I was speaking with a friend who is the Chief Operating Officer of a multi-national chemical processing company a few weeks ago. We were speaking about the various challenges that he is facing, which are not unlike the challenges faced by many companies. His most important goal was to maximize profits whilst minimizing inventory – nothing new here.

I was speaking with a friend who is the Chief Operating Officer of a multi-national chemical processing company a few weeks ago. We were speaking about the various challenges that he is facing, which are not unlike the challenges faced by many companies. His most important goal was to maximize profits whilst minimizing inventory – nothing new here.

We spoke about how he is trying to become specialized, being able to deliver short runs on short time schedules, but at higher margins. But being a chemical company, the change-overs are a challenge and can easily negate any increase in expected (hoped-for) margins. The same goes with building inventory in anticipation of orders.

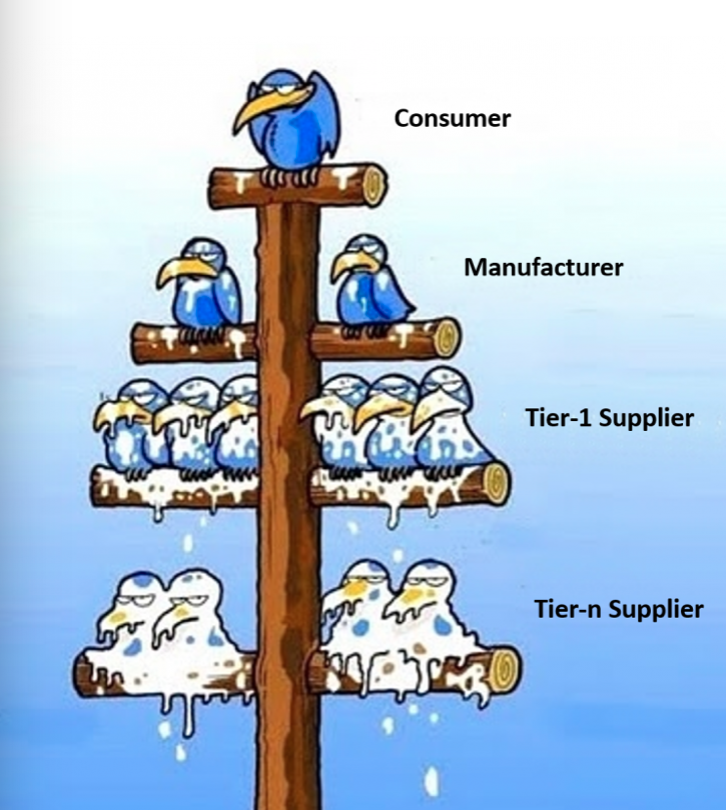

I made mention that, in a value-chain, almost always someone is left holding the “Old Maid”. We both laughed. We both laughed because it’s true.

Old Maid is a card game that most of us have played as very young children. Perhaps we have played it with our own children or grandchildren. And whilst they have decks of cards specifically for playing Old Maid, we always just used a regular deck of playing cards. The gameplay went something like this (credit Bicycle); “You remove one of the Queens from the deck and deal all of the cards out to the players. Each player removes all pairs from his hand face down. If a player has three-of-a-kind, he removes only two of those three cards. The dealer then offers his hand, spread out face down, to the player on his left, who draws one card from it. This player discards any pair that may have been formed by the drawn card. He then offers his own hand to the player on his left. Play proceeds in this way until all cards have been paired except one – the odd queen, which cannot be paired – and the player who has that card is the Old Maid!”

In this case, the Old Maid is inventory. And in a value-chain, I can almost guarantee that someone is holding the inventory – with the basic rule being, the weaker you are, the less power you have, and the more inventory you need to hold to satisfy fulfillments which are largely beyond your control. And, if you are going to carry the inventory, you want to make sure its as little as possible and what you do carry is lean – little or no fat.

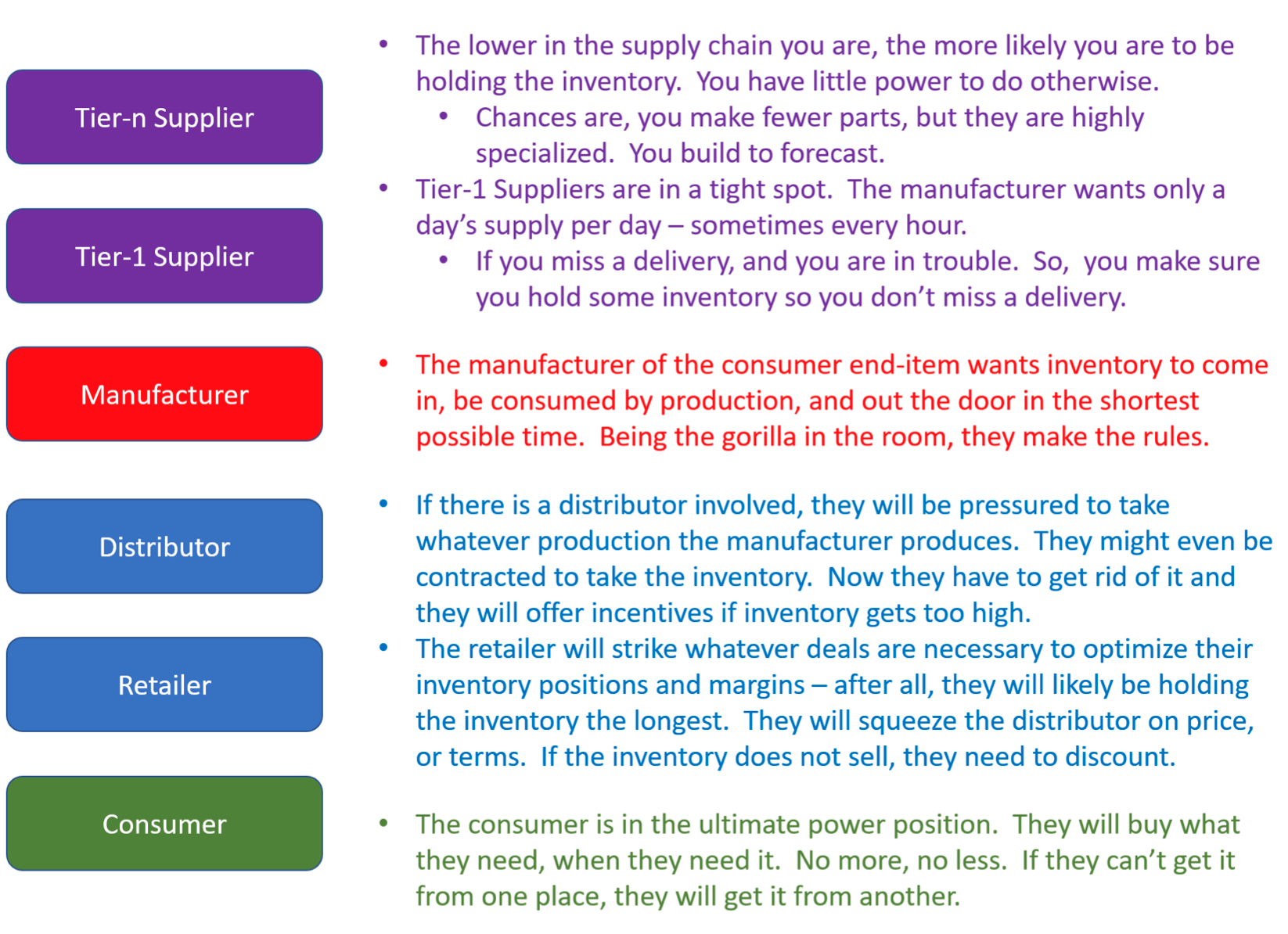

The two most powerful players in the value-chain are the manufacturer of the consumer end-item and the consumer themselves – with the ultimate power almost always being held by the consumer.

Think about it. At the retail level, you want to buy a gallon of milk, so you go to the grocery store. But the grocery store is out of milk. Do you just shrug your shoulders and go home without your milk? Or do you just go to the next grocery store? What if the dairy from whom you normally buy has a shut-down? Do you just go home without milk? Or do you buy your milk from the dairy that has kept production? Indeed, the consumer has the ultimate power. The best that the pre-consumer value-chain can hope for is that the consumer buys in bulk – gallons instead of pints.

But the manufacturer of the consumer end-item has the second greatest power. They set the tempo for all the other suppliers who must adjust to the varying demands in real-time. Sure, they will speak about “partnerships” and such to their suppliers and distributors. But when push comes to shove, the partnership demonstrates that it is obviously, even painfully, unequal – maybe nonexistent.

For instance; we need to look no further than the recent actions of the perennial stalwart of the Dow Jones Industrial Average (DJIA), General Electric. Navigating through a particularly rough business patch in GE’s history and according to an article in “Supply Chan Dive”, GE aims to reduce inventory and manage its supply chain “rigorously”. We all know that “rigorously” really translates to meaning that GE is going to shed more burden and responsibility on its suppliers. Their problems now become the suppliers’ problems. And so it goes…

Sure, we can use forecasts that predict production and inventory requirements. But as we all know, there are only two types of forecasts; wrong ones and lucky ones. But all it takes is one phone call from the next higher up in the food chain to throw your entire world into chaos.

This is the part of the article where you might be expecting to read some real easy, even obvious, solution that you can implement quickly, at low cost, and immediate effect. Unfortunately, I am going to disappoint. There is no magic button you can push or pill you can swallow that is going to help you reduce (not to mention eliminate) the excess inventory that exists through-out the value-chain.

There is only so much you can do that is external to your company. Whether upstream or downstream, you are never going to have complete visibility into your partners’ goings-on in real-time – not to mention transparency. It’s only fair, because there is only so much information you want to share with your own partners. Nobody wants to open their kimono except behind closed doors – and even then, only with the lights dimmed.

But what are some of the things you can do with your value-chain that have a positive impact?

- Poor Supplier Quality; The place to start is ensuring the products you are purchasing from your suppliers meets your specifications in a reliable manner – effective and efficient. If you can’t get this right, stop. Go no further until you do.

- Reduce Order Transaction Costs: There is an overhead cost associated with every purchase or production order produced. Evaluate the benefits of implementing technologies such as Electronic Data Interchange (EDI), Advanced Warehouse Management (AWM) and Manufacturing Execution Systems (MES) to minimize these overheads – but make sure to perform a cost/benefit analysis before procurement.

- Reduce Inventory Holding Costs: Improve space utilization in your warehouses through robotics, narrow aisle handling equipment, optimized warehouse layouts, and improved racks.

- Vendor Managed Inventory: Switch the responsibility for inventory to your vendor. Make them responsible for managing inventory levels to satisfy demand and charging for only what is consumed.

- Optimize Payment Terms: When it comes to longer- term purchase agreements, negotiate the best overall payment terms given the circumstances. It might not just be price, it could be when payment is due, or discounts for early payment, or invoicing only when inventory is consumed.

- Cycle Stock on Economics: Understand, get control, and optimize your total acquisition or production costs. Consider any total cost of outsourcing; landed costs, defects, cash tied-up in-transit, and so on. Evaluate which is better, shorter runs for lowing inventory or longer runs for cost reductions realized in reductions in changeovers and receiving labor.

- Transfer Inventory Instead of Purchasing:When stock levels are low on an item, check to see if there is an overstock situation elsewhere and take the opportunity to balance the inventory levels. Of course, this only makes sense if the cost to transfer is less than the cost to replenish and when the inventory depleted in one location is not going to cause a premature need for inventory replenishment there.

However, the biggest impact will come from efforts within your four-walls, where you have almost complete control. Let’s start with the elimination of waste. Waste is anything that has a cost but adds no value. The Toyota Production System (TPS) and Lean identify the “seven wastes” which are usually remembered by the acronym “TIM WOOD” and included;

- Transport: Moving inventory about has a cost but adds no value to the product. Seek and minimize, or even eliminate, transportation of inventory. This may (probably will) involve the reconfiguration of the manufacturing floor and warehouse locations.

- Inventory: Think of inventory as money that is sitting idle, even mishandled. If you were to visualize your inventory as cash, would you be content with stuffing it in a mattress for months, or even years? Would you stash it someplace where it was going to decay from exposure? Treat your inventory the same way. Put it to work as soon as you can – and manage and protect that which you can’t so it’s not lost.

- Motion: Whether man or machine, any movement consumes time and has a cost – make the effort to reduce or eliminate.

- Waiting: Waiting is opportunity to add value that is squandered. Try to create a continuous flow.

- Over-Processing: Sometimes, close enough is good enough. No sense on painting where nobody will see, or polishing or otherwise finishing beyond what is required. The product does not have to be “perfect”, it just needs to meet specifications.

- Overproduction: An extension of inventory above. Don’t make more than you need. There is a cost associated with carrying the inventory, not to mention it taking-up space for other inventory which might be needed. And you run the risk of the overstock becoming obsolete and scrapped.

- Defects: Simply put, work to make product within specification.

In addition to TIM WOOD, I would like to suggest a few other wastes and opportunities for improvement:

- Wasted Talent: Hiring and bringing an employee online to a point where they are producing for the company is very expensive. Make sure you invest in them – hone and leverage their passions and strength, augment their weaknesses. If you don’t take care of them and allow them to grow into their potential, they will leave – and along with them, your investment.

- Measuring the Wrong Things – or Measuring Things Wrongly: Collecting data is important, but only if you are going to do something with the data – otherwise, you might not want to bother. And if we are going to bother collecting the data, we want to make sure we are collecting it correctly – otherwise the analysis is not going to be of use (and could even be counter-productive). Also guard against people “gaming” the KPI’s for their own benefit (either to earn the bonus or keep them out of trouble).

- Finish Product Pull: For items from which multiple products can be produced, consider only completing the manufacturing process to the point where the items can diverge and completing the products when there is real demand.

- Customer/Inventory Profitability: Which customers and inventory items drive the most profit and which generate losses. Examine the matrix of customers, inventory, and profitability and optimize the balance accordingly.

- Liquidate Obsolete Inventory: If its worthless, get rid of it by whatever appropriate means are necessary – make room for something that is required. Although you will take a hit to the profit and loss (P&L) statement, the carrying cost is just throwing more good money after bad.

Even in spite of all of these efforts, even if you did them all to the best of your ability, there will be times and opportunities when the Old Maid will come to visit. But try to make her visits as brief as possible.

BIO:

Paris is the Founder and Chairman of the XONITEK Group of Companies; an international management consultancy firm specializing in all disciplines related to Operational Excellence, the continuous and deliberate improvement of company performance AND the circumstances of those who work there – to pursue “Operational Excellence by Design” and not by coincidence.

He is also the Founder of the Operational Excellence Society, with hundreds of members and several Chapters located around the world, as well as the Owner of the Operational Excellence Group on Linked-In, with over 60,000 members. Connect with him on LinkedIn or find out more about him here: www.JosephParis.me/card