In September 2021 the International Organization for Standards (ISO) published the results of its survey of 2020 certifications. (1) This piece reviews the results. It should be noted that there are two other assessments of the results. One is by Oxebridge Quality Resources. (2) The other is by CQI in the United Kingdom. (3) The assessments differ in focus. The Oxebridge assessment focuses on ISO 9001. While CQI provides an overview of all the ISO certification results. This piece will also provide an overview. But it will also discuss the numbers for the four certifications, 9001, 14001, 27500 and 45001, which have the largest numbers.

In September 2021 the International Organization for Standards (ISO) published the results of its survey of 2020 certifications. (1) This piece reviews the results. It should be noted that there are two other assessments of the results. One is by Oxebridge Quality Resources. (2) The other is by CQI in the United Kingdom. (3) The assessments differ in focus. The Oxebridge assessment focuses on ISO 9001. While CQI provides an overview of all the ISO certification results. This piece will also provide an overview. But it will also discuss the numbers for the four certifications, 9001, 14001, 27500 and 45001, which have the largest numbers.

Overview

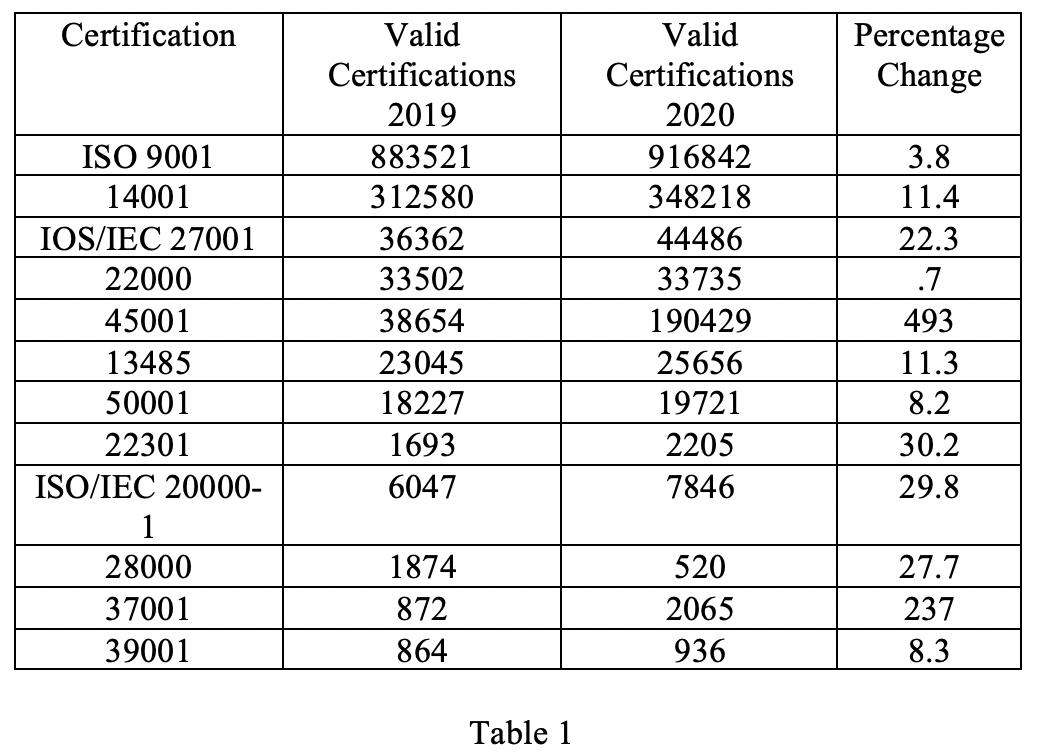

The titles and locations of the Oxebridge and CQI articles are in the end notes. The titles provide the basic summary. Oxebridge indicates “China to the rescue”, while CQI stresses a 17% growth in overall certifications. Both are correct. There was an overall growth in certifications. Table 1 below shows the 2019 and 2020 certification numbers for the major certifications.

The data shows a growth in all certification numbers. However, the second slowest certification growth was 9001. The problem is that the other top three (14001, 27001 and 45001) combined only make up 64% of the 9001 numbers. Thus, it will take several years before other certifications reach the 9001-certification level, individually or combined. Consequently, ISO’s growth and by extension, growth in the quality management field will still be dependent on growth in 9001 certifications. This is important when looking at certifications by country. This is where China came to the rescue.

Certifications by Country

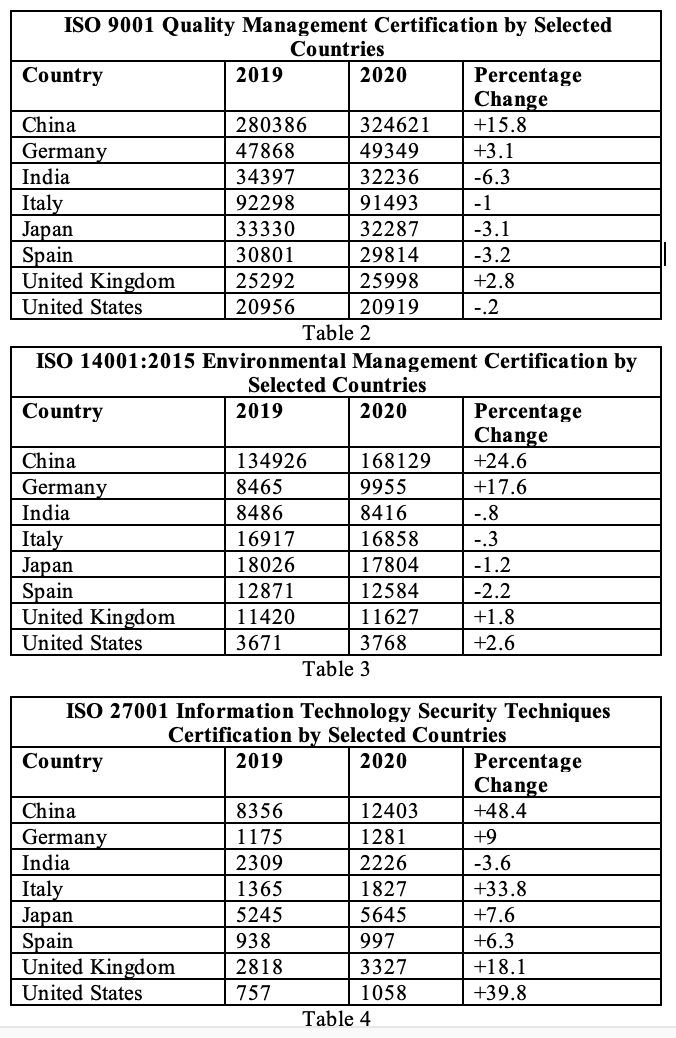

Tables 2, 3 and 4 show the number of certifications by selected country.

The 9001 certifications for China increased significantly. When this growth is compared with other countries, China did come to the rescue. In terms of 9001 growth, the United States was essentially flat, while India, Italy, Japan, and Spain had losses. China, Germany, and the United Kingdom had growth. Further, as tables 2,3 and 4 show, China made significant contributions to the overall growth in other ISO certifications.

The data supports the CQI general tone of pleasure about ISO growth figures. However, the fact that China is the driving force behind this growth supports the more cautious tone taken by Oxebridge.

Current Environment and Implications

It has been said that Just in Time works, until it does not. There is such a close linkage between suppliers and producers, if any link in the chain fails, the entire system is disrupted. Over the years one industry or another has seen disruption. These disruptions were generally localized, industry specific and due to weather related events. Until COVID – 19 shocks were short term. However, in response to COVID – 19 countries around the world shuttered their economies. This was particularly true in China, which was the epicenter of the pandemic.

The shutdown of entire economies and particularly the shutdown of China’s economy highlighted one basic issue, off shoring. Politician and the public became aware of the extent of the off shoring, and the dependence on other countries, primarily China, for basic products, especially medicines. The result is a focus on reshoring manufacturing.

The speed with which reshoring occurs will depend on the attitude of the political party in power. But there is no doubt, in long run, reshoring will pick up steam. Many of the reshored plants will replace or compete with those in China. This will impact China’s economic growth. China’s latest economic forecast indicates their economic growth is slowing. As it slows, the likelihood of significant expansion of ISO certifications becomes problematic. Consequently, a cautious assessment of China’s ability to sustain the 2020 ISO certification growth is warranted.

The idea that the reshoring of manufacturing plants will be a boon to both quality and ISO certifications, is also problematic. To compete with low-cost foreign workers, the reshored manufacturing plants will implement Industry 4.0. Industry 4.0 is based on the integration of machines, networks, and information technology. Quality management will be handled by machines. Product will flow down the production line. Scanners will identify defective products. The defective products will be immediately extract from the line. This degree of automation will make ISO 9001 certification less relevant as a determinant of competitive advantage. Competitive advantage will be determined by the extent to which Industry 4.0 elements are integrated and maintained. This likelihood will reduce the desire for 9001 certifications.

In summation, while China came to ISO’s rescue in 2020, the likelihood that it will show the same level of certification growth is questionable.

Endnotes

- ISO, 2021, The ISO Survey OF Management System Standard Certifications -2020-Explanatory Note, September, https://iso.org/the-iso-survey.hml

- Christopher Paris, 2021, ISO Survey 2020 Analysis: China To The Rescue, September 28, https://www.oxebridge.com/emona/iso-survey-2020-analysis-china-to-the-rescue.

- CQI, 2021, ISO has released the results from its survey on Management System Standard Certification 2020, reporting an increase of valid certificates of over 17% compared with 2019, https://www.quality.org/article/2020-iso-survey-management-system-standard-reveal-17-increase-certification?utm_context+buffered8lef@u.

James J. Kline is a Senior Member of ASQ, a Six Sigma Green Belt, a Manager of Quality/Organizational Excellence, and a Certified Enterprise Risk Manager. He has work for federal, state, and local government. He has over ten year’s supervisory and managerial experience in both the public and private sector. He has consulted on economic, quality and workforce development issues for state and local governments. He has authored numerous articles on quality and risk management. His book “Enterprise Risk Management in Government: Implementing ISO 31000:2018” is available on Amazon. He is the principle of JK Consulting. He can be contacted on LinkedIn or jamesjk1236@outlook.com.