No, this is not a reference to the Paper & Pulp Industry, though it could be considering how much paper money was floating.

No, this is not a reference to the Paper & Pulp Industry, though it could be considering how much paper money was floating.

The textbook definition of free-market capitalism states that the sole function of business is to create shareholder value and that the free market can regulate itself.MONEY FROM PAPER

Well, we have seen that definition become obsolete over the last 30 to 40 years. At present the definition is basically “the only purpose of business is to create shareholder value calculated by short-term results with little regulation.”

Needless to say this is no longer the capitalism described by Adam Smith. Instead, it is what I will call “financialization”. Simply put this is the “growing profitability of the finance sector at the expense of the rest of the economy and the dwindling regulation of its rules and returns.”

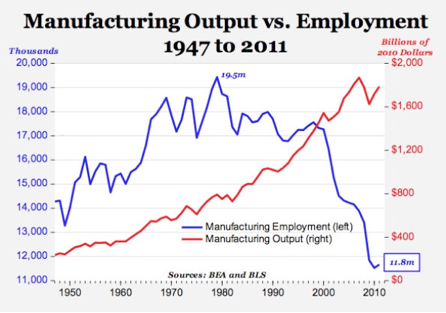

As New Deal regulations were slowly dismantled, financial sector growth accelerated along with high risk-taking and speculation. One of the immense problems caused by the rising financial sector and manufacturing sinking is that a low-employment industry replaced a high-employment industry. At its peak, in the mid-twentieth century, manufacturing generated 40% of all profits and created 20% of the nation’s job. Today finance controls 40% of the nation’s profits with 5% of the jobs. The focus of the economy is no longer on making things but making ‘false’ profits: money from paper.

In the past, Wall Street was comprised of banks that financed manufacturing’s capital investment and R&D, which made America great. However, today this ‘paper’ money economy has led to Wall Street being the banker of most corporations, which has given them control over key portions of the economy, especially manufacturing. Furthermore, Wall Street became the masters of manufacturing, demanding short-term profits rather than funding the strategies that led to long-term growth. Wall Street’s demand for short-term profits forced most manufacturers to slim down their organizations and eliminate the functions that did not show a quick ROI (Return on Investment)

Wall Street, freed from its New Deal regulations, loaded companies up with debt, cut R&D, raided pension funds, slashed wages and benefits, and decimated good paying jobs in the U.S. while shipping many abroad.” The lobbyists for the financial industry were able to remove all of the laws and regulations created during the New Deal. This allowed Wall Street to use many new quick-buck methods such as derivatives to make money from money and have all of their gambling protected by American taxpayers. Allowing finance to gamble with depositor’s money was a terrible decision that led to the crash of 2008 and will lead to another crash in the future unless they can be stopped.

TIMKEN STEEL STORY

A perfect example of this is the story about Timken Steel Co.:

In an article in the Boston Review, Susan Berger a professor at MIT makes the assertion that, “Since the 1980s, financial market pressures have driven companies to hive off activities that sustained manufacturing.” She refers to the example of the Timken Company, which was forced to split into two companies (Timken Co., IW500/299 and TimkenSteel, IW500/442) by the board of directors. The chairman argued that the company should stay together because that is how it had been able to offer high-quality products with good service support. The board overruled him based on the potential of better short-term profits.

This stripping down of companies to their core competencies has been forced on most of the large publicly held corporations to some degree. But in stripping them down, many critical functions have been lost. For example, apprentice-type training has been lost in many American corporations because it is long-term training and doesn’t have a good enough short-term ROI. Basic research of new technologies have also been dropped because they are seen by the shareholders as being peripheral to the core competencies.

LONG TERM FINANCIAL SUPPORT

The growth of this new economy also harkens another important question. If innovation is the critical strategy that will keep America in the race and its position as global leader, how can it happen without long-term financial support? This is a very strategic question because most innovation comes from the R&D and new technologies created by manufacturers.

Wall Street has the upper hand and continues to focus on short-term profits, rather than investing in manufacturing and the country’s infrastructure. It is hard to see how American manufacturing will be able to compete with the rest of the world like we did in the twentieth century. The sickness destroying America’s economic well being is financial planning. The primary symptom is the loss of U.S. manufacturing. Manufacturing is the basis of military and economic power. The movement of American manufacturing to mostly third world nations endangers us.

If we are going to have a chance at reversing the decline of manufacturing or developing a strategy of innovation that will keep the U.S. competitive, the current direction of the financial industry must be changed. In its pursuit of short-term profits, they are jeopardizing the long-term health of the economy and the manufacturing sector.

As an industry, finance does not deserve the trust of the American people. Consider just some of their more recent scandals:

- Private equity and corporate raiding: Corporate raiders contributed to inequality as they dismembered firms, laid off workers, auctioned off the assets and destroyed entire communities to reap huge rewards for few stakeholders.

- Credit: As regulations slowly collapsed along with oversight of consumer and mortgage lending, Wall Street introduced predatory lending in the form of high-interest-rate credit cards with fees and penalties, payday loans and subprime mortgages. The predatory lending practices “preyed on the poor and made them poorer.”

- Housing bubble: Big finance bundled bad mortgages and packaged them as toxic securities to be sold all over the world. The bubble bursting forced the economy off the cliff and into the great recession, but nobody went to jail, the shareholders paid the government fines and the taxpayers were forced to bail them out.

- Public Infrastructure: Another problem created by financialization is that there is less money available for government investment in the real economy. One study suggests we need $3.6 trillion to finance the repair or replacement of highways, bridges, sewer, water, and electrical transmission systems.

The problem is in aggregate demand. Although the actions of Wall Street have made the rich richer, it has done little for the average worker. This is a problem because 70% of the economy is based on consumption, and people are not consuming enough to grow the economy. Some of the people in the top 5% of earners are beginning to realize this, and even Wall Street is beginning to examine the problem. Top income earners have benefited from wealth increases but middle- and low-income consumers continue to face structural liquidity constraints and unimpressive wage growth. ”

Thus, despite the roughly $25 trillion increase in wealth since the recovery from the financial crisis began, consumer spending remains lackluster. Top income earners have benefited from wealth increases but middle- and low-income consumers continue to face liquidity constraints and unimpressive wage growth. It is no coincidence that the rise of financialization happened during the decline of manufacturing, middle-class income, capital investment, investment in infrastructure, and the rise of inequality.

The following graph also shows that the total employment in manufacturing grew until 1979, but has been declining steadily since this peak–and declining precipitously since year 2000. Since 1979 manufacturing has lost 8 million jobs.

THE SOLUTION

Perhaps the financial industry is an example of free-market capitalism at its best. But its lust for short-term profits has the power to hurt the economy and destroy the manufacturing sector. It is said that these types of capitalists who continually push the legal boundaries would sell you the rope at their own hanging. The one thing that they have proved over the last 4 decades is that they must be strictly regulated. I am convinced that left to their own devices, they will cause another financial crash of the economy.

The Dodd-Frank legislation is simply not enough to stop the finance industry from repeating its past crimes, and many banks are still too big to fail. At a minimum, we need to bring back the Glass-Steagel Act that separates the standard banking and investing parts of the bank from the risky instruments like credit default swaps and derivatives, which should not be protected by the FDIC.

Wall Street controls most of the money for capital investment, technology development, and the expansion of manufacturing. The focus now is on short-term investment and making money from money, not in long-term investments that would grow the manufacturing sector. If Wall Street is well regulated and the tools used in financial engineering made illegal, manufacturing might have a chance of getting its share of the money.

Bio:

Stuart Rosenberg has expertise in lean six sigma manufacturing systems, inventory systems and process improvements functions. Accomplished in use of optimization models to determine least cost facilities and drill down to workflow details in support of process and profit management. Oversaw all Inventory Collaborate effectively with business managers to resolve variances, refine forecasts and identify opportunities for improvement. While at Reckitt Benckiser, Linde Gas and Johnson & Johnson wore several hats including inventory manager, implementer and trainer of benchmarking and dashboard analytics, leader of cost optimization projects such as Lean and Lean Six Sigma, created and implemented cost and inventory metrics, collaborated across functional silos such as production, receiving, plant personnel and shipping to ensure inventory and cost systems integrity, wrote and implemented and trained staff on new Procedures to align with projects and continuous improvement leader.