium and small businesses will feel the pain because they have limited cash reserves. Large enterprises will suffer because of loss of consumers and suppliers (how dependent is your business on the small to medium size supplier/vendor? Or, is your small/medium size business heavily dependent on a customer (large enterprise) that may experience a decline in demand putting your operations at risk?)

Medical Support Systems (All Medically Related Endeavors)

❑ Doctors in demand for patient diagnosis – office visits

❑ Hospitals overwhelmed with patients

❑ Patients must be isolated, from traditional patient care

❑ Isolation supplies become limited, if available at all

❑ Respiratory equipment in short supply – for secondary pneumonia

❑ Committees will decide who gets respirator support & who does not

❑ Limited supplies of medication (no vaccine for 6-9 mos.)

❑ Hospital & public pharmacies must increase security for medications

Investments Fall (Anything that can be Monetized)

❑ Redistribution of family assets – reduced investing

❑ Companies need cash for operations vs. reduced investments

❑ Investors seek “safe havens” for investing – no 3rd world investments

❑ Reduced capacity to process investment activity – up to 40% of staff sick

❑ Stock and Bond Markets behave erratically leading to less and less investment in publicly traded stocks, bonds

❑ Private equity investments in companies drops for all the above reasons cited previously and all the subsequent points yet to come

Commodity Markets

❑ Demand becomes erratic leading to reduced trading

❑ Open pit operations are limited due to physical concerns – exposure to others in the trading pit

❑ Electronic trading (heavier now than ever) becomes erratic as power supply systems and Internet are less consistent

❑ Commodity delivery erratic

❑ Investors seek “safe havens” for investing – no 3rd world investments

❑ Reduced capacity to process investment activity – 30% of staff sick

Business Assets Depleted

❑ Lack of investing

❑ Redistribution of company assets to current expense issues

❑ Growth is replaced with survival strategies

❑ Revenue continues to slip

❑ Unemployment grows

❑ National disposable income declines

❑ Human capital (talent – an overlooked asset) not easily replaceable, long lead times to train, less loyalty, more dependent on technology

Business Failures Increase

❑ More Unemployment

❑ Loss of personal disposable income

❑ Increased demand for government services (at all levels)

Government Impact

❑ Substantial drop in revenues (tax base drops)

❑ Quarantine and Isolation requirements will us most of government assets

❑ Limited ability to provide of traditional support services

❑ Increased demand for services

❑ Social unrest ferments – “someone has to help us” mentality

Bankruptcies

❑ Business failures increase to unprecedented levels

❑ Increase in personal and commercial bankruptcies

❑ Backlog in court processing of bankruptcies

❑ Creditors wait longer for assets from courts

❑ Creditors see drop in assets from bankruptcies

❑ Creditors become more restrictive in loaning money and extending credit

❑ Credit and loan availability drops

❑ More companies fail due to lack of loans & credit

Creditors Fail

❑ Delays in bankruptcy processing & asset distribution results in lender failures

❑ Bankrupt company assets are not redistributed into the market

❑ Business market contracts because of operational asset decline

❑ Lender failures compounds bankruptcy backlog and asset distribution

Opportunities

❑ Large numbers of qualified, trained individuals available for employment

❑ Companies prepared to identify these people will grow stronger & faster

❑ Substantial number of opportunities will exist because of company failures

Business Impacts – How Long Can You Survive?

Impacts can be immediate and expensive. It is therefore prudent that your pandemic planning efforts consider the dynamic nature of the world’s markets as part of your overall strategy. This makes good business sense. It can be readily applied to situations other than a pandemic. With this broader perspective in mind your pandemic preparations can be leveraged into greater management awareness and perhaps, more of a competitive edge for your enterprise. This is true, for public sector entities too. Government can be more competitive and forward thinking and gain leverage with the constituents (taxpayers) whether they are individuals or businesses.

One key issue that businesses face with a pandemic that is different from other disasters is that multiple locations could be affected simultaneously. This is complicated by loss of personnel that could occur for several reasons – sickness, caring for sick individuals, school closures, fear of contamination at the workplace, etc. Most of the current business continuity models are based on the recovery of technology and facilities (“brick and mortar” type structures). Few are addressing the human component and if they do they are not doing it very well. First and foremost a basis for ensuring that communication and information flows seamlessly vertically and horizontally throughout the enterprise is essential. This means that you must have common terminology within and with all the external touchpoints (customers to vendors) that is clearly understood by all. Most organizations come up short when an analysis of the communication and information flow is undertaken. The general finding is that fragmentation and a lack of seamlessness exists.

Decision making regarding governance issues can only be addressed by senior executives. Senior executives will establish and manage voluntary compliance mandates as well as ensure compliance with regulatory driven requirements.

Strategy requires management engagement to achieve 3600 coverage. This coverage consists of: 1) forward looking capabilities “active analysis” and situational awareness; 2) awareness of challenges; 3) executable goals and objectives and 4) ability to capitalize on experience and past successes. Operating in a pandemic will require that your organization have a flexible and responsive strategy. Incorporating business strategy elements into the management decision making process at all levels of contingency planning can facilitate greater flexibility.

A tactical focus on processes rather than a strategic focus that is broader based – business goals, objectives and response to market demands can equal less than effective business continuity.

Steps to take…Now

The ability to effectively respond to and manage the consequences of an event in a timely manner is essential to ensure an organization’s survivability in today’s fast paced business environment. Several steps can be taken to prepare your organization.

First, put in place an effective surveillance program; meaning, expand your business impact assessment activities. See my article, ““Futureproofing” – the Process of Active Analysis” written in 2003 (updated 2017) for a discussion of how to rethink the business impact assessment process.

Second, recognize that you cannot depend on public authorities (read this as government at all levels) to be there for your organization. Rethink the basis on which you developed your plan – talk to the risk management and strategic planning personnel in your organization and find out what they are looking at regarding business

expansion, contraction, risk mitigation, etc. Revise your business continuity plan. Develop the ability, as an organization, to sequence back your operations while ensuring that your business system and its network (“value chain”) can maintain level of functionality while operating at reduced capability. When your business system and its network reach the state of minimum functionality, the organization can begin to conduct a campaign of “agile restoration” until it achieves a state of full functionality and a return to normal operations.

Third, train, drill, exercise. All the planning in the world is never going to be effective unless it can be implemented. One key to implementation is having a trained organization. That means that we must train not only the primary position holders in our organization, but we have to train the secondary and even a third level within the organization.

If Only We Had Known…A New Paradigm for Planning Strategists

In my book, “Integrated Business Continuity Planning: Maintaining Resilience in Uncertain Times” I asked:

“Is Business Continuity integrated into your business operations as a way of doing business; or is Business Continuity an adjunct to the business that you are involved in?”

As you ponder this question, you need to reconsider the value proposition offered by having an integrated approach to business continuity.

I offer the following definitions for this article and as a basis for developing an “integrated” approach to continuity:

Crisis: “A disruptive event that is amplified, elevated and magnified.”

Business Continuity: “All initiatives taken to assure the survival, growth and resilience of the enterprise.”

Executives have an obligation to their stakeholders to assure that everything that can reasonably be done to protect the business and ensure its competitiveness in the marketplace is done. Unless executives rethink the relationship between how they do business (strategy, competitive intelligence, etc.) and the way they currently address business continuity (managing disruptive events, security, etc.), the imbalance between “security” and competitiveness will not be resolved. Therefore, businesses must rethink their recovery strategies to be able to deal with and survive pandemics. This is a whole new paradigm for planning strategists.

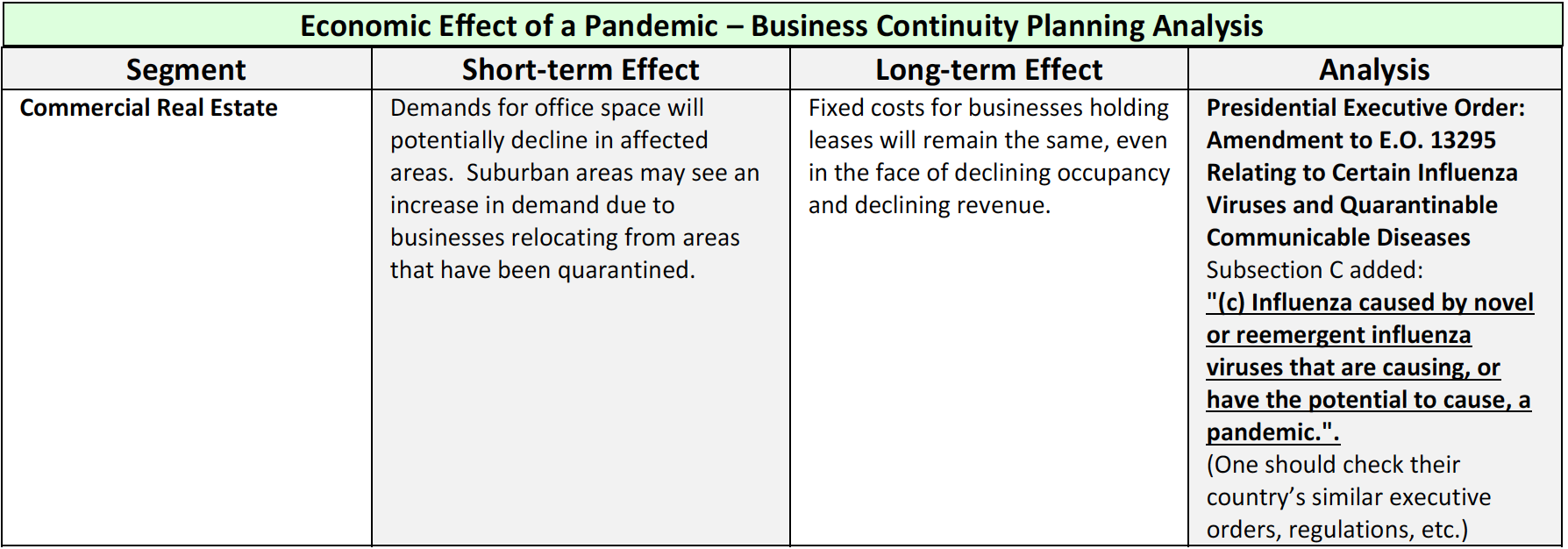

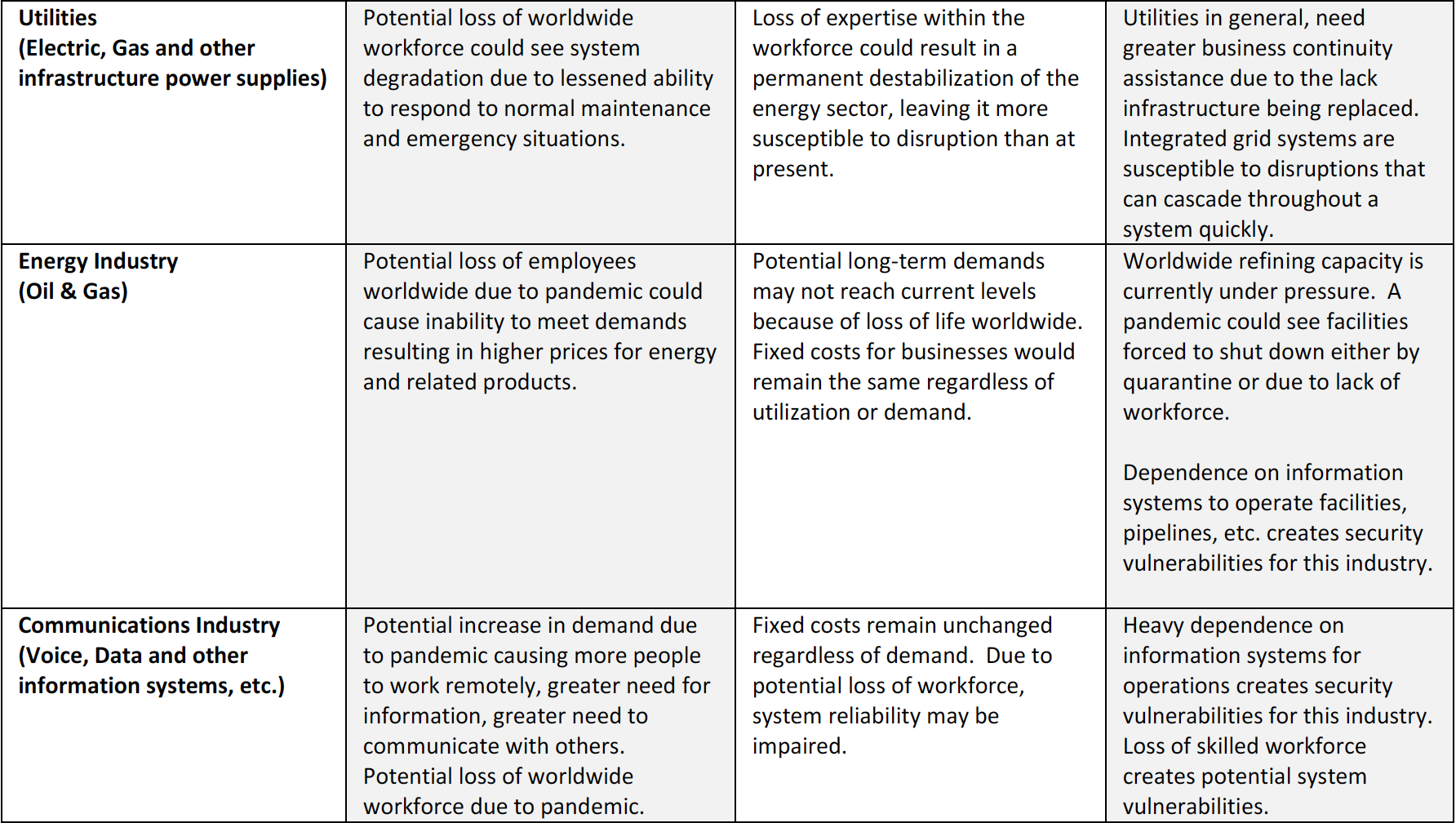

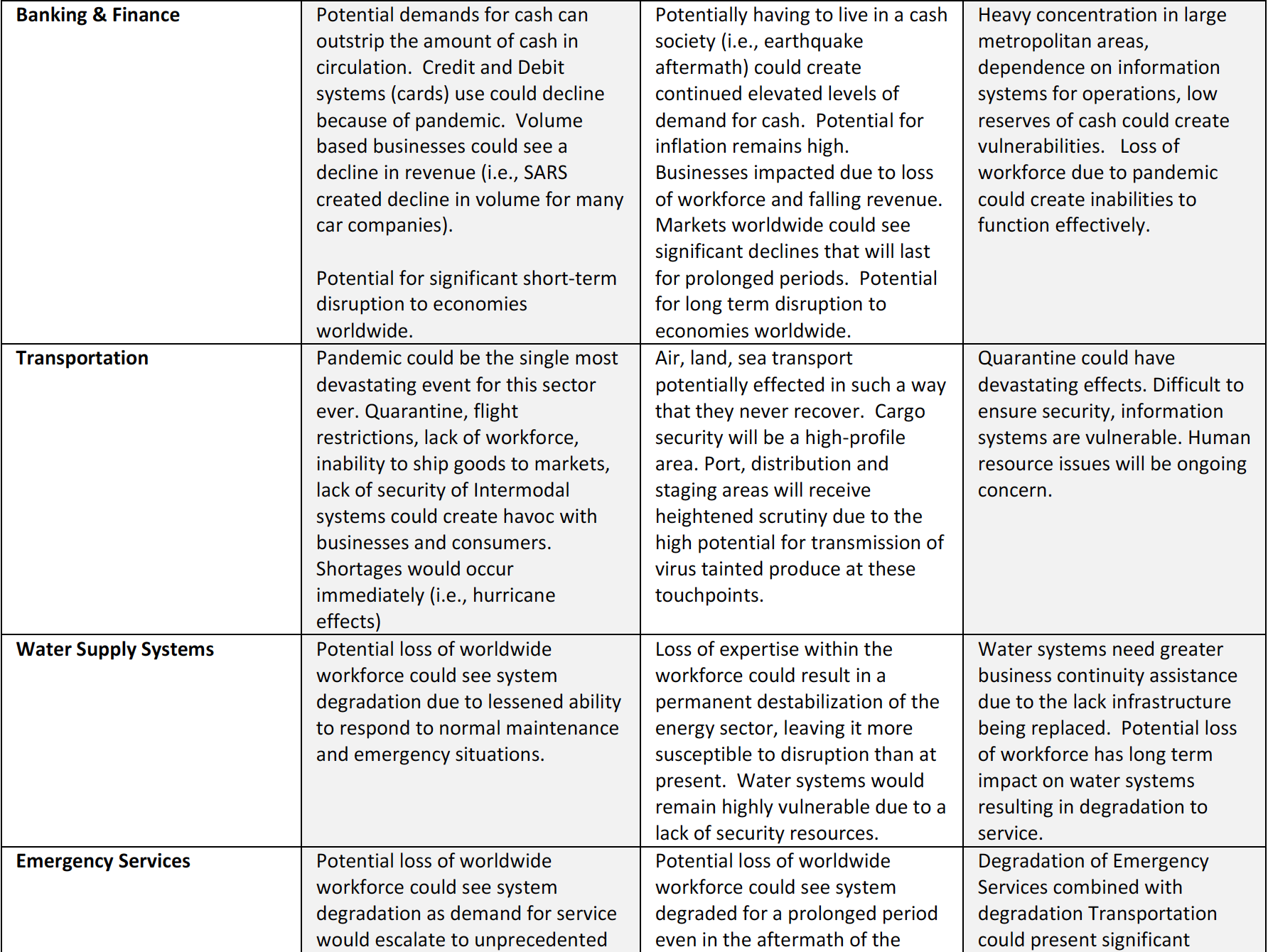

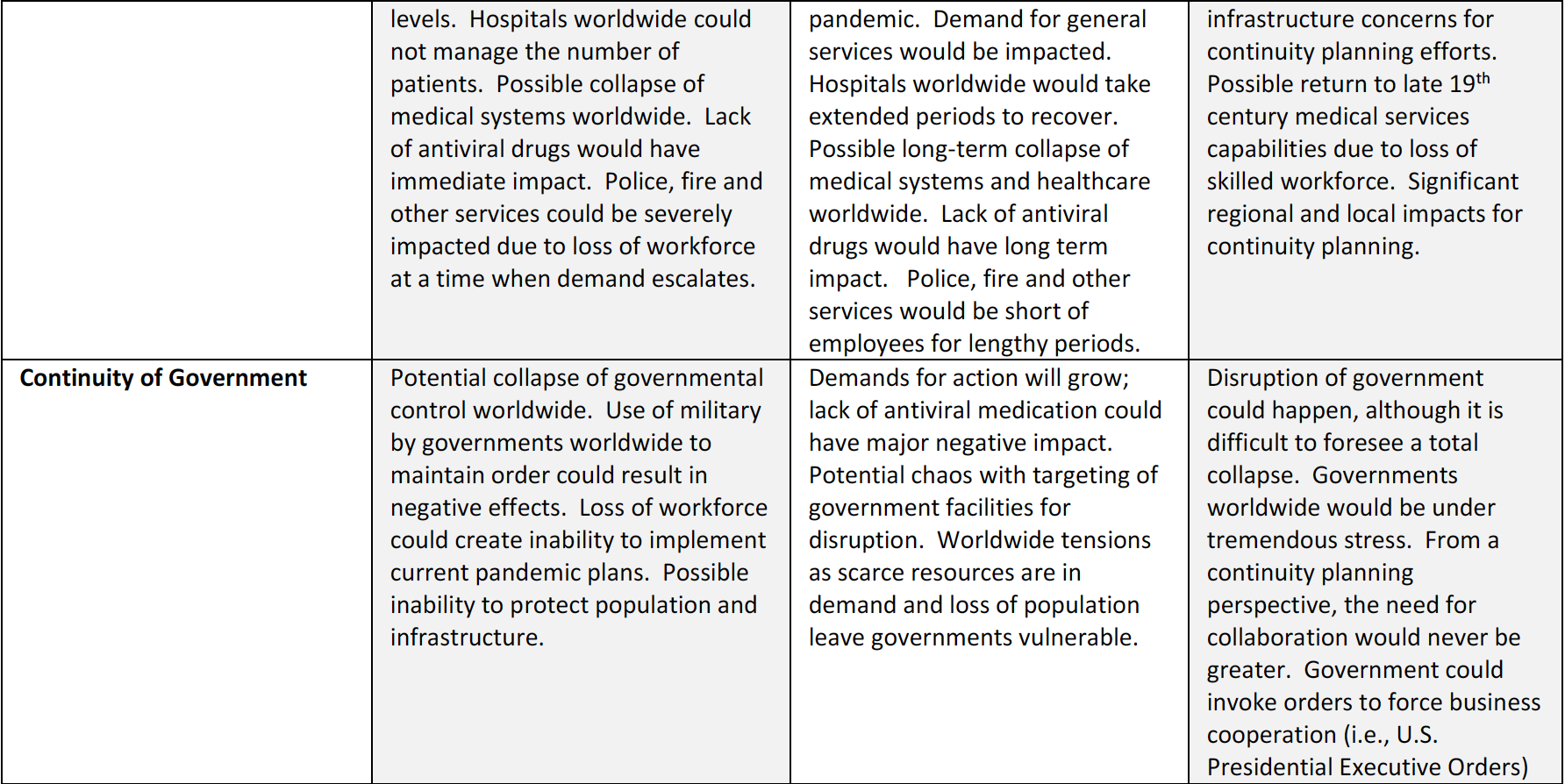

The table below speculates on some of the possible outcomes when the pandemic strikes.

Conclusion: Seize the Initiative – It Makes Sense

A Chinese proverb states that “Opportunity is always present amid crisis.” Every crisis carries two elements, danger and opportunity. No matter the difficulty of the circumstances, no matter how dangerous the situation… at the heart of each crisis lays a tremendous opportunity. Great blessings lie ahead for the one who knows the secret of finding the opportunity within each crisis.

Today business leaders have the responsibility to protect their organizations by facilitating continuity planning and preparedness efforts. Using their status as “leaders,” senior management and board members can and must deliver the message that survivability depends on being able to find the opportunity within the crisis.

Market research indicates that only a small portion (5%) of businesses today have a viable plan, but virtually 100% now realize they are at risk. Seizing the initiative and getting involved in all the phases of crisis management can mitigate or prevent major losses. Just being able to identify the legal pitfalls for the organization of conducting a crisis management audit: can have positive results.

We cannot merely think about the plannable or plan for the unthinkable, but we must learn to think about the unplannable. Business continuity planning must be overlapping in time, corrective in purpose complimentary in effect.

Bio:

Geary Sikich is a Principal with Logical Management Systems, Corp., a consulting and executive education firm with a focus on enterprise risk management and issues analysis; the firm’s web site is www.logicalmanagement.com. Geary is also engaged in the development and financing of private placement offerings in the alternative energy sector (biofuels, etc.), multi-media entertainment and advertising technology and food products. Geary developed LMSCARVERtm the “Active Analysis” framework, which directly links key value drivers to operating processes and activities. LMSCARVERtm provides a framework that enables a progressive approach to business planning, scenario planning, performance assessment and goal setting.

Prior to founding Logical Management Systems, Corp. in 1985 Geary held many senior operational management positions in a variety of industry sectors. Geary served as an officer in the U.S. Army; responsible for the initial concept design and testing of the U.S. Army’s National Training Center and other related activities. Geary holds a M.Ed. in Counseling and Guidance from the University of Texas at El Paso and a B.S. in Criminology from Indiana State University. Geary is presently active in Executive Education, where he has developed and delivered courses in enterprise risk management, contingency planning, performance management and analytics. Geary is a frequent speaker on business continuity issues business performance management. He is the author of over 410 published articles and four books, his latest being “Protecting Your Business in Pandemic,” published in June 2008 (available on Amazon.com).

Prior to founding Logical Management Systems, Corp. in 1985 Geary held many senior operational management positions in a variety of industry sectors. Geary served as an officer in the U.S. Army; responsible for the initial concept design and testing of the U.S. Army’s National Training Center and other related activities. Geary holds a M.Ed. in Counseling and Guidance from the University of Texas at El Paso and a B.S. in Criminology from Indiana State University. Geary is presently active in Executive Education, where he has developed and delivered courses in enterprise risk management, contingency planning, performance management and analytics. Geary is a frequent speaker on business continuity issues business performance management. He is the author of over 410 published articles and four books, his latest being “Protecting Your Business in Pandemic,” published in June 2008 (available on Amazon.com).

Geary is a frequent speaker on high profile continuity issues, having developed and validated over 4,000 plans and conducted over 450 seminars and workshops worldwide for over 100 clients in energy, chemical, transportation, government, healthcare, technology, manufacturing, heavy industry, utilities, legal & insurance, banking & finance, security services, institutions and management advisory specialty firms. Geary can be reached at (219) 922-7718.