The Security and Exchange Commission (SEC) is in the process of issuing a rule which will require organizations covered under its regulatory authority to report on the potential impact of environmental risks and the action the organization is taking to mitigate such risks. While the SEC’s current focus is on environmental risks, it is expected that it and other federal agencies will expand the requirement to not only Environment, but also Societal and Governance (ESG) risks.

The Security and Exchange Commission (SEC) is in the process of issuing a rule which will require organizations covered under its regulatory authority to report on the potential impact of environmental risks and the action the organization is taking to mitigate such risks. While the SEC’s current focus is on environmental risks, it is expected that it and other federal agencies will expand the requirement to not only Environment, but also Societal and Governance (ESG) risks.

ESG risk assessment is not new. It is being used by investment firms worldwide. It is estimated that one out of every three dollars invested by investment firms is ESG related. There are over 700 ESG funds. (1) There are also numerous companies which provide ESG ratings. These companies rate not only how well a company is doing with respect to ESG risk management. They also rate countries and local governments.

This piece looks at the implications of the emphasis on ESG risk assessment and the ESG ratings approach of one company. The company is MSCI ESG Research. It was selected for several reasons. First, its website provided sufficient information to indicate the basic approach. Second, almost 90% of the S&P 500 firms have utilized the MSCI ESG rating system. Lastly, the Committee for Sponsoring Organizations (COSO) uses the MSCI ESG rating methodology in its Enterprise Risk Management (ERM) ESG guide. This last item is important because the sponsoring organizations include American Association of Accountants, American Institute of Certified Public Accountants, Institute of Management Accountants, Financial Executives International, and the Institute of Internal Auditors. COSO is thus promoting ESG via its ERM model to the major financial professional groups. (2)

Scope of ESG Ratings

In general, the rating agencies address the ESG risks in seven categories. These are.

- Extractive Industries or energy production

- Material management

- Human rights and working conditions

- Community relations or indigenous peoples’ rights

- Customer relations or consumer rights

- Product responsibility or hazardous substances and waste management

- Company’s governance – transparency

The SEC rule would provide greater focus by requiring companies make risk management disclosures which include: 1. Any processes the company utilizes for identifying, assessing, and managing climate – related risks. 2. If the company has adopted a transition plan which includes the strategy to be used to reduce climate risks. 3. Companies which have a transition plan to identify the methodology and metrics used to identify and track the environmental risks metrics and the company’s mitigative efforts.

With this in mind, let’s turn to the MSCI ESG ratings.

MSCI ESG Ratings

In this instance, the MSCI ESG Research government ratings will be used because they show the basic structure and the metrics. The MSCI ESG Research’s government ratings provide an overall sustainability assessment of 198 countries/regions and 45 Local Governments covering Developed, Emerging and Frontier markets. The data set goes back to 2012. Countries are rated on a seven-point scale from AAA (best) to CCC (worst). The ratings are derived from a 0-10 score on underlying ESG factors. (3)

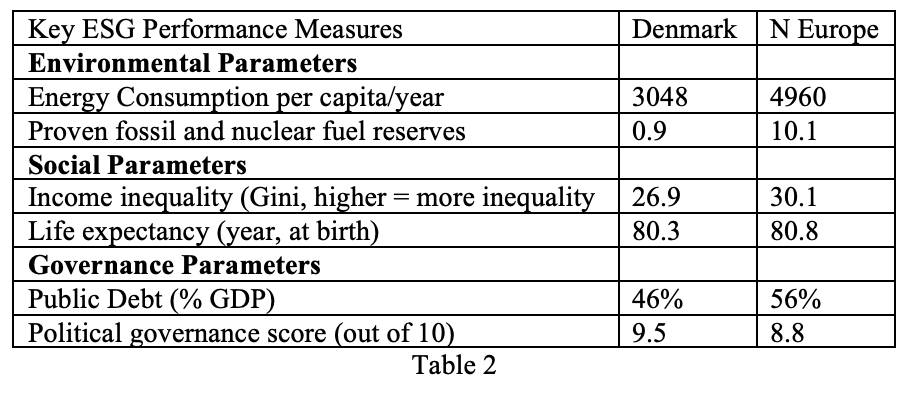

Table 1 below shows the elements used to develop the ESG government rating.

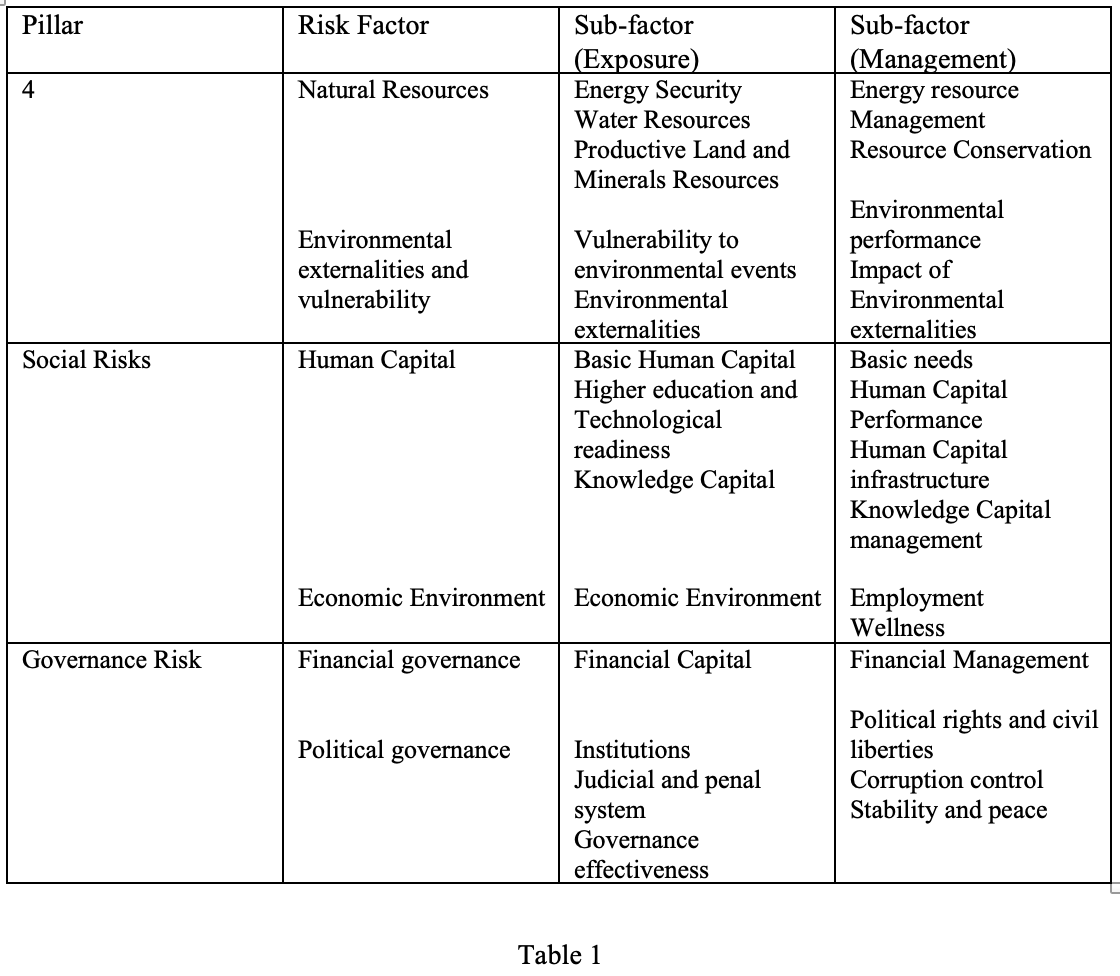

Table 2 shows how these factors are converted to metrics for the rating. The metrics can then be compared to other countries or geographic regions. In this case Denmark and Northern Europe. (4) (A similar approach is used for private sector companies.)

Table 2 shows how these factors are converted to metrics for the rating. The metrics can then be compared to other countries or geographic regions. In this case Denmark and Northern Europe. (4) (A similar approach is used for private sector companies.)

Looking at Table 2, one can see that Proven fossil and nuclear fuel reserves lines up with Energy Resources under the Natural Resource factor in Table 1. Similarly, Energy Consumption aligns with Energy Resources Management and Resource Conservation. While companies like MSCI ESG Research have established ESG measures, the SEC has yet to specify what measures covered firms are to use.

Based upon the SEC Environmental push and the ESG measurement sophistication of rating firms, there are several implications.

Implications

First, ESG is going to be an important determinant of organizational performance going forward. When the SEC rule is implemented the ESG risk management will impact a broad swath of the organizations in the country and worldwide. Second, because of the breadth of impact, be it environmental, societal or governance, a comprehensive organization wide approach will be needed to analyze and manage the risks. Such an approach is ERM. Thus, the use of ERM will increase. Third, the transition from broad elements to specific metrics is critical if ESG is to become an important measure. It is one thing for a company like MSCI ESG Research using consistent measures to evaluate funds, companies, and countries. It is another for the SEC to mandate environmental risk reporting across a wide spectrum of the economy, without some metric standard. to annually make reports on environmental risks. Without agreed upon metrics, there would be little or no ability to compare organizations or determine the effectiveness of ESG mitigation efforts. Consequently, the SEC and other federal agencies will need to come to some consensus on the metrics to be used. Most likely they will be like those used by MSCI ESG Research. Lastly, as ESG mitigation efforts become a key determinant of capital allocation, risk management will become a major focus of the C-Suite

Endnotes

- Wolfe, Durt, 2022, “Who Regulates the ESG Ratings Industry? Bloomberg Law, February 22, https//www.news.bloomberglaw.com/esg/who-regulates-the-esg-ratings-industry.

- COSO, 2018, Enterprise Risk Management: Applying Enterprise Risk Management to Environmental, Social and Governance-related Risks, October, https://wwwcoso.org/Documents/COSO-WBCSD-ESGERM-Guidance-Full.pdf

- MSCI ESG Research LLC, MSCI ESG Government Ratings, https://www/,sco/cp,/dpci,emts/10198/5cOd3545-f303-4397-bdb2-Bddd3b81ca1b

- MSCI ESG Research LLC, MSCI ESG Government Ratings: Sovereign Ratings, https://www.smart-and-funds.de/media/gov.presentation-ssci-esg-research-2017-2.pdf

Bio:

James J. Kline is a Senior Member of ASQ, a Six Sigma Green Belt, a Manager of Quality/Organizational Excellence, and a Certified Enterprise Risk Manager. He has worked for federal, state, and local government. He has over ten year’s supervisory and managerial experience in both the public and private sector. He has consulted on economic, quality and workforce development issues for state and local governments. He has authored numerous articles on quality and risk management. His book “Enterprise Risk Management in Government: Implementing ISO 31000:2018” is available on Amazon.