“Greed, for lack of a better word, is good. Greed is right. Greed works.” (Gordon Gekko, ‘Wall Street’ movie, 1987)

“Greed, for lack of a better word, is good. Greed is right. Greed works.” (Gordon Gekko, ‘Wall Street’ movie, 1987)

When energy-trading company Enron declared bankruptcy in 2001, it was the largest bankruptcy filing in U.S. history. Enron’s execs were pocketing millions while knowingly overstating the company’s earnings to shareholders through fraudulent accounting.

“Greed is good” even in the highly regulated financial services sector. UK’s Parliamentary Commission on Banking Standards sums it up nicely when it says, “Too many bankers, especially at the most senior levels, have operated in an environment with insufficient personal responsibility. Top bankers dodged accountability for failings on their watch by claiming ignorance or hiding behind collective decision-making. […] Remuneration has incentivised misconduct and excessive risk-taking, reinforcing a culture where poor standards were often considered normal. Many bank staff have been paid too much for doing the wrong things, with bonuses awarded and paid before the long-term consequences become apparent. The potential rewards for fleeting short-term success have sometimes been huge, but the penalties for failure, often manifest only later, have been much smaller or negligible. Despite recent reforms, many of these problems persist.” – with emphasis (Parliamentary Commission on Banking Standards, 2013)

Money as a key performance motivator is misguided

Money is commonly used as the primary lever to incentivise executives for exceptional work performance. It is hoped that the use of financial incentives can foster positive work environments, build supportive relationships, encourage higher-quality outputs, and most importantly, bring huge financial returns to shareholders. But up to a point!

This is why “from 1978 to 2020, CEO pay based on realised compensation grew by 1,322%, far outstripping S&P stock market growth (817%) and top 0.1% earnings growth (which was 341% between 1978 and 2019, the latest data available). In contrast, compensation of the typical worker grew by just 18.0% from 1978 to 2020.” (Economic Policy Institute, 2021)

For context, the CEO’s compensation increase is more than 25% to 33% greater than stock market growth (depending on which stock market index is used).

Money is a short-term motivator and a long-term destroyer

While individual financial incentives can increase employee performance and productivity by 42% to 49%, especially in the short term, these gains come at a cost in the longer term. (Wharton, 2011)

When people are rewarded for goal achievement, they are more likely to engage in unethical behaviour, such as:

- Cheating by overstating their performance.

- Shipping unfinished products.

- Cooking the books to exceed analysts’ expectations.

- Cheating on their professional exams at EY and KPMG.

These unintended consequences or unethical behaviours are more likely when people fall just short of their performance goals. Cheating to earn bonuses has, unfortunately, become the norm at many organisations.

When strong financial incentives are in place, many employees will cross ethical boundaries to earn them, convincing themselves that the ends justify the means. It can also undermine our intrinsic motivation to work on interesting, challenging tasks.

‘Profits before people’ results in adverse risk-taking

When the financial stakes are high for individual CEOs to get their ‘incentivised’ pay, there is nothing to stop them from creating a ‘follow-my-orders culture’ or aggressive risk-taking organisational culture.

There will come to a point whereby any further increases in remuneration as a performance motivator can only be counterproductive. It is incentivising misconduct, unethical behaviours and excessive risk-taking. It has also reinforced an organisational culture where poor standards are considered normal.

If they are lucky, they could get away with it. Otherwise, their risk-taking behaviours will inevitably cause a scandal or corporate collapse.

Mid-tier executives and engineers were encouraged to design Volkswagen engines that responded falsely to emissions tests. Executives demanded a win-at-all-cost performance in the absence of any appropriate procedural safeguards.

Batteries from external suppliers were shown to have caused the Galaxy Note 7 fires. But executives at Samsung had a follow-my-orders culture.

The Challenger space shuttle astronauts never needed to take a risk with their lives. The risk did not exist. It was created by risky and unethical management decisions.

General Electric was ruthless in driving continuous year-over-year profits. At least until they had so demoralized their workforce that profitability became impossible.

And Ford released its Pinto having made the decision that lawsuits would be less costly than fixing the car’s problems.

Unfortunately, executives in profit before people or follow-my-orders cultures don’t consider at a human level how their stated strategic intents shape the acceptable ethical boundaries for those who must turn those intents into reality.

Many financial incentive programs may work well in the short term, but in the long term, they can encourage unhealthy competition, make some workers feel hopeless and resentful about ever earning an incentive, and they don’t address the main driving force behind productivity, which is internal motivation.

Organisations that put profits above people fail to understand that their profits come from customers. Customers interact with their employees. If these employees who work for the organisation are unhappy, the organisation can’t make its customers happy. This is where these organisations put profits before their customers as well as profits before their employees.

‘People before profits’ results in constructive risk-taking

Since the main purpose of business is to make a profit, it’s a natural priority. Taking significant risks is an important aspect of great leadership because it’s needed to make significant progress.

But it is important to remember that your employees are the ones making those performance numbers go through the roof. This is where the people-first approach in a supportive risk-taking environment is a more socially conscious and sustainable model.

The challenge is to overcome many fundamental business management conflicts like putting people first, trusting them, and being honest and transparent. Putting people first means that managers must give them enough time, attention, and support. It also means truly listening and caring about people.

For each of us as individuals, it boils down to a choice – being risk-averse and playing it safe for job security; or taking considered risks and striving to make a significant and meaningful difference.

Those of us who want to make a meaningful difference at work must be willing to take significant risks. If I take risks in an attempt to significantly make my organisation better and I am being reprimanded or lose my job because of it, the attempt is always something to feel good about personally. Losing a job does not feel good and it is not an outcome that I want, but the source of income can be replaced.

Organisations that put people first and create a supportive risk-taking and performance culture where employees can strive to make a significant difference for their customers, will create happy employees and customers that will both generate sustainable profits for the business.

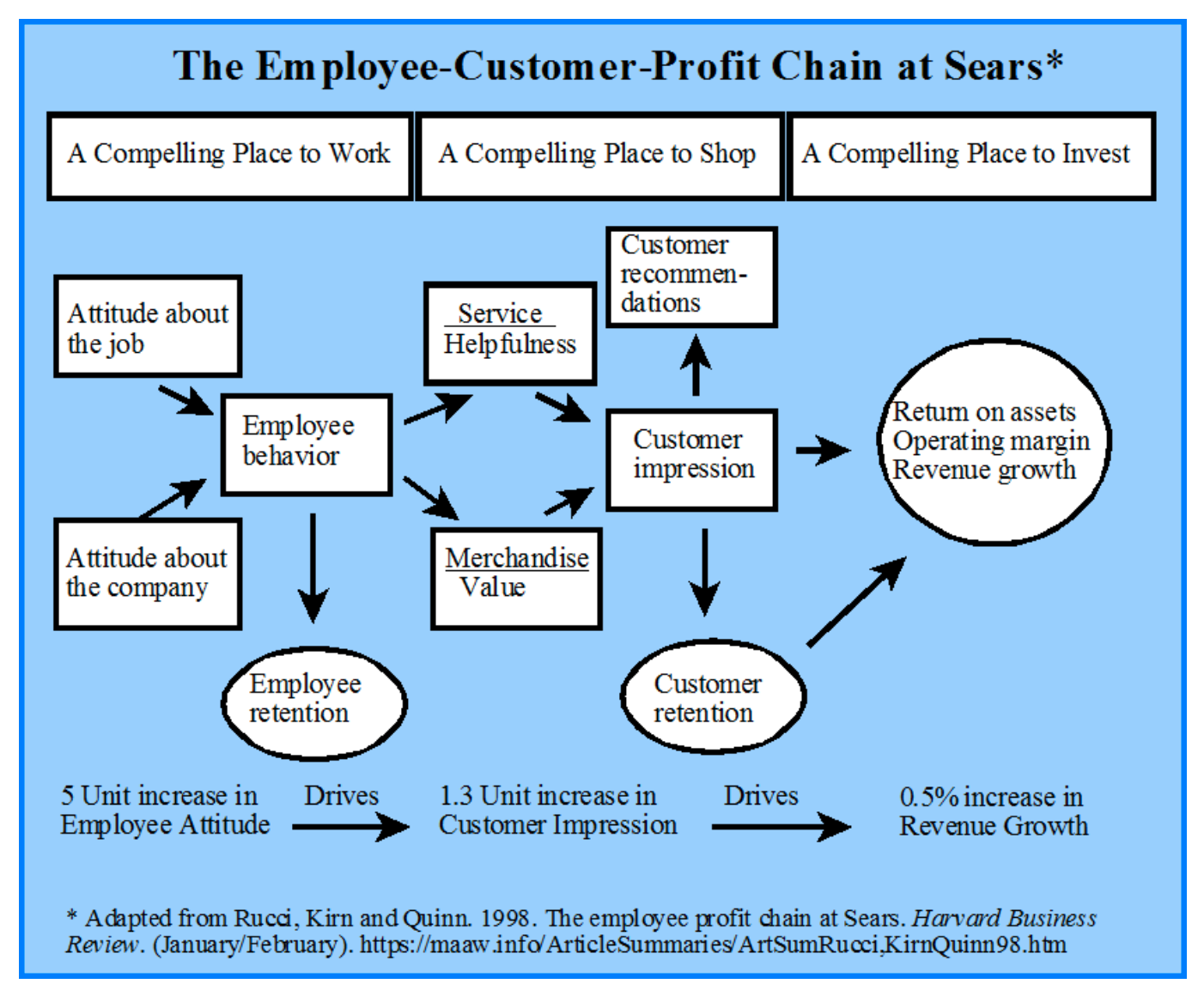

The Sears’ Employee-Customer-Profit Chain, shown below, tells us that a 5% improvement in employee attitudes will result in a 1.3% increase in customer satisfaction resulting in a .05% improvement in revenue growth.

Organisations, therefore, need an enabling organisational culture and systems to create and maintain positive employee engagement, which will lead to increased customer engagement and experience. This in turn drives revenue growth for the organisation. This causal link to organisational performance is important.

It’s all about people

McKinsey’s recent analysis of the reasons why employees are leaving their jobs in record numbers showed that the most important factors were social and psychological, including not feeling valued by their organisation or manager or not having a sense of belonging at work. (De Smet, et.al, 2021.)

A quantitative analysis of more than 16,000 workers globally in 2015 showed that at all levels of income, the most important factors determining people’s job satisfaction were interpersonal relationships and having an interesting job – each accounting for around 20 per cent of the explainable variation. In contrast, the level of pay accounted for only 4 per cent of the variation in people’s job satisfaction. (De Neve et al., 2018)

In a representative global survey of nearly 50,000 people across 38 countries, more than 60 per cent of respondents agreed or strongly agreed with the statement “I would enjoy having a paid job even if I did not need the money.” Only 16 per cent of respondents rated “high income” as more important than having “an interesting job.” (ISSP Research Group, 2013)

Organisational members must be made partners in the effort to create a great organisational culture where they can take the necessary risk and be fully engaged to perform at their best and fully satisfy their customers’ needs and requirements, which will lead to superior organisational performance.

This is the second of a series of seven articles on the topic of risk culture and how organisations can improve their performance through uplifting their risk maturity.]

Professional bio

As a Chartered Accountant with over 25 years of international risk management and corporate governance experience in the private, not-for-profit, and public sectors, Patrick helps individuals and organizations make better decisions to achieve better results as a corporate and personal trainer and coach at Practicalrisktraining.com.

Given that improving risk culture and maturity has become a top of mind for many executives and risk professionals, he has conducted in-depth research into the topic and written several articles, which can be found at https://practicalrisktraining.com/risk-culture.

Patrick has authored several eBooks including Strategic Risk Management Reimagined: How to Improve Performance and Strategy Execution.