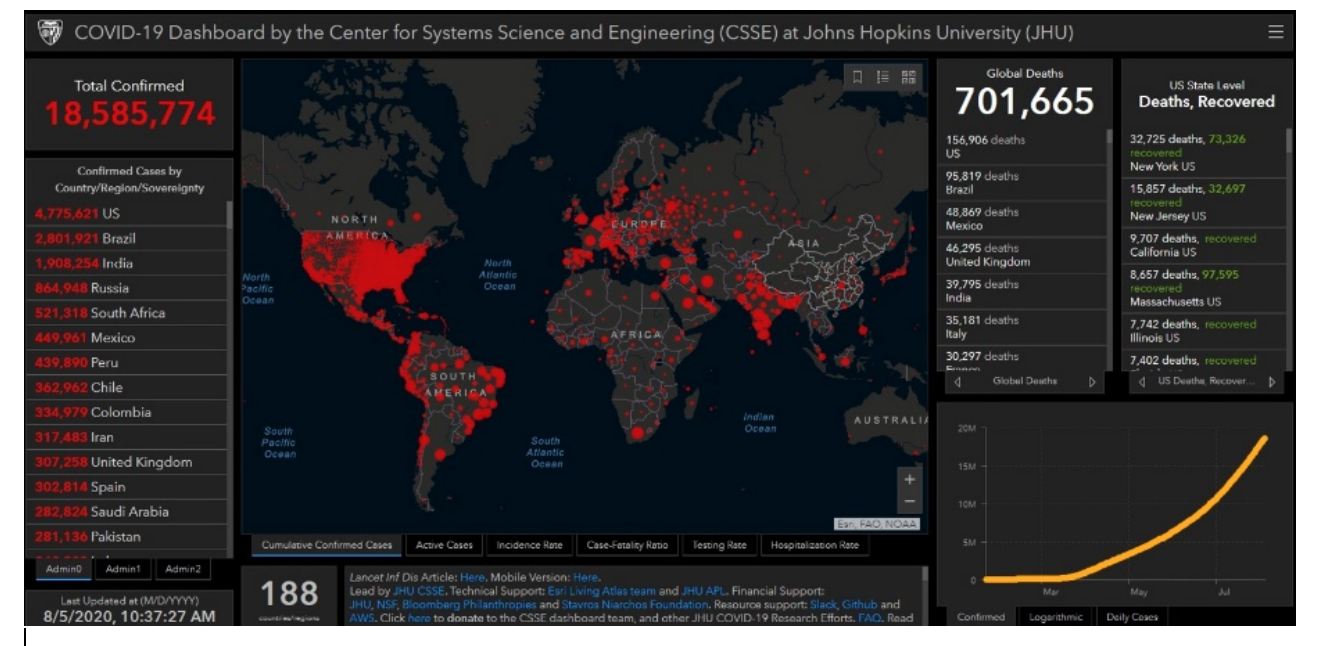

As of 5 August 2020, COVID19 has claimed over 700,000 lives and has over 18 million confirmed cases. Yet, it seems that people are casually disregarding protective measures that have been enacted by governments at all levels. Could it be that confusing information in the early stages of the pandemic contribute to the seemingly casual approach people are taking? Or, could people be numb to the seriousness of this pandemic because they have been conditioned by movies, such as, Contagion, Outbreak, Flu, etc.?

As of 5 August 2020, COVID19 has claimed over 700,000 lives and has over 18 million confirmed cases. Yet, it seems that people are casually disregarding protective measures that have been enacted by governments at all levels. Could it be that confusing information in the early stages of the pandemic contribute to the seemingly casual approach people are taking? Or, could people be numb to the seriousness of this pandemic because they have been conditioned by movies, such as, Contagion, Outbreak, Flu, etc.?

The Effect of Conditioning – Movie Mayhem

Movies, such as the ones I cited above and the numerous disaster films that proliferate in Hollywood and film studios across the world have an effect on people. Made for television disaster films and other television series, reality shows, etc., have an effect on people, influencing them to think that this is the real world. In fact, you can readily do a simple survey of television watchers and by asking a few simple questions determine how their beliefs about the world have been shaped by what they watch.

It is difficult to get people to acknowledge the seriousness of the COVID19 pandemic when they do not see people in Hazmat suits desperately attempting to save the human race from carnage and extinction. When we look at the real world, we do not see dead and dying laying in the streets with frantic First Responders and medical people screaming for assistance STAT! The news media does not get to do extensive coverage of Emergency Rooms. Why? Because they are Emergency Rooms and this virus is pretty easy to spread from patient to reporter, camera person, etc.

Take a look at the photo. This is what movies condition us to expect; chaos, confusion, etc. Reality is hard to rationalize when we do not see the virus and being told that we need to wear masks, social distance, take precautions, are subject to lockdowns and have freedom of movement curtailed.

America (USA) Not Used to Not Entitled

Americans love their freedom and chafe at being told that they cannot do something. “You have to wear a mask”. “You have to social distance”. “Wash your hands frequently”. These and other well-intentioned orders are being regularly ignored. In many instances fights, shootings and other confrontations have occurred as a result of attempts to enforce the rules. Is civil disobedience the result of frustration? Or, is it human nature? By the way, the US (America) is not the only place where these events occur, it just has media attention and gets broadcast and appears in social media applications where you can complain, post just about anything and feel free to express yourself. Try doing that in some other countries.

VUCA – America

VUCA – Volatility, Uncertainty, Complexity, Ambiguity is a good reflection of where the USA is today. We have to begin to understand the interdependencies that the pandemic is revealing. The current situation in the USA can be broken down into five parts:

- Economic

- Societal

- Geopolitical

- Environmental

- Technological

These five categories contain many sub-categories and critically, they are interdependent in many complex and opaque ways. A brief discussion of each follows:

- Economic

The USA is still one of the strongest economies in the world today. However, the strains of the pandemic are beginning to become apparent. Widespread layoffs in the service sector have caused unemployment to surge. The service sector, gig economy or whatever you choose to label it accounts for approximately 70% of Gross Domestic Product (GDP) and almost 80% of employment in the USA according to the authors of COVID-19: The Great Reset. These workers have been hard it by the pandemic. How long can the economic strain be sustained before the situation erupts? Government stimulus has helped. However, the second round of stimulus is now mired in political bickering, leaving those without a safety net (i.e., savings) with few options.

- Societal

We are seeing a fraying of society in the USA. The pandemic has brought a lot of tension to the surface. Just yesterday evening and early this morning (9, 10 August 2020) Chicago is experiencing widespread looting in its business district, where shops have been broken into and looted. An Alderman stated in a news interview that, “The looters show now fear of the police” as they ransack stores. The COVID19 pandemic is putting a lot of stress on the USA; stress that the out-of-work service sector is expressing in growing violence and protests against the system.

- Geopolitical

The domestic political situation in the USA is currently best described as divisive. It seems that there is little bi-partisan support for the enactment of a unified response to the pandemic. Instead of 50 states operating as one, we have each state operating against the others for supplies of personal protective equipment, etc. There is no uniformity of what is required for individuals – “wear a mask, don’t wear a mask”. Lockdowns are inconsistently enforced. The Federal government is at odds with the states in many critical areas. All in all, the geopolitical situation in the USA is an unhealthy mess and may not get well soon. This will have an effect on the containment and extinguishment of the pandemic due to inconsistent and conflicting guidance.

- Environmental

While the environment has benefited from the pandemic – less pollution due to lockdowns, plant closures, less driving, etc., there is another aspect to the environmental impact of the pandemic. The vast amount of medical waste generated will have to be dealt with at some point. The unregulated waste from discarded masks may actually present a vector for the coronavirus to continue its spread. The environmental impact of closed buildings reopening can present additional healthcare risks. Cleaning of buildings to ensure that they are safe and habitable is an environmental concern and a potential environmental impact that needs to be assessed and addressed.

- Technological

Technology has seen a temporary shift, i.e., working from home, working remotely, etc. This has been an interesting development as more and more companies are seriously considering making the change permanent. The change from office to home work environment may be viewed by many as a blessing. However, the stress that it puts on infrastructure (environmental impact) cannot be overlooked. The USA has an old infrastructure that may not be as robust as it should be. Additionally, we see the threat of cyber intrusion, the need for greater cyber security and physical security as issues that impact the technological area. In the area of medical technology there are stresses to develop a vaccine to address COVID19. The question of when a vaccine will be available, its effectiveness, etc. is not know at present, putting more stress on technology for a solution.

Concluding Thoughts

My recent article, entitled, “Where is Our Next Shock Coming From”, offered 5 potential shocks that could result from the COVID19 pandemic. I will summarize them below as they apply to the USA. While these potential shocks are not guaranteed to materialize, they are worth considering for government and business leaders at all levels as we navigate the COVID19 pandemic and its aftermath.

- Shock # 1: COVID19 Economic Recovery – An oscillating recovery with one step forward and maybe two steps backward for a while and then a gradual smoothing of the oscillations and a resetting to another operational model may be the reality. Somethings will change forever and somethings will cease to exist. However, the path forward has always been marked by extinction and renewal. The hospitality industry – restaurants, hotels and related services may not see a robust return to the pre-COVID19 days. The transportation industry is being devastated by the impacts to airlines operations worldwide. The cascade effect has seen oil prices drop to record lows and tenuously recover some of the pre-COVID19 price per barrel. Many who depend on jobs in the service industries could find that the road to recovery is one that will experience significant after-shocks.

Bottom Line: Economic recovery will not be rapid; many industries will shrink as a result of changing market preferences and a large segment of the population my never get out from under the yoke of debt.

- Shock # 2: Geopolitical Tensions Explode into Armed Conflict – Take your pick of potential hotspots that could explode – Russia – Ukraine, China – India, India – Pakistan, North Korea – South Korea, China – USA, Europe – Eastern Europe, Middle East – anywhere, Israel – Iran, Saudi Arabia – Iran, Iran – USA, the list could go on and on; but, I think you get the gist. Could we be on the path to a major global conflict? The tipping points are there and COVID19 has provided fuel for the fires. Internal conflict in the USA is already occurring on a limited basis, could it become widespread?

Bottom Line: COVID19 has created the ideal storm for fanning the flames of national and global conflict. Instability, desperate measures to retain a status quo, loss of economic exchange due to trade policies; the smallest spark could set off a chain reaction that would be devastating.

- Shock # 3: Sovereign Debt Triggers Global Depression – Even while the markets continue to recover, the issue of Sovereign Debt hangs over us like the Sword of Damocles. It’s not just the US that is of concern, it is every major country in the world. Debt is rampant and governments are printing money as fast as they can. What will it take to lose confidence in a country’s fiat currency?

Bottom Line: A COVID19 induced depression could lead to large scale conflict with significant consequences.

- Shock # 4: A Great Reset – Leaders of the world unite to declare a clearing of all debt from the books. Everyone starts over again with no debt obligations. While this may seem farfetched and in the realm of fantasy, it could happen. According to Wikipedia a debt holiday, debt relief or debt cancellation is the partial or total forgiveness of debt, or the slowing or stopping of debt growth, owed by individuals, corporations, or nations. From antiquity through the 19th century, it refers to domestic debts, in particular agricultural debts and freeing of debt slaves. In the late 20th century, it came to refer primarily to Third World debt, which started exploding with the Latin American debt crisis (Mexico 1982, etc.). In the early 21st century, it is of increased applicability to individuals in developed countries, due to credit bubbles and housing bubbles.

Bottom Line: A low probability, high impact event that would be rationalized by everyone afterward, expressing that they all saw it coming – a “Black Swan” by Nassim Taleb’s definition. Could a debt reset alleviate the social ills that COVID19 has brought to the surface?

- Shock # 5: The Internet Lynch Pin Collapses – Any number of causes for a collapse of the Internet have been posited; from solar flares to hackers. While it seems impossible for the Internet to collapse, the reality is that the Internet is fragile in so many ways. One can think of very few areas that the Internet has not penetrated. However, there are fingers of instability that emanate from the Internet to almost every aspect of society. Connected as we are, could we survive a significant or total degradation of the Internet? How dependent is the world on this fragile underpinning? It goes beyond social media into the heart of all of the world’s critical infrastructures, geopolitical interfaces, financial, manufacturing, food producing, transportation, healthcare, etc.

Bottom Line: A low probability, high impact event that would be rationalized by everyone afterward, expressing that they all saw it coming – a “Black Swan” by Nassim Taleb’s definition.

I leave you with an excerpt from an article on Ulysses Grant that reflects decision making in times of uncertainty.

“Once, a colonel approached Grant with a requisition order authorizing large expenditures. Briefly reviewing the report, the general gave his approval, catching the colonel by surprise. Might the general want to ponder the matter a little longer? Was he sure he was right? Grant looked up. ‘No, I am not,’ he responded; ‘but in war anything is better than indecision. We must decide. If I am wrong, we shall soon find it out and can do the other thing. But not to decide wastes both time and money, and may ruin everything.’”

This concludes a snapshot view of the current COVID19 situation in the USA. It is not meant to be comprehensive or focused on traditional emergency response perspectives. It is meant to get the readers thinking about the complexity that we are dealing with and the realization that things do not occur in a void; actions, reactions all cascade and have collateral effects.

Geary Sikich – Entrepreneur, consultant, author and business lecturer

Contact Information: E-mail: G.Sikich@att.net or gsikich@logicalmanagement.com. Telephone: 1- 219-513-6244.

Contact Information: E-mail: G.Sikich@att.net or gsikich@logicalmanagement.com. Telephone: 1- 219-513-6244.

Geary Sikich is a seasoned risk management professional who advises private and public sector executives to develop risk buffering strategies to protect their asset base. With a M.Ed. in Counseling and Guidance, Geary’s focus is human capital: what people think, who they are, what they need and how they communicate. With over 30 years in management consulting as a trusted advisor, crisis manager, senior executive and educator, Geary brings unprecedented value to clients worldwide. Geary has written 4 books (available on the Internet) over 475 published articles and has developed over 4,500 contingency plans including over 1,000 pandemic preparedness plans for clients worldwide. Geary has conducted over 500 workshops, seminars and presentations worldwide.

Geary is well-versed in contingency planning, risk management, human resource development, “war gaming,” as well as competitive intelligence, issues analysis, global strategy and identification of transparent vulnerabilities. Geary began his career as an officer in the U.S. Army after completing his BS in Criminology. As a thought leader, Geary leverages his skills in client attraction and the tools of LinkedIn, social media and publishing to help executives in decision analysis, strategy development and risk buffering. A well-known author, his books and articles are readily available on Amazon, Barnes & Noble and the Internet.

References

Apgar, David, “Risk Intelligence – Learning to Manage What We Don’t Know”, Harvard Business School Press, 2006.

Chernow, Ron, “Grant” Penguin Press; 1st Edition October 10, 2017, ISBN-10: 9781594204876, ISBN-13: 978-1594204876, ASIN: 159420487X

Davis, Stanley M., Christopher Meyer, “Blur: The Speed of Change in the Connected Economy”, (1998).

Forstchen, William R. Ph.D.; “One Second After”, Forge Books; 1st edition (March 17, 2009), ISBN-10: 0765317583, ISBN-13: 978-0765317582

Kahneman, Daniel, Rosenfield Andrew M., Gandhi, Linnea, Blaser Tom, Harvard Business Review October 2016 Issue; “Noise: How to Overcome the High, Hidden Cost of Inconsistent Decision Making”

Kami, Michael J., “Trigger Points: how to make decisions three times faster,” 1988, McGraw-Hill, ISBN 0-07-033219-3

Kovach, Bill and Rosenstiel, Tom “Blur: How to Know What’s True in the Age of Information Overload” 2010, Bloomsbury USA

Levene, Lord, “Changing Risk Environment for Global Business.” Union League Club of Chicago, April 8, 2003.

Musser, George, “Spooky Action at a Distance”, Scientific American/Farrar, Straus and Giroux, Copyright 2015 by George Musser, page(s): 168-170

Orlov, Dimitry, “Reinventing Collapse” New Society Publishers; First Printing edition (June 1, 2008), ISBN-10: 0865716064, ISBN-13: 978-0865716063

Schwab, Klaus and Malleret, Thierry, “COVID-19 The Great Reset”, Forum Publishing, World Economic Forum, 2020, ISBN 978-2-940631-12-4

Sikich, Geary W., “The Financial Side of Crisis”, 5th Annual Seminar on Crisis Management and Risk Communication, American Petroleum Institute, 1994

Sikich, Geary W., “Managing Crisis at the Speed of Light”, Disaster Recovery Journal Conference, 1999

Sikich, Geary W., “What is there to know about a crisis”, John Liner Review, Volume 14, No. 4, 2001

Sikich, Geary W., “The World We Live in: Are You Prepared for Disaster”, Crisis Communication Series, Placeware and ConferZone web-based conference series Part I, January 24, 2002

Sikich, Geary W., “September 11 Aftermath: Ten Things Your Organization Can Do Now”, John Liner Review, Winter 2002, Volume 15, Number 4

Sikich, Geary W., “Graceful Degradation and Agile Restoration Synopsis”, Disaster Resource Guide, 2002

Sikich, Geary W., “Aftermath September 11th, Can Your Organization Afford to Wait”, New York State Bar Association, Federal and Commercial Litigation, Spring Conference, May 2002

Sikich, Geary W., “Integrated Business Continuity: Maintaining Resilience in Times of Uncertainty,” PennWell Publishing, 2003

Sikich, Geary W., “It Can’t Happen Here: All Hazards Crisis Management Planning”, PennWell Publishing 1993.

Sikich Geary W., “The Emergency Management Planning Handbook”, McGraw Hill, 1995.

Sikich Geary W., “Black Swans or just Wishful Thinking and Misinterpretation?” 2010.

Sikich, Geary W., “Risk the Nature of Uncertainty”, 2016

Sikich Geary W., “Can You Calculate the Probability of Uncertainty?” 2016.

Sikich Geary W., Stagl, John M., “The Economic Consequences of a Pandemic”, Discover Financial Services Business Continuity Summit, 2005.

Tainter, Joseph, “The Collapse of Complex Societies,” Cambridge University Press (March 30, 1990), ISBN-10: 052138673X, ISBN-13: 978-0521386739

Taleb, Nicholas Nasim, “The Black Swan: The Impact of the Highly Improbable”, 2007, Random House – ISBN 978-1-4000-6351-2

Taleb, Nicholas Nasim, “The Black Swan: The Impact of the Highly Improbable”, Second Edition 2010, Random House – ISBN 978-0-8129-7381-5

Taleb, Nicholas Nasim, “Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets”, 2005, Updated edition (October 14, 2008) Random House – ISBN-13: 978-1400067930

Taleb, N.N., “Common Errors in Interpreting the Ideas of The Black Swan and Associated Papers”; NYU Poly Institute October 18, 2009

University of Foreign Military and Cultural Studies, http://usacac.army.mil/organizations/ufmcs-red-teaming

Vail, Jeff, “The Logic of Collapse”, www.karavans.com/collapse2.html, 2006

Vembunarayanan, Jana. “Risk vs Uncertainty”, 2013 (https://janav.wordpress.com/ https://janav.wordpress.com/author/jvembuna/

Venezuelan natural gas rig sinks; http://news.bbc.co.uk/go/pr/fr/-/2/hi/americas/8679981.stm, Published: 2010/05/13 14:38:59 GMT © BBC MMX

Weick, KE 1993, “The Collapse of Sensemaking in Organizations: The Mann Gulch Disaster”, in Administrative Science Quarterly, Vol. 38, No. 4 (Dec., 1993), pp. 628-652

Weick, KE 1995, “Sense-making in organizations”, Sage Publications

Weick, KE 2001, “Making Sense of the Organization”, Blackwell Publishers

Weick, KE, Sutcliffe, KM, and Obstfeld, D. 2005, “Organizing and the Process of Sense-making” Organizational Science, Vol. 16, No. 4, pp. 409–41

https://en.wikipedia.org/wiki/Debt_relief

https://www.entrepreneur.com/article/331198

https://www.youtube.com/watch?v=1mZ1f_8YOEc&feature=youtu.be