Projects are about businesses and business is about money. Very few firms are not-for-profit and profit margins are fundamental to ensuring a company’s survival in the dog-eat-dog world of the markets they operate in. Profit declaration is an essential part any company’s annual report and a quick, but not necessarily accurate indicator of its financial health.

Projects are about businesses and business is about money. Very few firms are not-for-profit and profit margins are fundamental to ensuring a company’s survival in the dog-eat-dog world of the markets they operate in. Profit declaration is an essential part any company’s annual report and a quick, but not necessarily accurate indicator of its financial health.

According to the microeconomic ‘Theory of the Firm’ companies exist to maximize net profits and all decisions must bear this in mind. But profit margins are based upon forecasts and assumptions until a final account is determined. It’s only then that the grim reality of undeniable and irreversible losses is seen or the comfort any balance hasn’t slipped into the red, or the euphoria that predetermined margins have been maintained or even exceeded!

Projects, at least in the construction industry, are based upon contracts and competitive bidding. The maximisation of profits is based upon an estimation of, amongst other things, the prices of labour and subcontracts, plant and equipment costs, staffing, and the market rates of fuel and other raw materials. As part of the estimation process risks are considered as well as a company’s specialist technical and managerial know-how in an effort to have the contract awarded and to maximise profit within the tendered price.

After award and during project execution the accuracy, or otherwise of any tender and the expected revenue, i.e. the top line, will be put to the test. The profit margin is part of this revenue, but if operating costs increase, the precious profit margin will be put under pressure and the bottom line will be threatened…but which line is more important?

Top Liners

There are those who consider the tender price estimate to be sacrosanct. After all, the tender may have taken many months to put together and is the culmination of a company’s investment in terms of both time and human effort as well as managerial input, engagement of specialists, suppliers, consultants, and even subcontractors.

With such an investment, and that the tender price becomes an input into a company’s balance sheet, it can’t be wrong, or can it? Any inference of it being wrong cannot be accepted. However, a tender price is also a forecast and as a forecast is a prediction of what should have happened if what actually happened didn’t, particularly in the light of incorrect assumptions.

Tenders are based on estimates and the hope that the price will be attractive enough for the contract to be awarded. Consequently, a degree of optimism is to be expected in any tender as is a less than risk averse approach in appreciating the known risks as well as considering anything unforeseeable.

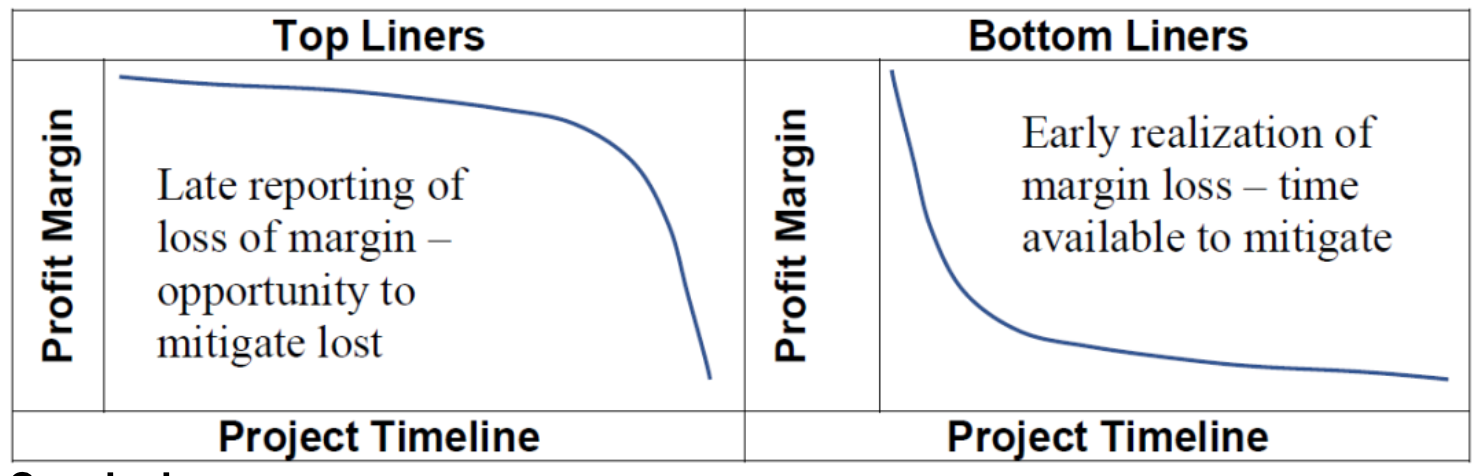

The topliners defend the tender estimate and will choose the upside of any possible downside. Contrary views, even supported by facts regarding the adequacy of the tender are quickly suppressed and doubters just as quickly admonished. The top line and elusive profit margin are maintained through creative accounting, ignoring real risks, shaving operating costs and trimming staff and their durations. Good news reporting sounds sweet but eventually cost reports and bank balances show the bitter truth, but why wait to see the inevitable bottom line and waste precious time?

Bottom Liners

Once a contract starts money starts flowing…some in but, at the start, a lot out. In the heady days of mobilisation and establishing site offices, recruiting key personnel, signing up suppliers of materials, and procuring equipment along with submission of a contract programme / schedule and other contract paraphernalia including insurances, bonds and guarantees a budget also needs to be cut.

This initial budget will be based upon the tender budget but with the marked difference that real costs will be used and that the forecasts will be made in the light of having an actual contract in hand. The potential for any wild enthusiasm and optimism bias regarding the costs will be quickly curtailed in the reality of real invoices and non-negotiable quotes. Any tentativeness at tender will quickly become conclusive after contract signing.

The first budget allows the opportunity to assess the appropriateness of the tender in the light of execution rather than the possible rose-tinted hue of bidding and planning. Real prices and costs can be used and actual rates of spend so that costs to complete may be assessed and reported.

Reporting real costs may well be at difference to the planned costs and the real, rather than perceived bottom line will begin to emerge. Furthermore, programme matters may also come to light in cutting the budget which, in turn may also have an impact on the bottom line. Reporting the bad news of possible loss or lateness is a difficult proposition for some but, when looking at the bottom line, sooner should be for the better.

False News, Real News

Financial reporting can be an emotive subject. Nobody likes to give ‘bad news’ related to decreased potential profit margins and it’s easier to give ‘good news’ in the form of, say, white lies. Some report that the top line isn’t “really” being affected but there’s a “slight” (and slipping) impact on profit and “it’s too soon to tell”. This may be true in the short term but in the longer term its false and, as the truism goes, it costs what it costs.

In reality costs are known early on in the project and adverse impacts on the top line and bottom line can be ascertained. NASA advocate that the sooner you get behind the more chance there is of catching up, similarly the sooner cost overruns, or losses are recognized the more time is available to find mitigative measures to cut one’s losses.

Conclusions

Business is about making money and while the reporting of financial position is important the timing and candidness are fundamental to managing both the top and bottom lines.

For the top liners who believe that the tender budget should be defended they report good news even if, in the long run, this will eventually be seen as false news.

Defending the top line detracts from seeing the truth and wastes the time that could be spent on identifying and managing budgetary control opportunities and to focus on the bottom line…after all, it’s the bottom line that counts…isn’t it?

Bio:

Malcolm Peart is an UK Chartered Engineer & Chartered Geologist with over thirty-five years’ international experience in multicultural environments on large multidisciplinary infrastructure projects including rail, metro, hydro, airports, tunnels, roads and bridges. Skills include project management, contract administration & procurement, and design & construction management skills as Client, Consultant, and Contractor.