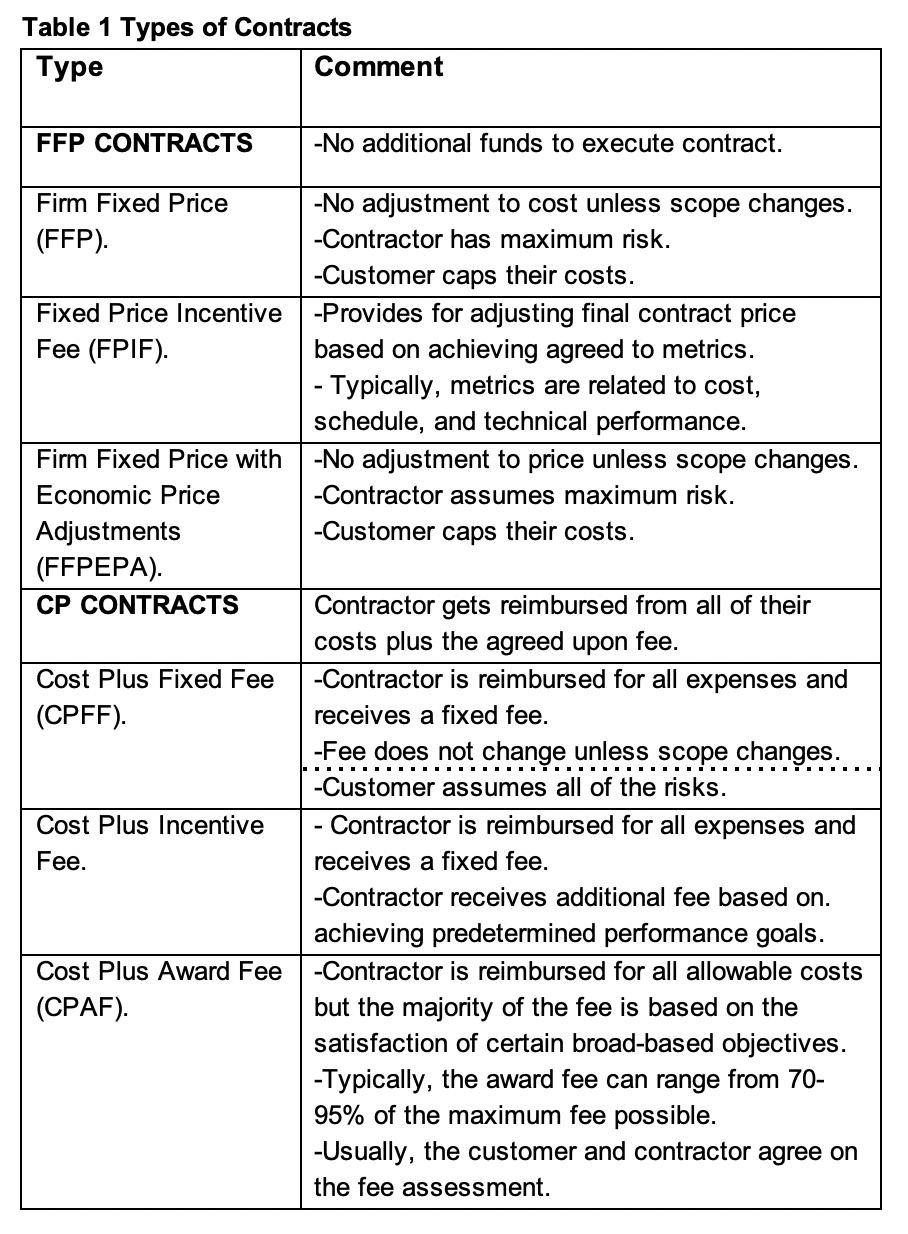

There are two basic types of contracts applied to development projects. They are Firm Fixed Price (FFP) and Cost-Plus (CP). Each type has a number of different variations shown in Table 1. FFP contracts are for projects with mature technology, less uncertainty, and more predictability. CP contracts are for projects with new technology, a lot of uncertainty, and less predicability. There are other types of contracts but are out of scope for this paper.

There are two basic types of contracts applied to development projects. They are Firm Fixed Price (FFP) and Cost-Plus (CP). Each type has a number of different variations shown in Table 1. FFP contracts are for projects with mature technology, less uncertainty, and more predictability. CP contracts are for projects with new technology, a lot of uncertainty, and less predicability. There are other types of contracts but are out of scope for this paper.

Table 1 lists the various types of contracts and comments as to the salient features of them. The type of contract awarded is based on a number of factors including considerations such as: complexity of project requirements; uncertainty of scope; party assuming unexpected cost risk; need for predictable project costs; and period of performance. This paper focuses on the FFP and the Cost-Plus Fixed Fee (CPFF).

FIRM FIXED PRICE (FFP) CONTRACTS

A FFP contract type results in the contractor assuming the risk. There are two risks. First one is the contractor loses the contract because their bid is too high. The second risk is the contractor’s bid is too low and they lose money if they win the contract. The contractor has to walk a tightrope to minimize their risk and win the contract. The winner a FFP contract is the contractor with the lowest proposed price. Typically, the fee for an FFP contract is between 12-15%.

HOW TO BID A FFP CONTRACT TO REDUCE RISK

It is the mission of the proposal team to generate the best cost. Management has the pricing responsibility.

The cost generation starts with bottoms up estimate and checked with a top-down sanity check. The bottoms up cost estimate starts with the project management basic documents such as the Work Breakdown Structure (WBS), the Integrated Master Schedule (IMS) and a thorough, complete risk assessment to ensure the cost and schedule to mitigate the identified risks are included in the proposal. The top-down check usually involves searching existing databases for completed projects to identify a similar project. Compare the actual costs the legacy project realized to the bottoms up number. If they are in reasonable alignment, then the cost estimate is good. If the alignment is much different then you need to find out why and fix it before including it in your proposal.

When it comes to estimating the risk mitigation costs and schedule, it is unreasonable to think that all risks identified do not happen. Therefore, the estimated cost for each risk needs to be discounted. The discount is based on the probability of the risk being realized and the impact to the project if it happens. For example, if there are 20 identified risks, the first step is to come up with the cost and schedule estimate to recover if the risks occur. Discount the cost for each risk and the sum becomes the budget for risk mitigation that is included in the proposal. Margin has to built into the IMS for the risk mitigation effort.

Once the proposed costs have been approved by management, they determine what price to bid. If the company is trying to break into a new product line, they may want to reduce the profit in an effort to win the contract. An example of this is a project I was involved in. The company wanted to get into a new product line as part of their 5-year plan. One company owned the vast percentage of the product market they were chasing. Management reduced their price fairly significantly to ensure they won the contract. Their strategy worked. They got the contract award. To recover some of the lost profit, management gave each team leader a challenge to come in under their cost estimate.

COST PLUS FIXED FEE(CPFF) CONTRACTS

For a CP contract, the customer assumes the risk. In this case there is only one risk for a contractor. The risk is that the bid is too high and they lose the contract.

For a CPFF contract , the contractor receives the total fee independent of the cost. The contractor can overrun the budget by 100% and they will still get the same fee. The risk to the contractor in this case is if the costs overrun is significantly high the return on Investment (ROI) is less. That is because the percent of fee compared to the cost bid goes down impacting the ROI.

HOW TO BID A CPFF CONTRACT TO REDUCE RISK

The short answer is to bid only cost. Do not include risk mitigation costs because the customer assumes the risk. When estimating the cost do not be too conservative. Remember this is a competitive bid and to win the lowest possible cost is required.

A risk assessment is still necessary because the contractor wants to know what the more serious risks there are to decide the best way to cover the cost and schedule to mitigate them but in an aggressive way. In a very completive situation, contractors may decide to purposely bid low on the assumption the deficit will be made up with added scope which is not unusual for a CPFF contract.

Typically, the winning proposal for a CPFF contract is based on best value to the customer. They look at the proposed cost from a realistic view point. If the proposed cost is considered to be unrealistically low, the bid will probably be thrown out. A similar situation applies to the proposed schedule. The customer also looks at the contractor’s experience and track record.

SUMMARY

Contractors need to be aware of their risk position when bidding on a contract. A FFP contract has two risks to consider. First one is bidding too high and losing contract. Second is bidding too low and losing money because there is no more funding coming forth from the customer. A CPFF contract has only one risk to the contractor. The risk is losing the contract because the bid was too high. There are ways to mitigate the contractors’ risk when bidding on a project that is discussed above.

The other point to keep in mind is the contractors’ decision making and focus once under contract. It is virtually impossible to manage cost and schedule at the same time. For example, if under a FFP contract the contractors’ decisions and focus has to be on cost since there is no more funding forthcoming from the customer. In this case, the schedule slides. On the other hand, for a CPFF the contractors’ decisions and focus has to be on the schedule. Let the costs slide since the customer pays all of the expenses. \

Currently John Ayers is an author, writer, and consultant. He authored a book entitled Project Risk Management. The first is a text book that includes all of the technical information you will need to become a Project Manager (PM). He authored a second book entitled How to Get a Project Management Job: Future of Work. This book shows you how to get a PM job. Between the two, you have the secret sauce to succeed. There are links to both books on Amazon on his website. https://projectriskmanagement.info/. He has presented numerous Webinars on project risk management to PMI including one on June 16 that addresses how to merge Agile with Waterfall to arrive at a Hybrid method. He writes columns on project risk management for CERM (certified enterprise risk management). John also writes blogs for Association for Project Management (APM) in the UK. He has conducted a podcast on project risk management. John has published numerous papers on project risk management and project management on LinkedIn. John also hosts the Project Manager Coach club on clubhouse.com.

John earned a BS in Mechanical Engineering and MS in Engineering Management from Northeastern University. He has extensive experience with commercial and U.S. DOD companies. He is a member of the Project Management Institute (PMI. John has managed numerous large high technical development programs worth in excessive of $100M. He has extensive subcontract management experience domestically and foreign. John has held a number of positions over his career including: Director of Programs; Director of Operations; Program Manager; Project Engineer; Engineering Manager; and Design Engineer. He has experience with: design; manufacturing; test; integration; subcontract management; contracts; project management; risk management; and quality control. John is a certified six sigma specialist, and certified to level 2 Earned Value Management (EVM).

Go to his website above to find links to his books on Amazon and dozens of articles he has written on project and project risk management.