When the tourist asked the way to Dublin the response was:

When the tourist asked the way to Dublin the response was:

“If I was you, I would not start from here!” (Old Irish joke).

It has become fashionable for management perspectives to be risk orientated or biased and even attempt to view all endeavour from a risk perspective however contorted and illogical the resulting picture. It is counter to the logical and intuitive way that we experience the world and inhibits a more holistic and integrated approach to management.

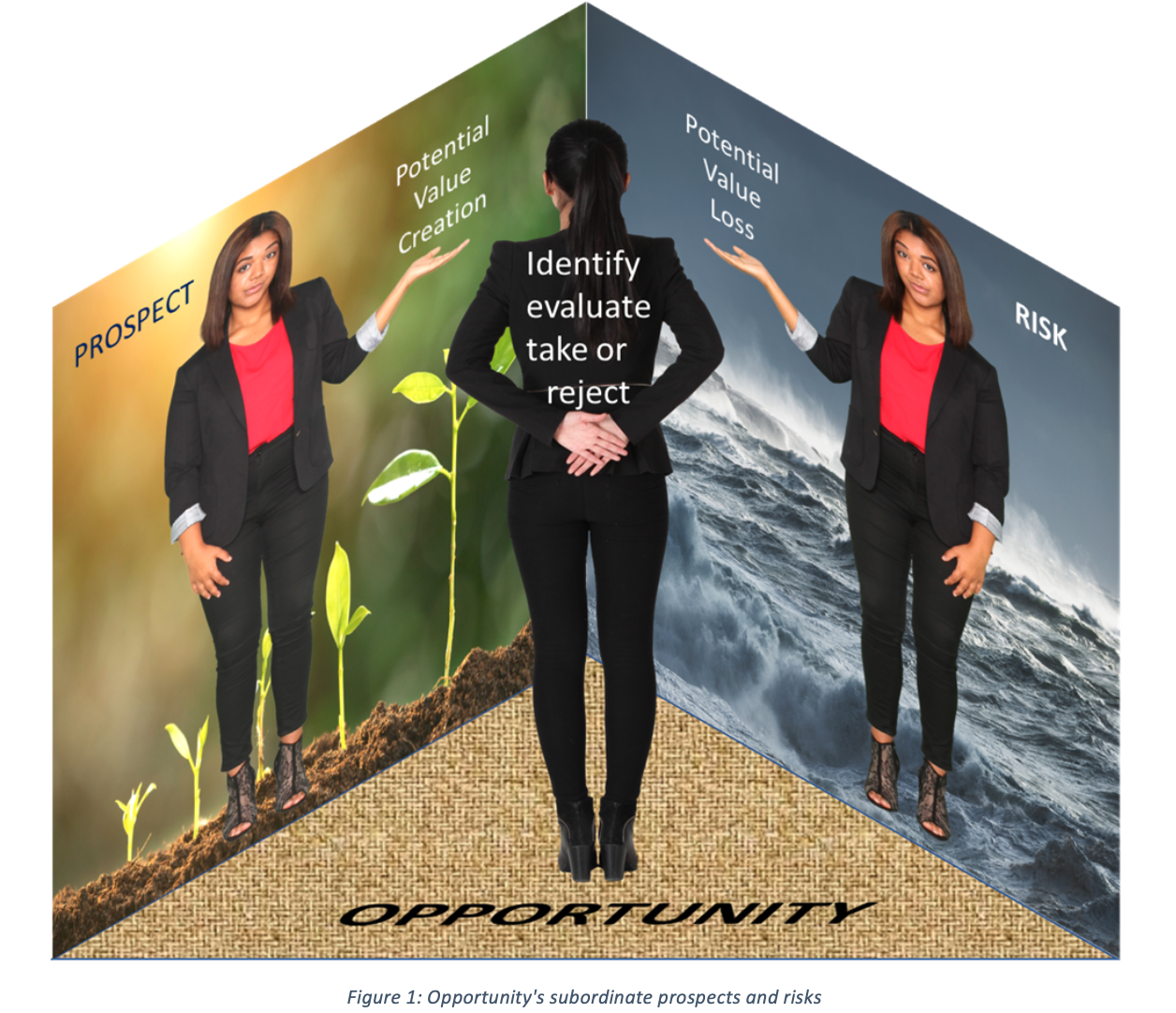

The essence of human behaviour is the seeking, evaluation, and taking and rejecting of opportunities sought to fulfil our needs as shown in Figure 1: Opportunity’s subordinate prospects and risks. Management is the process of directing resources to create and retain value that fulfil our needs by taking right and rejecting wrong opportunities. Management is conducted within a sea of opportunity in real time while the associated consequential unpredictable potential upsides and downsides are realised after the opportunity has been taken or rejected.

Prospect and risk are different but similar animals and result from assessing future positive and negative outcomes while in the process of taking and rejecting opportunities, which is what we call behaviour. It is conducted and potentially observable in real time. For example, a marriage ceremony may be readily observed as it happens while the success of the marriage will play out over time. To be more successful individually and collectively, we need to understand the natures and interrelationships of opportunity, prospect and risk. This empowers us to effectively define and communicate objectives and problems and deliver optimal solutions and outcomes.

Observing holistically

We tend to see just what we look for and are blind to all else and the overarching big picture. It is our natural tendency to feel comfortable with our entrenched mental models of how the world functions and how we can influence it to satisfy our individual and collective needs. It is like five hundred years ago when we saw the world from a flat perspective. Most people today find that perspective amusing as they regularly see pictures of the earth as a glorious and beautiful near to perfect sphere. However few management professionals today question the risk centric management perspective, acknowledge its flaws, and understand that it is hindering integrated holistic thinking.

Given that the human brain is supposed to be the most complicated structure and dynamics within the universe, it is difficult to conceive of a greater challenge than the theory and practise of governance and management at any level. If we are ever to fully master this great challenge, we need a fully holistic perspective such that we see every aspect and impact as it positively and/or negatively affects all of the stakeholders’ needs.

However, there is a predominance of current management thinking that views and attempts to understand everything in terms of risk as the foundation management theory and practise. Like the flat earth thinking of yesterday this is restricting and impeding a holistic understanding and practise of management which is so urgently needed to address mankind’s pressing problems. The first stage of problem solving is to define the problem, but we cannot do this effectively with ill-conceived concepts, principles, and definitions. The concept of risk is very powerful but only addresses the likelihood of potential loss in all its various forms – if we look through the looking glass there is a mirror world of upsides which is the principle motivator of all human endeavour to satisfy needs.

Critical definitions

Before we explore the relationships between opportunity, prospect, and risk it is helpful to define them. This can be problematic because even considering risk alone, there are many definitions across standards and regulations. ISO lists about a hundred different definitions of risk.

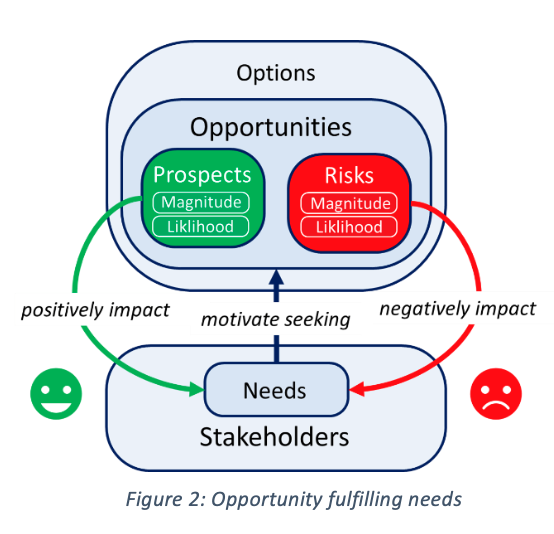

The Universal Management System Standard MSS 1000 definitions below are part of a universal set of mutually consistent management concepts. See also Figure 2: Opportunity fulfilling needs .

Option

Something or a path that has or may be chosen.

Opportunity

Something or a situation favourable for the attainment of an objective or a requirement.

Prospect

Combination of the potential gain and the likelihood of its realization.

Risk

Combination of the potential loss and the likelihood of its realization.

Stakeholder

Any individual, group or organization that can affect, be affected by, or believe itself to be affected by the organization’s existence, assets, or activities.

Need

Requirement of a stakeholder.

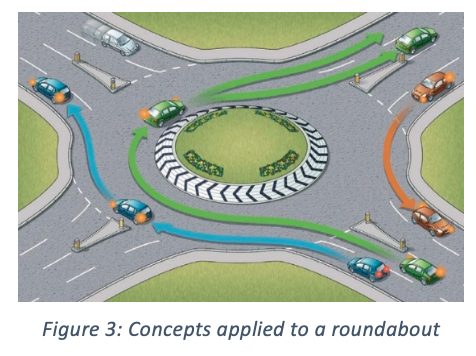

A practical example aids understanding of the definitions in the previous section. Imagine a UK road journey and you enter a roundabout with multiple potential exits. Using the definitions, we can define the situation unambiguously. See Figure 3: Concepts applied to a roundabout.

Assuming we obey the law, the roundabout has four exits which includes a complete U-turn. We therefore have four options open to us but in the example, only two appear to be favourable to continue our journey to the desired destination. There are therefore two opportunities to choose between depending on the likely upsides (prospect) and downsides (risk) impacting stakeholder needs while making and completing this fictitious journey. Stakeholders may include the driver, other drivers, vehicle owner, goods supplier, goods receiver, insurer, emergency breakdown service, emergency services, insurer of vehicle, insurer of goods etc.

General upsides and downsides to consider are journey time, fuel usage, possible disruption and delays, safety on the route, stops for refuelling, refreshment and rest, toll charges, performing another task on the way e.g., a delivery, contractual penalties etc.

Prospect and risk similarities

Prospect and risk:

- Share conceptual symmetry.

- Contains a likelihood component constrained by uncertainty.

- Contain a magnitude component constrained by uncertainty.

- Are measures of potential future impact realisation.

- Are relativistic according to the stakeholder.

- Polarities may change according to the stakeholder.

- May be expressed qualitatively and/or quantitatively.

- May make use of the same units to express magnitude and likelihood components.

- May be modelled mathematically, by simulation and by structured analysis aids (management tools).

Prospect and risk differences

- Prospect and risk have opposite polarities (gain and loss respectively).

- Prospect positively impacts stakeholder needs and is desirable and motivates while risk negatively impacts stakeholder needs, is undesirable and demotivates.

- Stakeholders have an appetite for prospect but a tolerance of risk.

- Prospect of fulfilling stakeholder needs is the reason organisations are created and gives them purpose while risk inhibits need fulfilment.

Opportunity is not the opposite of risk

Opportunity being the opposite of risk is a myth and gives rise to misleading ill-conceived commonly used expressions like ‘risk and opportunities’ which are even embedded in ISO standards.

Comparing opportunities and risks is like comparing apples and pears. Opportunities exist and can be taken or rejected in the present while prospect and risk have a future uncertainty component. Opportunity is expressed by different units to those used for prospect and risk. Although opportunity is something or a situation favourable for the attainment of an objective or a requirement, it inevitably contains some degree of downside. In reality prospect and risk are subordinate components of opportunities.

Opportunities are sought, evaluated, taken, and rejected at strategic, tactical, and operational levels. It is the nature of life and management and is what we understand as ‘behaviour’ which in turn determines all aspects of performance capable of being influenced by humankind. No organisation, product or service was ever rationally created to deliver loss, other than in organised conflict with an enemy.

More success naturally emerges from opportunity centric thinking which leads to take more strategic, tactical, and operational right opportunities and less wrong ones. There are many ways to help achieve this through identifying and assessing prospects (likely upsides) and risks (likely downsides), depending on the size and nature of the organisation.

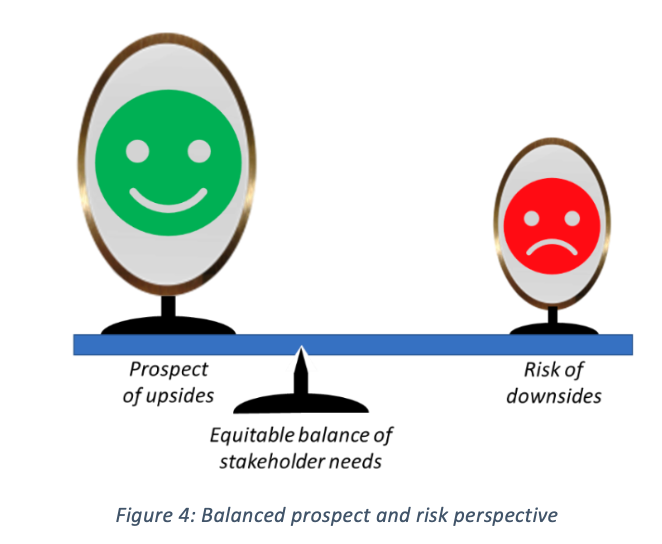

The more simply that we can describe the real world that we inhabit, the better will be able to manage it to equitably fulfil stakeholder needs. See Figure 4: Balanced prospect and risk perspective

Human behaviour is the continual seeking taking and rejecting of opportunities in a world of uncertainties. This is what an alien would observe. However, not all uncertainty is associated with risk nor is it the principle motivator of human endeavour. A vast world of prospect exists through the risk looking glass that justifies our tolerance of risk.

Although risk is a critically important silo it is nevertheless still a silo and must not be a constraining bubble preventing us from seeing what is through the ‘Risk Looking Glass.’ A full 20:20 holistic management vision is essential to define and understand situations to support optimal decision making.

However, we should not break the looking glass but get rid of it as a limiting obstacle to our envisioning and understanding. We must acknowledge the importance of the big picture and how to holistically manage its upsides and downsides, and associated uncertainties. This is analogous to flat earth thinking evolving to round earth thing, and classical physics at the beginning of the 20th century giving way to quantum theory and relativity. Just as we now understand the universe to be composed of the mirror concepts of matter and anti-matter, we must be able to holistically see a joined-up reality of potential stakeholder upsides and downsides subject to uncertainty. We must be able to holistically seek, take and reject opportunities with the objective of equitably optimising stakeholder satisfaction while making the best use of resources. This is the foundation principle of ‘Integrated Management’ defined by the ‘Integrated Management Community’ in 2002.

NOTE: The IMC is open globally to anyone interested in the theory and application of joined up thinking approaches to management and problems. www.integratedmanagement.info

Bio Ian Dalling

Ian Dalling is the Director of ‘Unified Management Solutions’, that specialises in integrated approaches to quality and risk management. He is a Chartered Mechanical and Electrical Engineer, a fellow of the Chartered Quality Institute, a fellow of the International Institute of Safety and Risk Management and holds degrees in engineering and physics. He is a retired management consultant and chair of the Integrated Management Community.

Ian’s career commenced in 1962 working for the Central_Electricity_Generating_Board in various posts within nuclear power plants embracing operations, planning, management services, quality management. In 1989 he moved to the United_Kingdom_Atomic_Energy_Authority Safety and Reliability Directorate (SRD) as a risk management analyst and consultant.

His career has spanned the design, construction, commissioning, operation, and decommissioning of conventional and nuclear power plants, as well as providing a wide range of quality/risk management consultancy in other major hazard industries including oil and gas, electrical power distribution, rail, construction and medical devices. He started his own management consultancy in 1999 delivering services for clients in the UK and internationally in Eastern Europe, India, and China for national and international clients. He chaired the Chartered Quality Institute Integrated Management Special Interest Group from 2007 until 2020 when it was morphed into the Integrated Management Community. Ian led the international team that created the world’s first universal management system standard without boundaries (MSS1000). He has published many integrated management papers and articles.

His roles have included:

- Leading operational planning team during the construction and commissioning of the Dungeness B Advanced Gas Cooled Reactor nuclear power plant.

- European Notified Body Quality Manager certifying machinery and medical devices under European Product Directives.

- Serving on the European Process Safety Centre Committee, and the British Standards steering committee for BS 8800:1996, a guide on the management of occupational health and safety. BS8800 informed OHSAS18001 which informed ISO45001.

- Leading a team assessing the 120-year decommissioning programme for the Winfrith Steam Generating Heavy Water Reactor in the UK.

- Assessing UK nuclear weapons assembly and maintenance safety culture.

- Developing crisis and emergency plans for a regional electricity company.

- Member of international team that assessed the safety of the Lithuanian Ignalina RBMK nuclear power plant following the Chernobyl_disaster.

- Providing systems analyst support during the development of safety critical software.

Publications

Ian Dalling has published many articles on integrated management and the universal management system standard MSS1000 in a range of publications including CERM Risk Insights, the International Institute of Risk Management (IIRSM), the Chartered Quality Institute (CQI), and the International Register of Certified Auditors (IRCA) Journals.

Publishing a book on integrated management is still on Ian ‘s to-do list. The closest to fulfilling this aspiration has been the drafting of the 300 page universal management system standard MSS1000 which he intensely focused on between 2011 and 2014. It was based on a set of mutually consistent unified management principles, concepts and definitions. MSS1000 had been demonstrated to be possible in his article ‘Order from Chaos’ published in the April 2011 edition of Quality World which explained a full scope boundless hierarchical management topic taxonomy. In essence, the taxonomy defined a logical place for everything that can potentially be needed in a management system, standard, regulation, license etc. and was informed by his quality and risk management consultancy experience and the creation of proven full scope boundless integrated management systems created with his clients.

Ian has published the following notable papers on various aspects of integrated management:

- Research into relationships and correlations between plant safety performance and occupational safety performance for British_Energy and BNFL Magnox in conjunction with DNV, 2000.

- Understanding and assessing safety culture, Society for Radiological Protection meeting, Saint Catherine’s College Oxford, 9 April 1997, published in the December 1997 Journal of Radiological Protection. Includes the ‘Dalling Model’ of organisational performance.

- The Future is Unified – a Model for Integrated Management, Quality World, April 2000.

- Integrated Management Definition, CQI Integrated Management SIG, 2002, reissued 2007.

- Eyes and Ears (integrated monitoring), Quality World, April 2004 – subsequently translated and published into Chinese and Japanese in the ‘Global Sources’ journal.

- Integrated Management System Definition and Structuring Guidance, CQI Integrated Management SIG, 2007.

- Order from Chaos (management topic taxonomy), Quality World, April 2011.

- Drafting of Universal Management System Standard MSS1000. 2011-2014.

- Management Integration: Benefits, Challenges and Solutions, International Institute of Risk and Safety Management (IIRSM) Technical Paper, March 2012.

- Managing Data in an Evolving World – A guide for good data governance, International Institute of Risk and Safety Management (IIRSM) Technical Paper, August 2016.

- Using MSS 1000 to Boost Performance, CQI Integrated Management, October 2016.