Generally, every effort is made to reduce risks in software development projects to ensure achieving functionality, time and cost goals. One common risk-mitigation practice is to employ established, stable technologies when new, less well-understood or in-transition business processes are involved.

Generally, every effort is made to reduce risks in software development projects to ensure achieving functionality, time and cost goals. One common risk-mitigation practice is to employ established, stable technologies when new, less well-understood or in-transition business processes are involved.

However, projects supporting longer-term, strategic business initiatives may produce suboptimal results if organizations do not push the envelope in order to maintain currency with evolving technology standards and preserve options to keep the application consistent with market competition and changing business models over its usable life.

In this post, I begin to explore how we can identify cases in which accepting risks associated with employing newer technologies, architectures or methodologies can add value to a project.

SOME METRICS

Software development projects are investments, pure and simple, and any attempt to judge them strictly on a cost basis is dangerously short-sighted, to say the least. In this context, financial metrics should be used to value them. Here are some general metrics that are relevant:

- Discounted Cash Flow (DCF)—a DCF model assigns a current value to each cash flow over the life of an investment. A cash flow that (a) occurs farther in the future or (b) is riskier (less predictable) is discounted more heavily.

- Net Present Value (NPV)—the NPV of an investment is the sum of all of the discounted cash flows associated with it. It is a way to put a value on an investment in which money is paid out initially (say, funding a software project) and the benefits realized in the future (for instance, reduced operating costs.)

- Total Cost of Ownership (TCO)—TCO is a measure of the cost of building and operating a software application over its usable life.

There are innumerable nuances to these metrics, such as what rates to use to discount different cash flows, and so on. Let’s not wrap ourselves around the axle worrying about them; the form of the model will not change much, regardless of how these parameters are determined.

The acceptance criterion for a project is simple—its NPV. A project with an NPV of $1Million is presumed to add $1Million to the value of the organization funding it as a result of the excess of positive discounted cash flows over negative ones. Theoretically, an organization should find a way to fund all NPV- positive opportunities to maximize its value, though practical realities usually intervene.

WHICH CASH FLOWS MATTER?

Identifying all of the relevant cash flows (and other value measurements which we will discuss) is critical to coming up with a valid valuation for a project. Consider:

- Project implementation costs, both direct (programmer salaries, software acquisition, infrastructure implementation) and indirect (internal user training)

- Business benefits, such as the ability to enter a market that would have been impossible without the application system. Think of building a retail web site for a previously bricks and mortar-only company.

- Overhead benefits, such as reduced operating costs resulting from increased automation or the ability to run the application on fewer or cheaper platforms. For instance, consider the potential to reduce IT operations staff and save on facilities, communications and power costs by relocating server operations to a cloud provider.

So, an elementary project NPV for an application to enable an organization to begin selling a new product might look like:

- Direct Implementation Costs—Programming, Project Management, Software Licensing, Server Infrastructure, Business User participation: cash outflow of $1.5Million over one year

- Overhead costs—staff to support the new application: $250,000 per year

- Net Profits from selling the new product—Sales, less cost of goods sold and administrative expenses: $1Million per year over five years.

Over five years, the sum of the cash flows and discounted cash flows is:

|

Category |

Cash Flow |

Discounted Cash Flow |

| Direct Implementation Costs |

($1.50 Million) |

($1.25 Million) |

| Overhead costs |

($1.25 Million) |

($1.00 Million) |

| Net Profits |

$5.00 Million |

$3.75 Million |

| Total |

$2.25 Million |

$1.50 Million |

Keep in mind that discounting future expenditures and profits to the present time reduces their value. Therefore, in this simple example the project has a positive NPV of $1.5Million.

A MORE REALISTIC MODEL

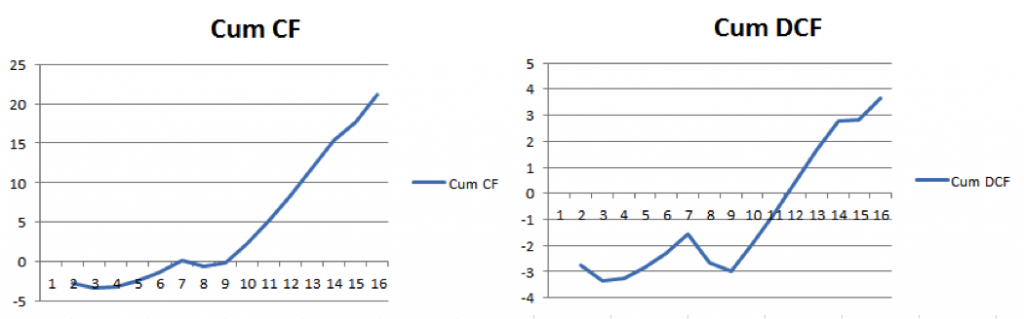

I built a more nuanced model, which includes Direct and Indirect Development, Operations Overhead and Infrastructure costs and Net Profit on Sales. In addition, I selected different rates to discount the various costs and the profits. Finally, I included expenses for development or enhancement at three points in the project’s life—years 1, 7 and 14. The two graphs, below, show the cumulative cash flows and discounted cash flows by year:

Even though the second model is still simplistic, it illustrates some general characteristics that are common across systems investments:

- Initial implementation represents the largest investment component of a project; however there is almost always further investment required over an application’s life to enhance or upgrade it.

- The timing, size and frequency of required further investments have a great deal of impact on the NPV of the project.

- There is often a ramp up period before benefits can be fully realized. Thus, the illustrated project has a negative cumulative cash flow until year five.

- The later years of a system’s life, in which little further investment is required, are when most of the cumulative positive cash flows and contribution to positive NPV occur.

These suggest that a system’s value is significantly increased by:

- Minimizing the number and scope of major enhancements or modifications,

- Increasing its usable life and

- Accelerating the onset of realizing benefits.

Given these concerns, what should we consider to ensure that we are optimizing investments in information technology for our enterprise? In the next post, I will present some thoughts on this issue.

Bio:

Howard M. Wiener is CEO of Evolution Path Associates, Inc., a New York consultancy specializing in technology management and business strategy enablement. Mr. Wiener holds an MS in Business Management from Carnegie-Mellon University and is a PMI-certified Project Management Professional.

He can be reached at:

howardmwiener@gmail.com

(914) 723-1406 Office

(914) 419-5956 Mobile

(347) 651-1406 Universal Number