ISO 31000:2018 stresses the need for risk management to be integrated into operational functionality and decision making, but little has be written on how to actually achieve this. Scenario Analysis is not a modern technology but how you can provide operational management with risk based decision marking collateral. Continue reading

ISO 31000:2018 stresses the need for risk management to be integrated into operational functionality and decision making, but little has be written on how to actually achieve this. Scenario Analysis is not a modern technology but how you can provide operational management with risk based decision marking collateral. Continue reading

Category Archives: RBT@Risk™

#192 – ISO 31000 RISK VALIDATION – NARESH RAO

Featured

ISO 31000 Says in “Introduction”

ISO 31000 Says in “Introduction”

Organizations of all types and sizes face internal and external factors and influences that make it uncertain whether and when they will achieve their objectives. The effect this uncertainly has an organization’s objectives is “risks”.

All activities of an organization involve risk. Organizations manage risk by identifying it, analysing it and then evaluating whether the risk should be modified by risk treatment in order to satisfy their risk criteria. Throughout this process, they communicate and consult with stakeholders and monitor and review the risk and the controls that are modifying the risk in order to ensure that no further risk treatment is required.

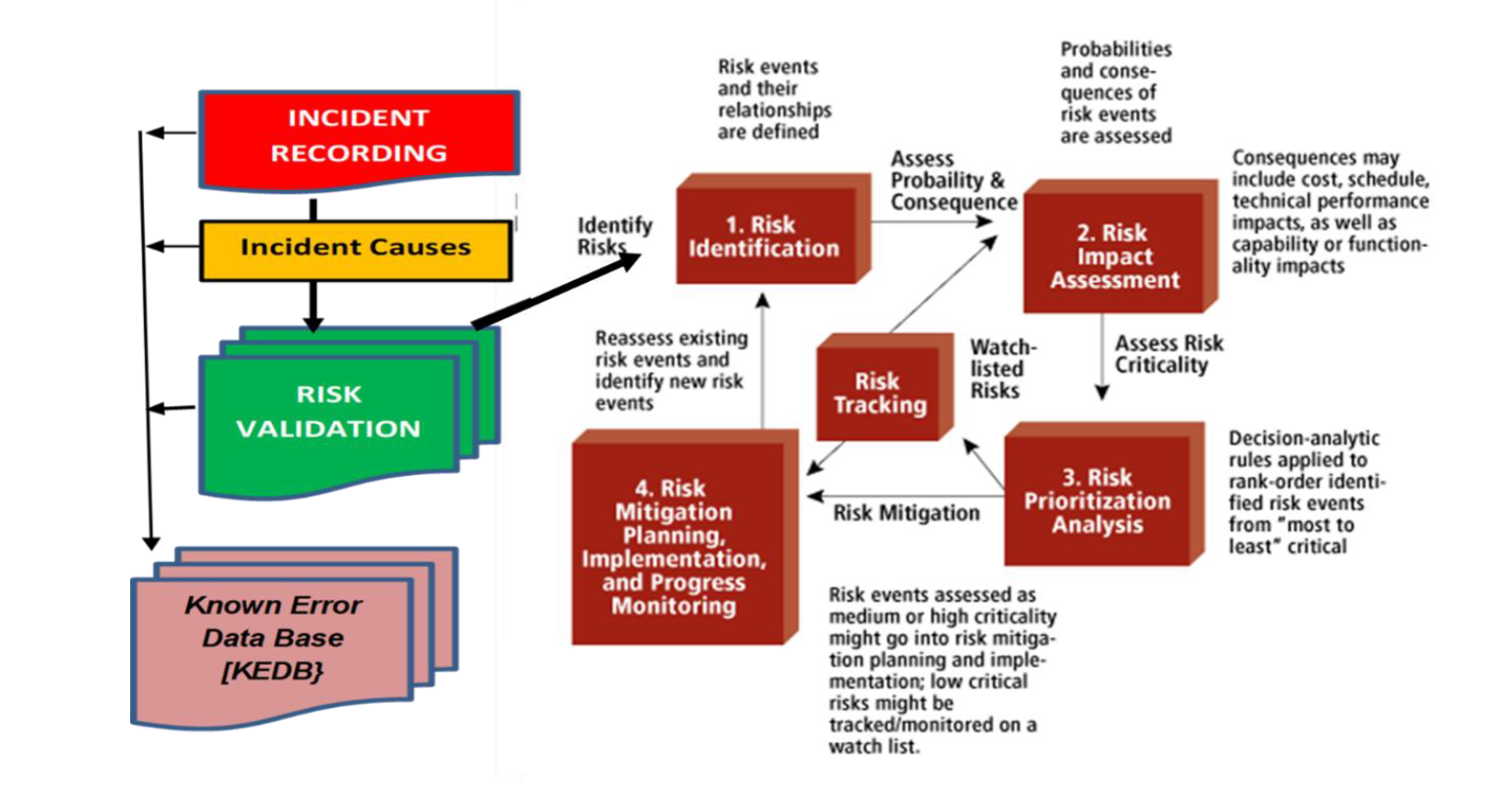

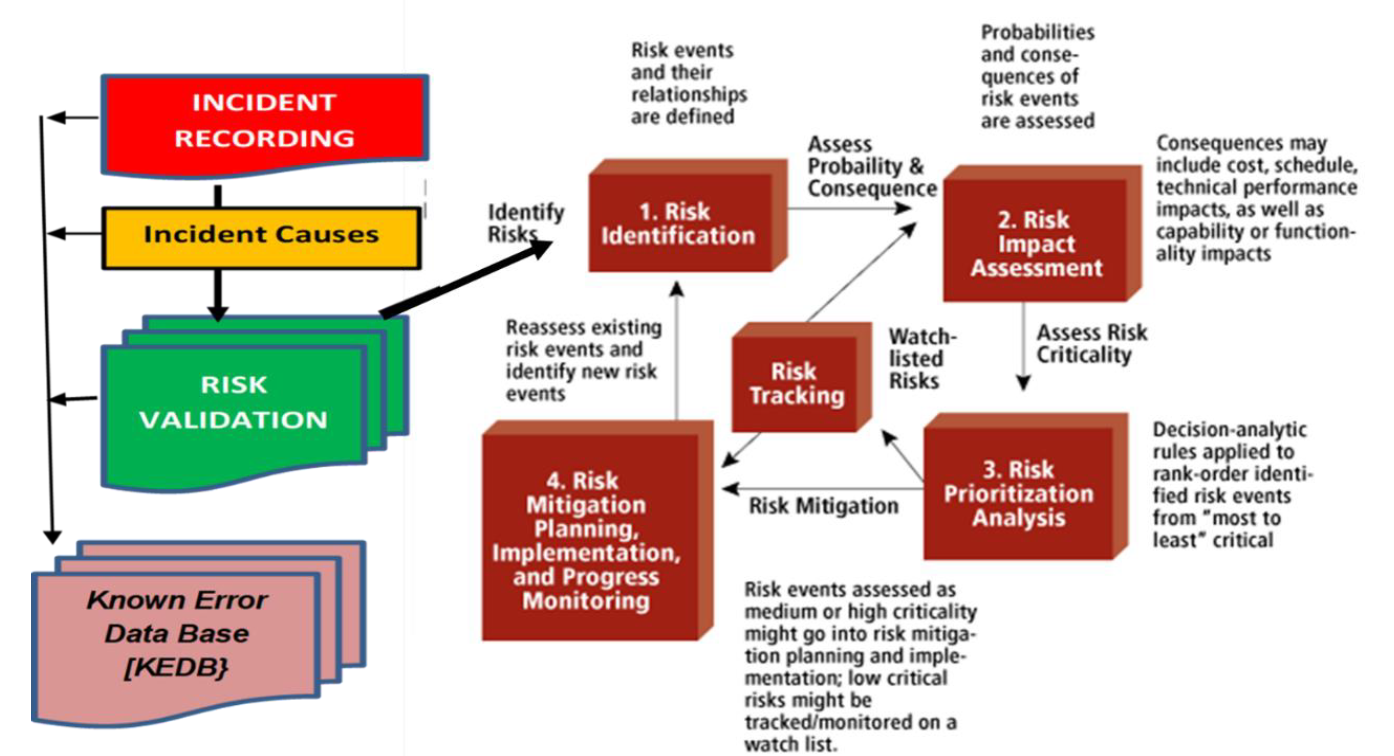

Risk Framework – Life Cycle with Risk Validation

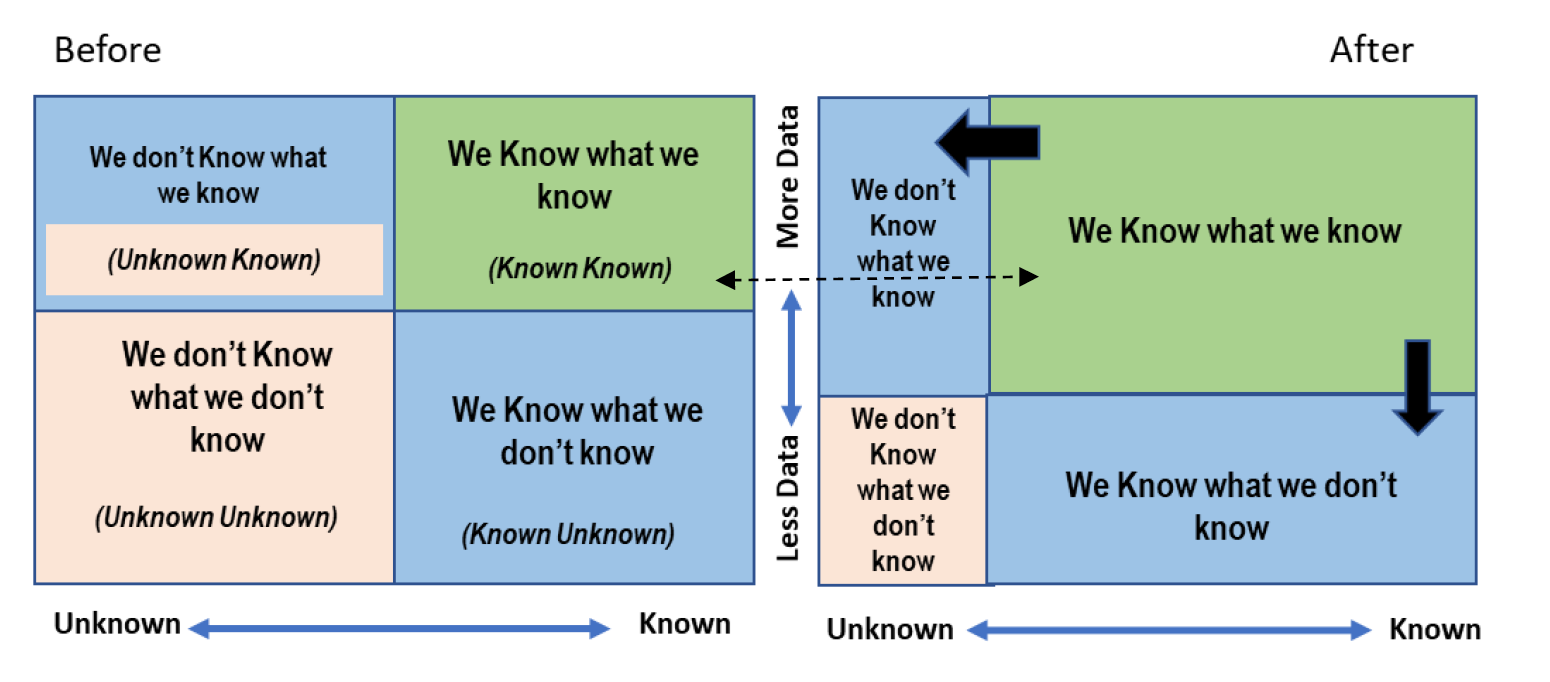

The risks which are identified are based on what one’s vision can point out. There are many unearthed risks which “Risk Owner” may not be able to visualize and also may not be able to identify certain unknown risks or vulnerabilities, which may cause an incident.

The initial “Risk Identification” is done by the Risk Owners” based on:

The initial “Risk Identification” is done by the Risk Owners” based on:

➢ Past Experience

(Every Experience has a price to pay)

&

➢ Future Vision

(Based on Capability and Capacity of the “Risk Owner”)

(Based on Capability and Capacity of the “Risk Owner”)

This means the Risk Management is Vision Based, initially.

Objective > How to convert Vision Based Risk Assessment to Factual Based Risk Assessment?

Why ?

Well > Evidence Based to Decision Making is the basic Principle of Management System and Auditing

Risk Evaluation

Before proceeding

to understand Risk Validation, it is important to look more deep into RISK MANAGEMENT:

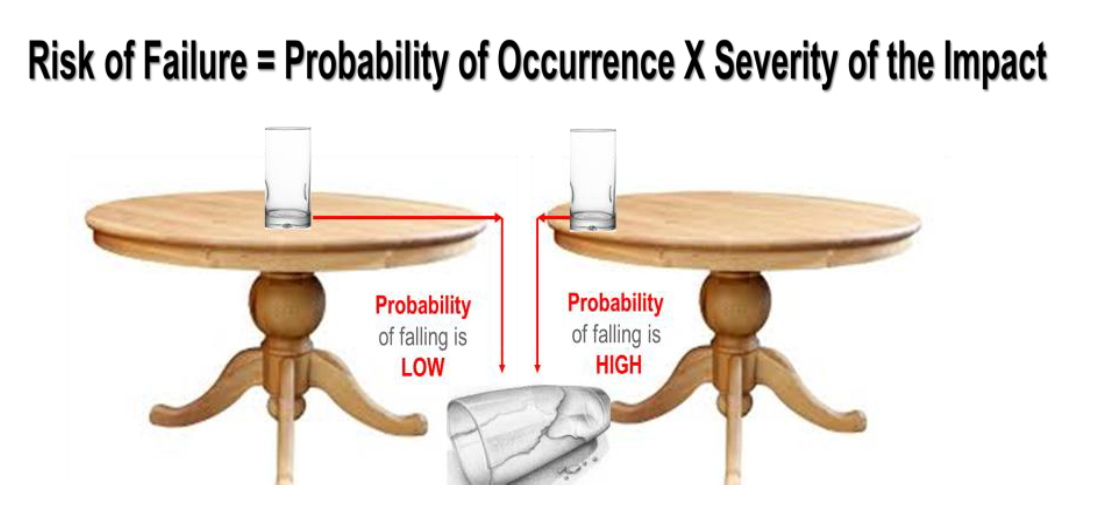

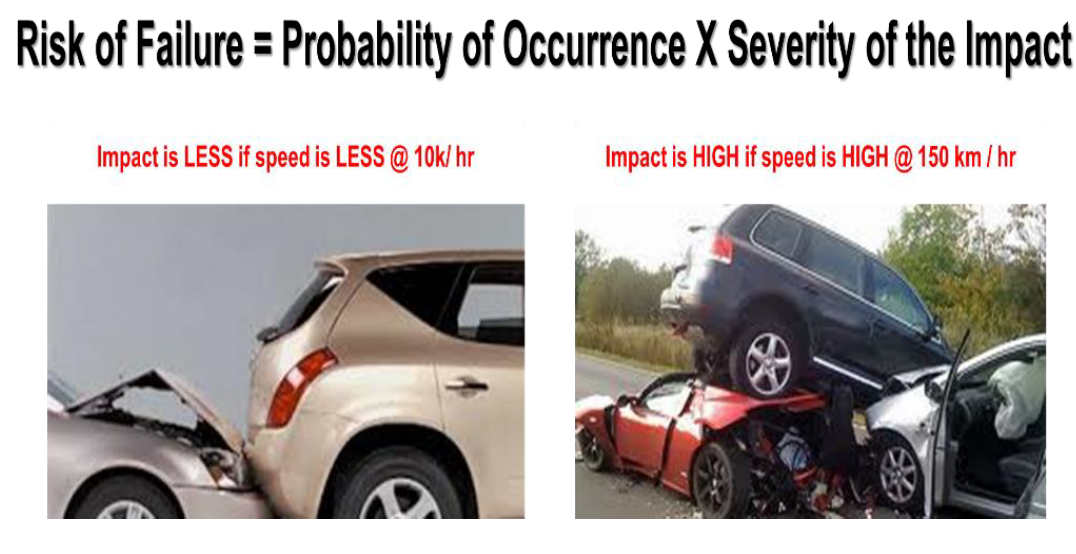

- a) Risk Evaluation : Generally parameters considered in evaluating Risk are:

PROBABILITY OF OCCURANCE & SEVERITY OF IMPACT which consolidated result is considered as RISK LEVEL – this Risk Level can be achieved through Quantitative or Qualitative Methodology.

If you observe carefully following conclusion of Impacts differ between scenarios of Stable Asset or Moving Assets:

In Stable Assets – Probability Changes more than Severity

In Moving Assets – Severity of Impact Changes more than Probability

Examples >

STABLE ASSETS

MOVABLE ASSETS

In Industry, most of the processes work on IT platform and IT (Information Technology) falls under Stable Assets – thus any controls implemented (to reduce the risk), reduces the Probability – example is Firewall on Servers – all controls reduce the probability only as if they are breached, Impact is same – high risk.

Impact changing generally occur in Moving Assets like moving machine, health & safety like road accident (as shown above) or person falling from height (impact changes based on speed or height).

Risk Mitigation Effectiveness

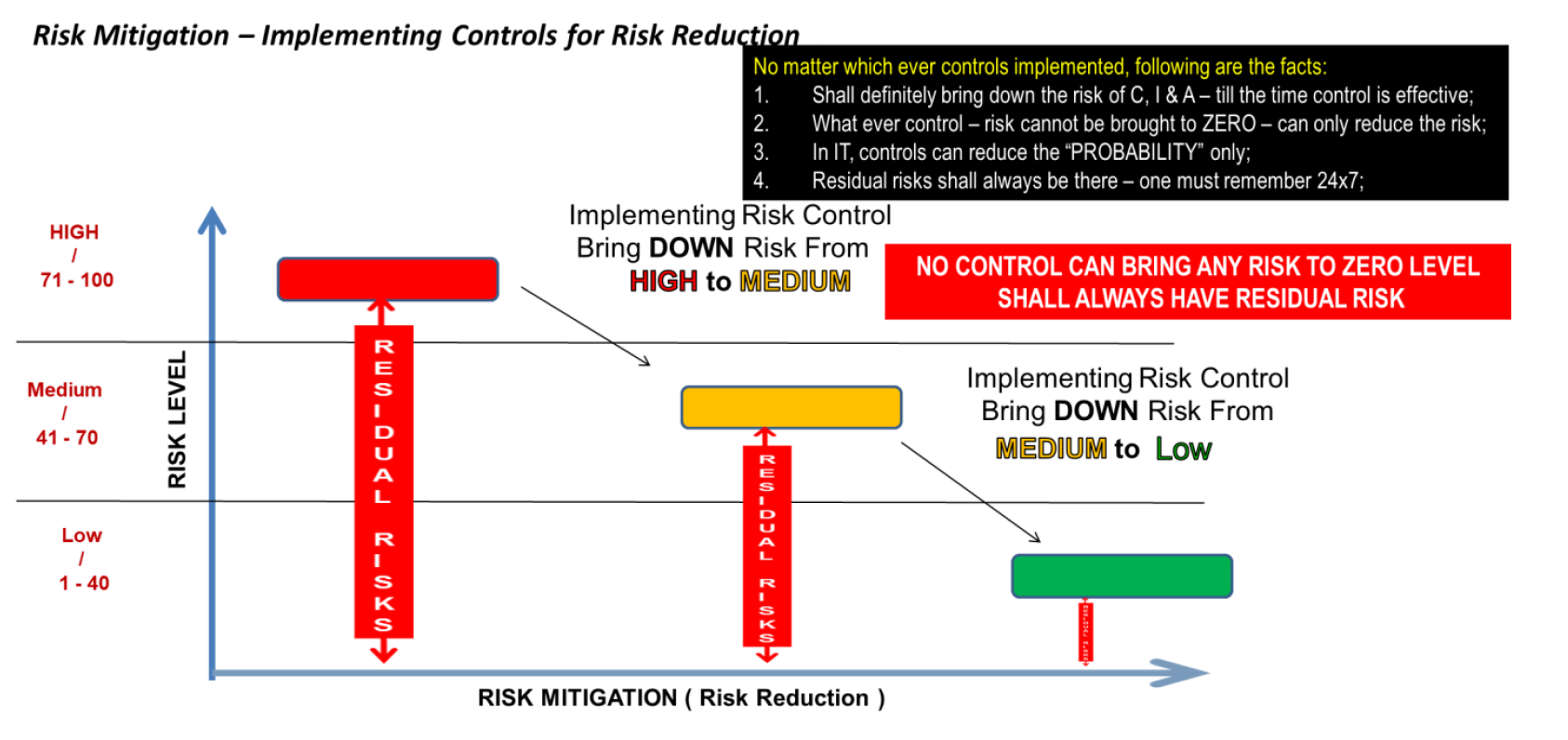

- A) – Residual Risk Existence

Another important aspect of Risk Management is Control to reduce the risk – no matter what controls are put, the Risk Cannot be reduced to Zero – some element of residual risk is bound to be there.

The type of investment in mitigations depends on below or any combination

➢ Probability and / or Impact of vulnerability;

➢ Risk Appetite & Risk Tolerance;

➢ Monitoring Controls or Risk Reduction controls;

➢ Management perception of the Risk;

➢ Risk Owner’s perception of the Risk;

➢ Market influence on business;

➢ Competition perception;

➢ Risk Acceptance Criteria

The residual risk visualization / perception also gives rise to Risk Owner’s decision, in case Residual Risks are not acceptable.

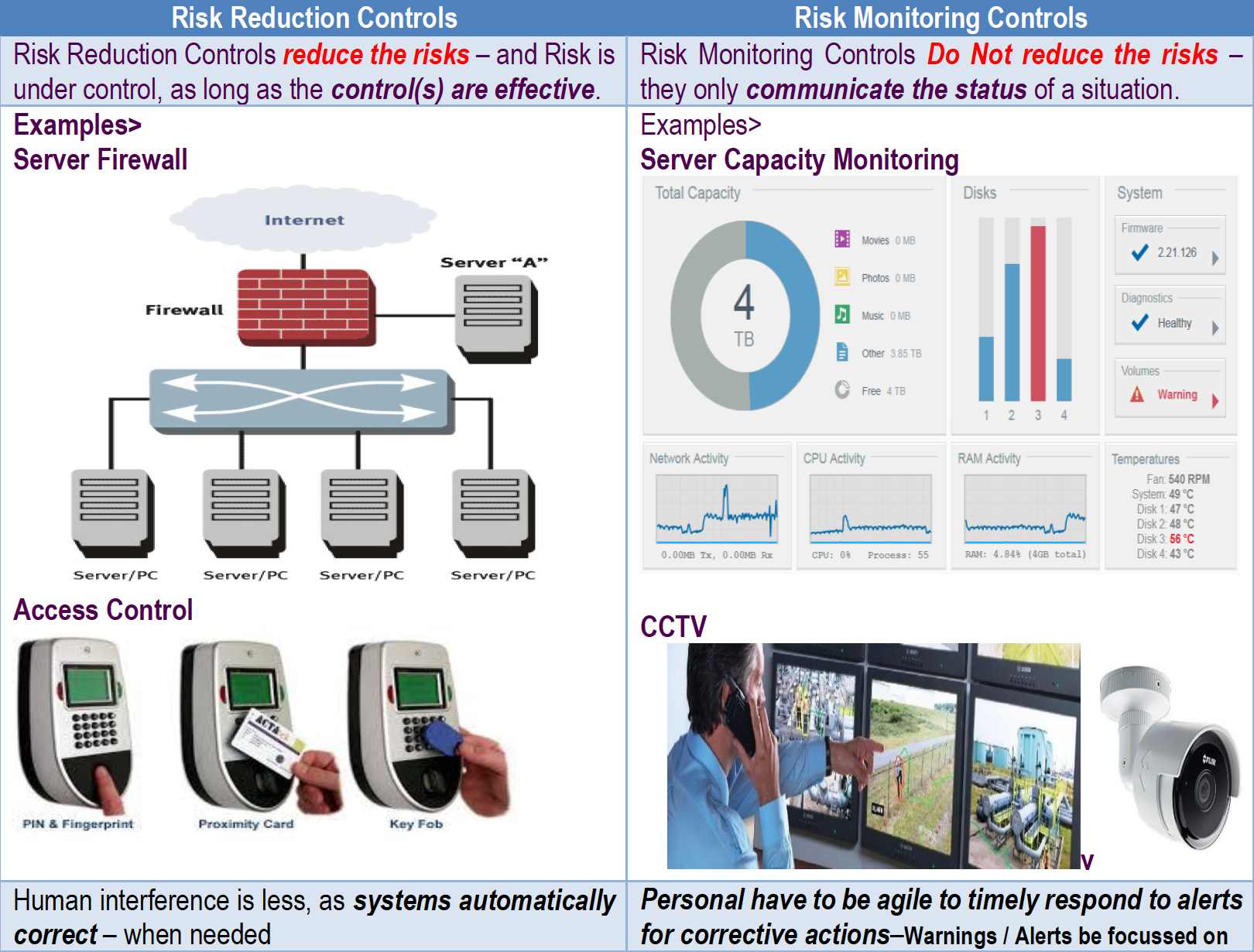

B) – Risk Control Effectiveness

There are two types of controls which exists

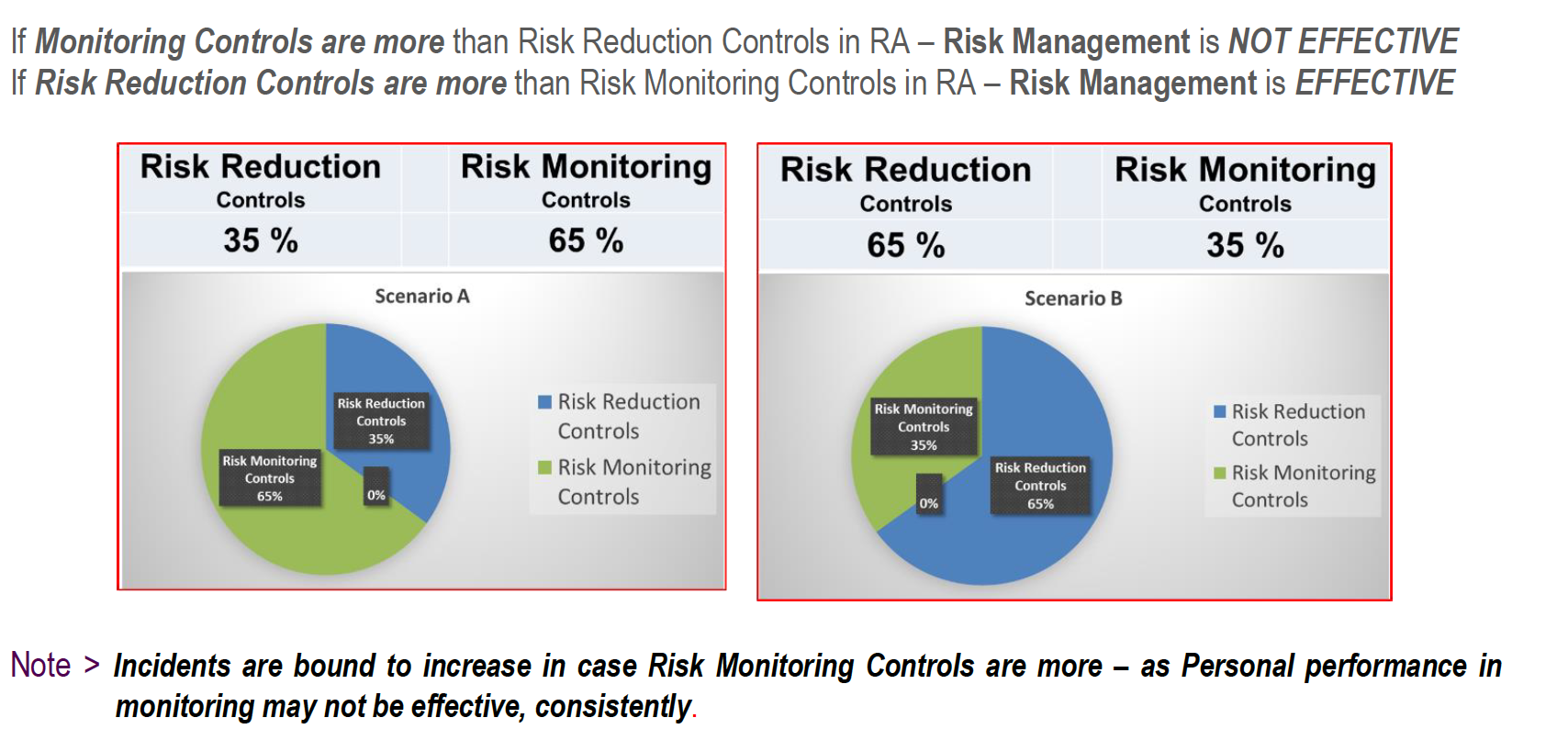

If Monitoring Controls are more than Risk Reduction Controls in RA – Risk Management is NOT EFFECTIVE

If Risk Reduction Controls are more than Risk Monitoring Controls in RA – Risk Management is EFFECTIVE

After all risks are identified, mitigated & monitored – what next?

Well, there is one more objective left out, which we discussed above:

Question>

– How to covert a vision based Risk Assessment into Factual based Risk Assessment?

Answer>

– Updating Risk Assessment after an incident occurs

Now “Risk Owners” have to do is – “Risk Validation” when incident happens

1) Identify the causes of the risks

2) Compare the causes of the incident to risk assessment and update the same – which is Risk Validation.

Some cautions are to be taken as below:

> Residual Risks

> Controls – Risk Reduction controls like (Server Firewall, etc.) and Monitoring Controls (like CCTV, etc.)

> Relevant Interested party not identified

> Interested party identified but not the risk or vulnerability

We need to know why the Incident occurred on first place, in spite of existing controls. Risk Validation shall help us to understand –which vulnerability in the Risk Assessment lead to the incident:

– The Risk Management Strategy OR

– Risk Process (criteria or evaluation or mitigation or acceptance criteria)

KEDB (Known Error Data Base) – updated after every Risk Validation in Incidents, apart from linking up to RA for required corrective actions. This updated KEDB is used for future reference, thus building up the knowledge base for the scope of the organization. By doing this, you are actually validating actual incidents with vision based current risks – thus converting vision based RA to Factual based RA.

Risk Assessment – Preventive Action Vs Corrective Action

As per Annex SL on which most of ISO Management Standards, new versions are released, the Preventive Action word is replaced by “Risk & Opportunities” there is no need for Preventive Actions;

– but when Risk Assessment is updated based on an incident – entire information of that specific risk (including controls & residual risks) now gets converted as corrective action(s) and do not remain as preventive, any more.

The definition of Corrective Actions is “Eliminating the causes of detected non-compliance and Pre-venting from recurrence”

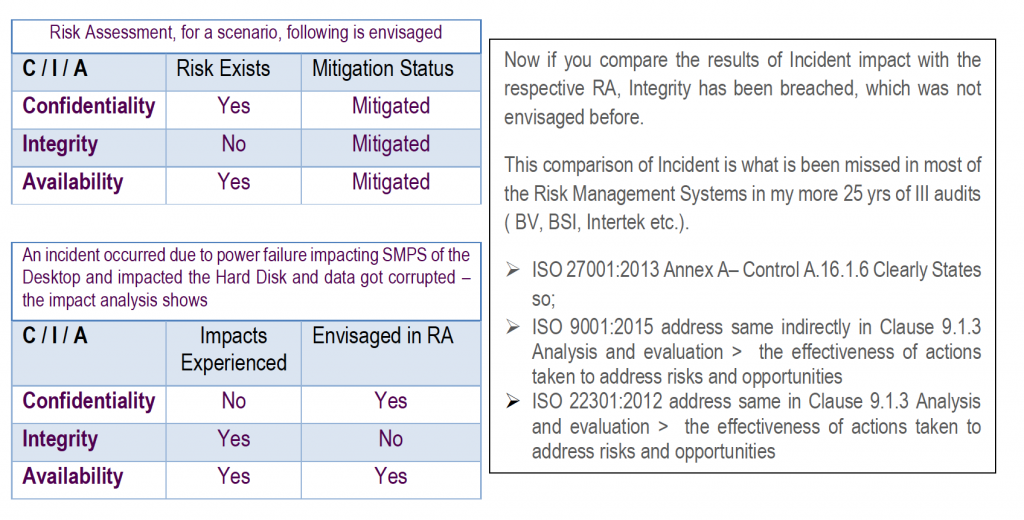

Example: (Information Security)

There are three parameters of Information Security:

➢ Confidentiality ( Information is available only to authorised personnel and not to unauthorized personnel )

➢ Integrity ( Accuracy and Completeness of Information )

➢ Availability ( Information is available to authorised personnel, when required)

Note >

If Confidentiality Breaches, changes of Integrity & Availability breaches automatically increases

If Integrity Breaches, chances of Availability breaches automatically increases

If Availability Breaches, then no risk for Confidentiality & Integrity is not there

Hope you have gained from this white paper on RISK VALIDATION and hope that this would benefit, if practiced. Requesting you to share your comments via mail to naresh@ircbo.solutions

Best Regards > Naresh RAO, Technical Director, IRCBO Solutions Pvt. Ltd., INDIA

Bio:

Started carrier from banking software development in 1986 then was an entrepreneur of textile mill. Entered Management Systems in 1993. Became and auditor with DNV(III CB) and later AQSR, RINA , KPMG, BSI and Intertek in senior positions like Regional Manager, Head Operations, General Manager , Head Standards and Business Solutions. Also a Lead Trainer in qualifying III party auditors on risk based standards. Now running a consulting firm in all Management system standards, apart from III party auditor for Intertek etc. and also has his own Lead Auditor course in Business Continuity (ISO 22301:2012) , Annex A based ISMS software (ISO 27001:2013 – new product about to be released globally)”

Naresh RAO,

Technical Director,

IRCBO Solutions Pvt Ltd.,

www.ircbo.solutions

mail > naresh@ircbo.solutions

mobile > +91 981182 7758

#190 – FEDERAL HIGHWAY ADMINISTRATION RISK BASED ASSET MANAGEMENT – JAMES KLINE PH.D.

Featured

The 2012 Moving Ahead for Progress in the 21st Century Transportation Act (MAP 21) requires state departments of transportation to develop a Transportation Asset Management Plan (TAMP). The TAMP is to include a Risk Based Asset Management Plan (RBAMP). The two plans must be certified by the Federal Highway Administration (FHWA) by June 30, 2019. Continue reading

#186 – PREDICTABLE SURPRISES: THE VOLKSWAGEN STORY – JIM KLINE PH.D.

Featured

A predictable surprise is a risk event that in some form is known within the organization. It is of a nature that if left unresolved, it could be costly. But fixing the problem appears to have larger short run costs, than long term benefits. The Volkswagen diesel emissions fraud is one such example. It also a case where the penalties imposed outweighed the short term costs. Moreover, had a risk assessment occurred at several points along the way, there might not have been a scandal. Continue reading

A predictable surprise is a risk event that in some form is known within the organization. It is of a nature that if left unresolved, it could be costly. But fixing the problem appears to have larger short run costs, than long term benefits. The Volkswagen diesel emissions fraud is one such example. It also a case where the penalties imposed outweighed the short term costs. Moreover, had a risk assessment occurred at several points along the way, there might not have been a scandal. Continue reading

#186 – INNOVATION VS. TRANSFORMATON – JOSEPH PARIS

Featured

If you want your business to survive, you need to innovate. If you want your business to have a chance of thriving, you need transformation. Certainly, either innovation or transformation are no guarantees of success – but the lack of both almost certainly leads to doom. Need proof? Can you name one company or one industry (other than government) today that, when faced with a change in the marketplace, failed to innovate – and instead stayed with its traditions, and survived – not to mention, thrived? If you think of one, let me know. How about a company that faced a transformation in the marketplace – how did it fare over time? Continue reading

If you want your business to survive, you need to innovate. If you want your business to have a chance of thriving, you need transformation. Certainly, either innovation or transformation are no guarantees of success – but the lack of both almost certainly leads to doom. Need proof? Can you name one company or one industry (other than government) today that, when faced with a change in the marketplace, failed to innovate – and instead stayed with its traditions, and survived – not to mention, thrived? If you think of one, let me know. How about a company that faced a transformation in the marketplace – how did it fare over time? Continue reading